Speaking at Routes World in Las Vegas, Air Canada's Alexandre Lefèvre, Managing Director of Network Planning and Scheduling, said that the Star Alliance carrier has the ambition to increase India flights beyond 3x daily, a frequency which comes into effect in a few days. This is separate from its strategic partnership with Emirates, which sees Air Canada's Toronto-Dubai service rising to 1x daily.

Are more India flights coming?

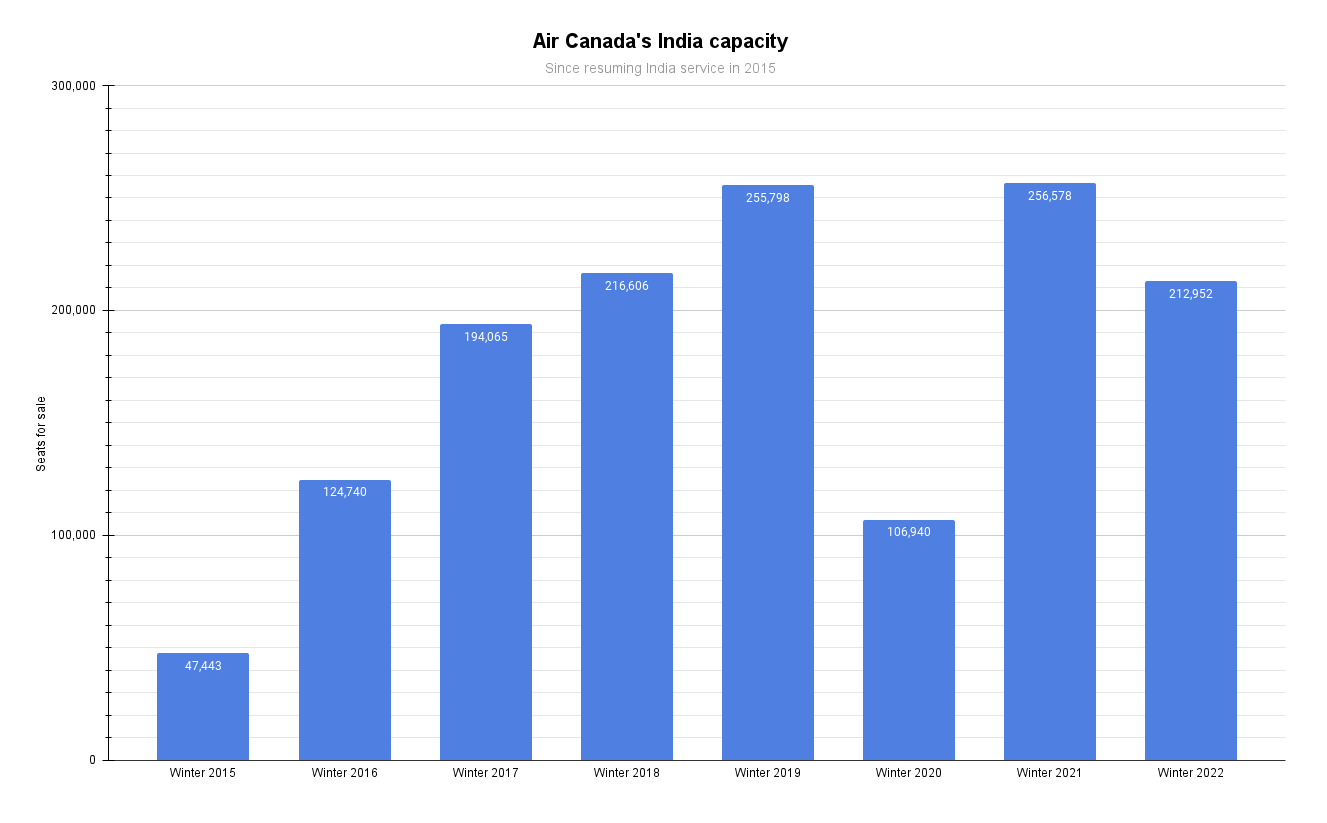

Air Canada will switch to winter schedules on October 30th, four days from writing. According to the latest data from OAG, it has 213,000 roundtrip India seats for sale this winter with between 2x and 3x daily flights.

That capacity isn't a record. It doesn't beat last winter (257,000) or winter 2019 (256,000), even though a new service is coming. It is down because Vancouver-Delhi is still suspended.

Still, growth is intended. Lefèvre said that the carrier hopes to add more Indian flights as part of its "big development of the international market." However, there was no clarity on whether this will mean more flights on existing routes or the launch of new markets.

Stay aware: Sign up for my weekly new routes newsletter.

Where does it fly now?

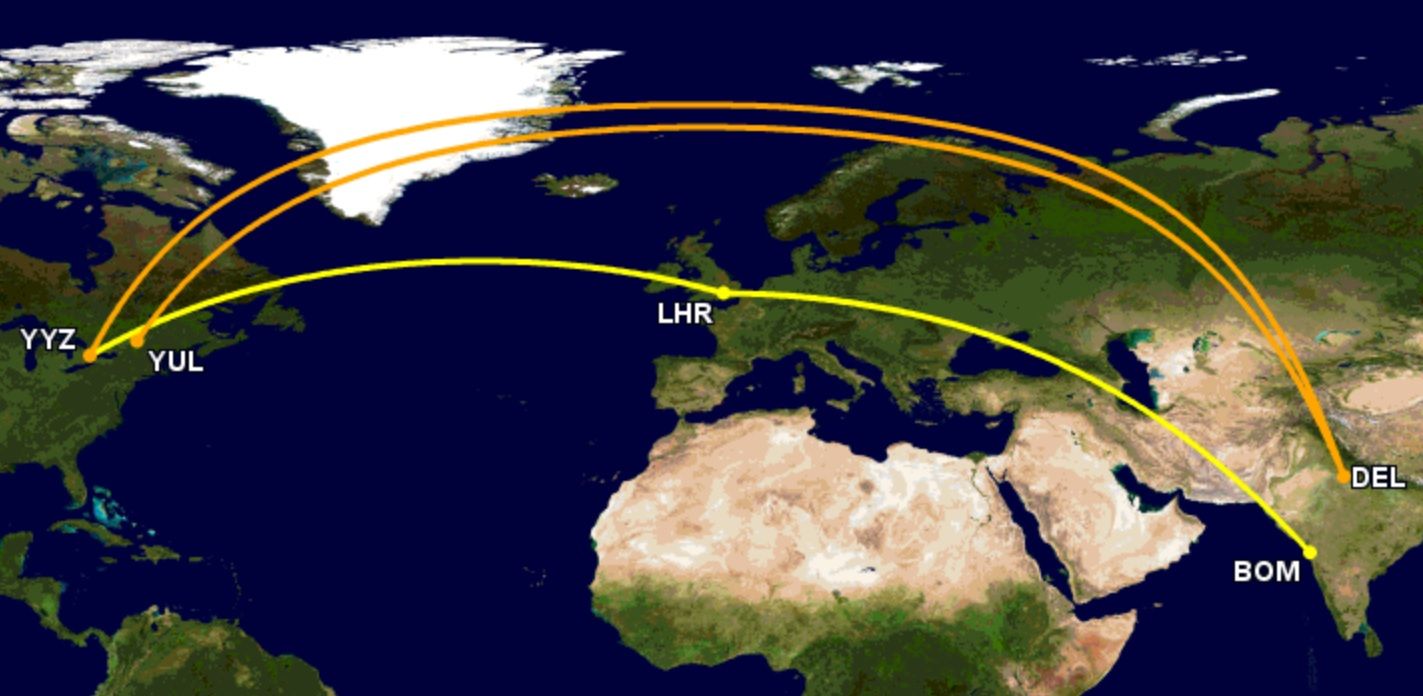

Air Canada has three India routes this winter, as summarized below. Two are from Toronto, which includes Toronto-Delhi, the largest city pair between North America and India, with nearly half a million passengers in 2019, surpassing even New York-Delhi.

- Montréal to Delhi: 3x weekly, mainly by the 777-200LR but later the 787-9. The route started nearly a year ago

- Toronto to Delhi: 1x daily 777-200LR

- Toronto to Mumbai (via London Heathrow): 1x daily 787-9, beginning on October 30th

Discover more aviation news.

No Vancouver-Delhi

Notice the absence of Vancouver to Delhi, a long, 6,934-mile (11,159km) airport pair. Air Canada launched it in October 2016, and it last operated in March 2022. That was ostensibly partly because of the consequences of rerouting to avoid overflying Ukraine and Russia. It was supposed to return last month but didn't. And when writing, it isn't scheduled or bookable, such is the ongoing conflict in Ukraine.

However, Vancouver-Delhi, a large market of 298,000 P2P passengers in 2019, remains operated by fellow Star Alliance carrier Air India, which overflies Russia. It currently runs 1x daily but will reduce to 3x weekly next summer.

Where else might happen?

Lefèvre's desire to have more than 3x daily India flights could be straightforwardly realized by simply reintroducing Vancouver-Delhi. It'd then have up to 4x daily and one of the highest numbers ever. This is the most obvious way of increasing service and will inevitably happen at some point.

But thinking more creatively and looking into the crystal ball, what other routes might (or might not) be considered? For this, it is helpful to relate to Montréal-Delhi, which had ~41,000 P2P passengers in 2019, according to booking data; a good foundation to build on with a 3x service and transit passengers on top.

There are the likes of Calgary-Delhi (63,000 P2P passengers) and Toronto to Ahmedabad (61,000), Chennai (50,000), Bengaluru (47,000), and Hyderabad (44,000). When fare per mile is considered, Toronto-Bengaluru comes out first, albeit only marginally, while Calgary-Delhi is by far the shortest route.

Toronto-Bengaluru? Calgary-Delhi?

While Bengaluru is the second longest of the above routes, its average one-way fare, excluding taxes and any fuel surcharge, was US$480 in 2019, the highest of the others, reflecting stronger premium demand. It was also higher than Montréal-Delhi, essentially because Montreal has a 15% shorter distance. Indeed, Bengaluru would be far Air Canada's longest nonstop.

Meanwhile, Calgary-Delhi is a meaningfully larger P2P market than Montréal-Delhi. They're also about the same distance, at least before rerouting because of Ukraine/Russia, meaning it would probably have the same fate, for now, as Vancouver-Delhi.

However, Calgary suffers from a 16% lower average fare than Montréal-Delhi. And as Calgary isn't a significant international hub for Air Canada, unlike Toronto, Montréal, and Vancouver, it'll probably be ruled out.

Looking into the crystal ball, where would you like Air Canada to fly next? Let us know in the comments.