Air France-KLM CEO Ben Smith has hit out at the disadvantage faced by his, and other Western carriers, in flying to Asia. Smith argues that Chinese carriers will have a major advantage thanks to access to Russian airspace, which can cut down travel time by under three hours. Let's find out more.

Unfair access

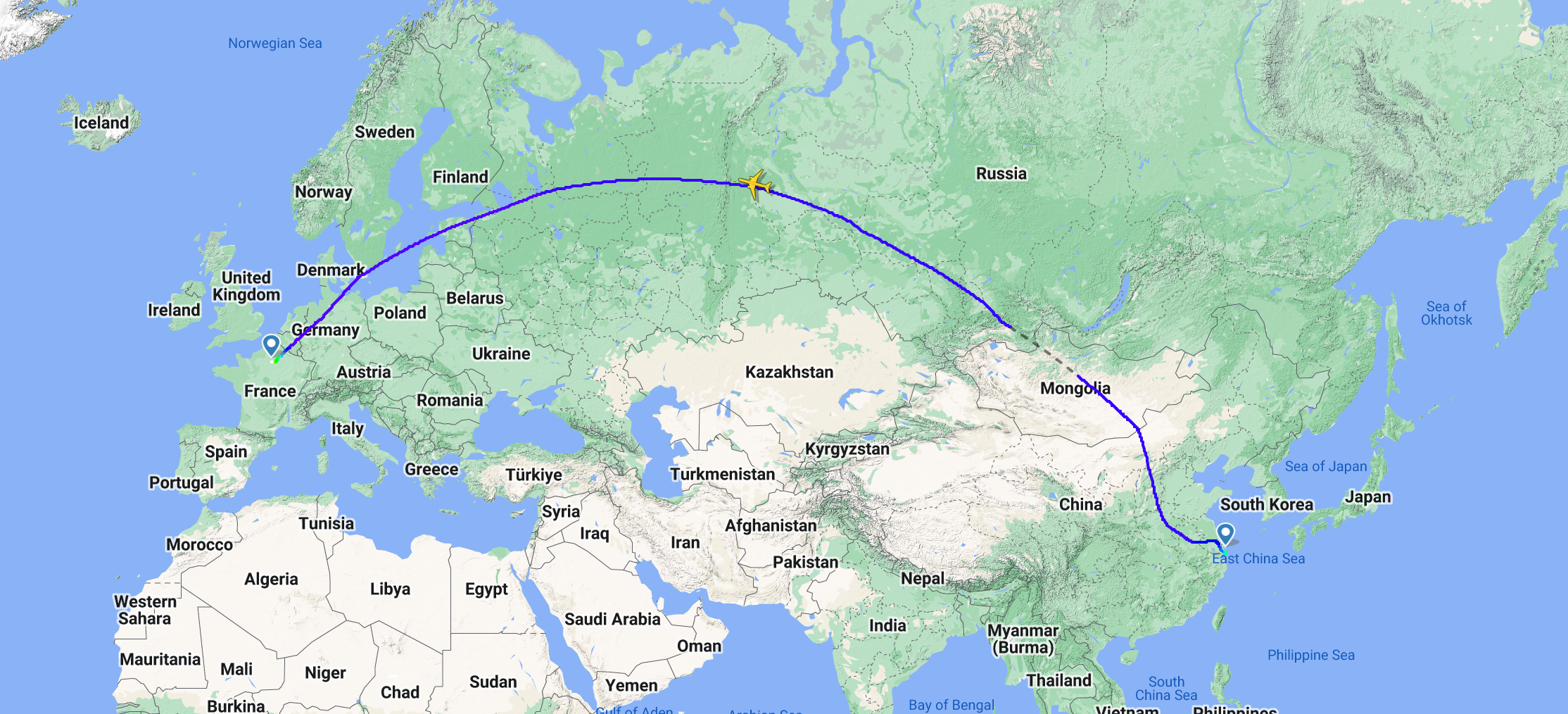

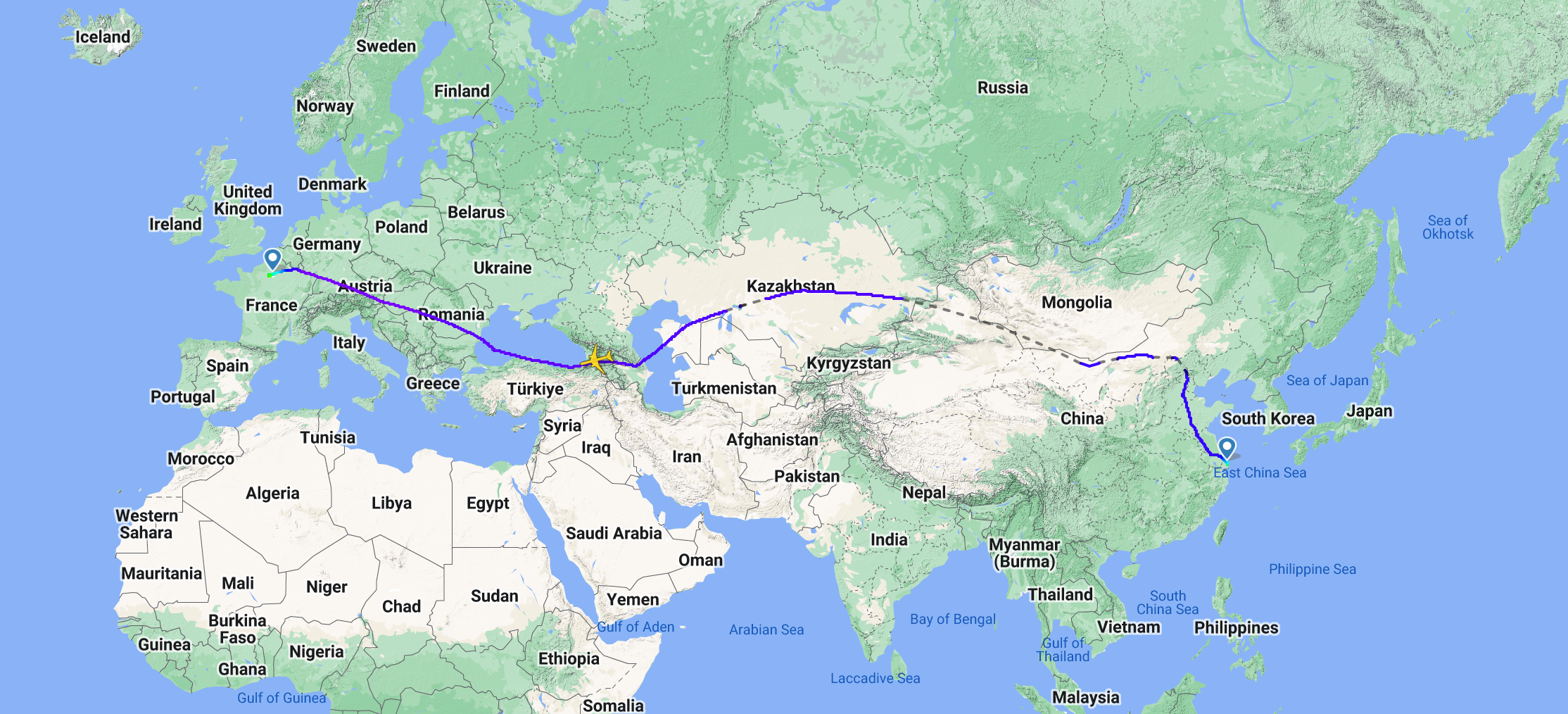

Russia's invasion of Ukraine has reshaped the global aviation map, with Western carriers barred from using the country's vast airspace due to the imposition of sanctions. Due to this, flights to and from Europe to Asia are now significantly longer for home carriers, while many Asian and Middle Eastern airlines have continued using Russian airspace.

As China reopens to the world, Air France, KLM, and Finnair are looking to boost their capacity closer to pre-pandemic levels. However, they now face a significant hurdle: far longer flights. Finnair CEO Topi Manner noted, "We think that what this will mean is that it will be very hard to make secondary cities of China profitable in terms of flying."

This is a view seconded by Ben Smith, who spoke about the impact on some of its longest routes, "between Paris and Seoul, it can add up to three hours in flight time. If you’ve got a Chinese carrier that is flying over Russia, they’ve got an unfair advantage over us.”

Get the latest aviation news straight to your inbox: Sign up for our newsletters today.

Chinese airlines raring to go

Even before the pandemic, Chinese carriers had a much greater share of the market than foreign ones. However, with added flight times, European carriers are at risk of never even reaching their 2019 capacity levels. Take two examples to illustrate the problem, China Eastern and Air France's services from Shanghai (PVG) to Paris (CDG).

On 17th and 18th February (respectively), AF193 departed PVG at 22:56 local time and MU553 at 00:55 the same night. However, AF193 landed at 05:58 the next morning, while MU553 at 05:38 the same day. Indeed, access to Russia shaves off anywhere from 1 hour and 30 minutes to 2 hours.

As Manner mentioned, it will be difficult to maintain services to secondary Chinese cities, such as Xi'an and Nanjing, which will be much less profitable and serve fewer connecting passengers. Meanwhile, local carriers are likely to extend their dominance in the market in the near future.

Check out all the latest European aviation news here

Still pushing ahead

Despite the disadvantages, Air France-KLM still plans to reintroduce at least 50% of its 2019 capacity to Shanghai and Beijing. While this is a far cry from the profitable markets of the past, it underscores the importance of China for airlines in making their operations profitable once more. With the country now open to all, the group is expecting to make its way back into the black after three years of state aid and capacity limits due to travel restrictions.

What do you think about Air France-KLM's lack of access to Russian airspace? Let us know in the comments.

.jpg)