On July 22nd, United Airlines and Air Canada announced they will expand the existing partnership in the US-Canada market by establishing a joint business. The aim is to increase the number of flights between the two countries, harmonize the two carriers' schedules, and offer a seamless travel experience to the airlines' customers. Let's see what United and Air Canada have in store.

Two carriers "united" for better connectivity

The joint business agreement between United and Air Canada builds on the long-standing alliance which already ties the two airlines. United and Air Canada are indeed members of Star Alliance and of the transatlantic Joint Venture (JV) A++ with the German flag carrier Lufthansa.

The main benefits of this partnership entail more flight options for passengers traveling between the US and Canada, and harmonized schedules, which translates into a seamless travel experience for customers. As for now, the agreement counts codeshare flights to 38 destinations in the US and eight of the most popular cities in Canada. Besides widening and strengthening the two carriers' networks, the joint business will also sustain the two North American carriers in their post-pandemic recovery.

Which strategies will the two airlines adopt?

After being granted Antitrust Immunity (ATI) by both the US and Canadian authorities, the two carriers are now able to implement the following strategies to enhance their services between the two markets:

- Coordinating schedules, thus being able to offer more flight options throughout the day;

- Further developing codeshare agreements on transborder flights, except for some US leisure destinations. Particularly, customers will be able to fly to a total of 46 codeshare destinations with more than 400 daily frequencies in 2022, with the possibility of increasing the number of codeshare domestic routes in the US and Canada;

- Sharing revenues on flights between the carriers' hubs, as per ATI approval;

- Aligning customer policies to offer a seamless customer experience onboard and on the ground, for instance by establishing co-locations at airports and increasing accrual and redeem options for MileagePlus and Aeroplan loyalty programs members.

The benefit of schedule harmonization

Air Canada Senior Vice President of Network Planning and Revenue Management, Mark Galardo, commented on the advantages of a joint business with United in the US-Canada transborder market by stating that:

(The joint business) will also enable us to optimize our hubs and schedules and to broaden our global connectivity to maintain our leadership in the market

Indeed, one of the greatest advantages brought about by joint businesses between airlines is the chance to avoid the so-called wingtip-to-wingtip flights, whereby competing airlines flying to the same destination tend to schedule their flights around peak hours. However, by doing so, none of the carriers manages to properly maximize capacity, as demand is split between multiple airlines departing around the same time.

Yet, a joint business implies revenue and, more rarely, profit sharing on determined routes. Therefore, it is indifferent to a JV member with which airline passengers actually fly (hence the term "metal-neutral" to define JV in the airline industry). Consequently, airlines are able to spread capacity throughout the whole day, thus maximizing capacity and offering more options and better service to customers.

For instance, after a joint business was established between Delta Air Lines and Aeromexico, the two carriers' schedules on the New York JFK to Mexico City (MEX) route were harmonized as follows:

- 2012 (pre-Join Venture), JFK to MEX

|

Delta Air Lines |

10:15 |

13.05 |

17:05 |

|

Aeromexico |

09:30 |

14:00 |

17:15 |

- 2014 (post-Joint Venture), JFK to MEX

|

Delta Air Lines |

10:30 |

11:30 |

||

|

Aeromexico |

09:05 |

14:00 |

16:05 |

20:05 |

Whereas in 2012 the airlines were competing for demand around the same departure times (09:30 - 10:15; 17:05 - 17:15), after establishing a joint business the two carriers coordinated their schedules, offering services throughout the whole day and at different times.

Besides schedule harmonization, a joint business allows for better exploitation of the carriers' hubs. According to OAG, after establishing the transatlantic Joint Venture between Air Canada, Lufthansa, and United Airlines, the number of passengers who connected at United's hubs of New York/Newark, Washington D.C., and Chicago increased by 52% between 2019 and 2016. Subsquently, both United and Air Canada expect to optimize their hubs by means of this partnership, as Mr. Galardo underlined:

It (the agreement) will also enable us to optimize our hubs and schedules to broaden our global network connectivity to maintain our leadership in the market.

Stay informed: Sign up for our daily and weekly aviation news digests.

A very profitable market

A joint business in the US and Canada market can prove very profitable for both carriers. Indeed, in 2019, this market-pair was the second-largest international market worldwide and the most significant international market for both United and Air Canada, as measured in seats.

In the last year before the pandemic, United carried approximately 2.3 million passengers between the US and Canada, yielding revenues in the amount of $792 million. On the other hand, 4.7 million passengers flew with Air Canada between the two countries, for total revenues of $1.5 billion. In terms of capacity, as measured in Available Seat Kilometers (ASKs), in 2019 Air Canada's capacity (17 billion ASKs) between the two markets was more than three times that of United (5 billion ASKs).

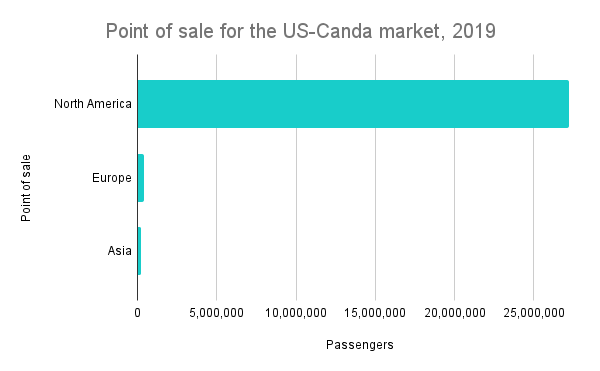

In terms of traffic, in 2019 the US-Canada market showed the typical traits of a seasonal market, with peaks during winter (February-March), and summer (June-September). According to the Global Distribution System (GDS) Sabre, in 2019 95% of the passengers purchased an economy class ticket to fly between the two countries, with business class customers accounting for just 4% of the total traffic. Moreover, North America is the most relevant point of sale, followed by Europe and Asia, as shown in the graph below.

Towards enhanced network and world-class service

The joint business between the two North American carriers aims to develop two world-class air service providers.

According to Skytrax, Air Canada is currently the best carrier in North America; indeed, it is the only airline in this region to have received a 4-star rating by Skytrax, which also awarded the airline prizes for Best Airline Staff in North America, Best Airline Staff in Canada, Best Business Class Lounge in North America, and an excellence award for successfully managing COVID-19. On the other hand, United operates the most comprehensive global route network among the North American carriers from its several hubs in Chicago, Denver, Houston, Los Angeles, New York/Newark, San Francisco, and Washington D.C.

Simple Flying reached out to both United Airlines and Air Canada for further comment. We will update the article with any additional announcements from the airline.

What do you think of this new partnership between United and Air Canada? Let us know in the comments below!

.jpg)

.jpeg)

.jpg)