In the latest escalation of the Russia-Ukraine war, Boeing and Airbus have both stopped supplying parts and support to Russian airlines. It comes as large numbers of leased Irish-registered aircraft must be returned, numerous countries have banned Russian flights and aircraft, and airlines stop flying to Russia, often because they must. All of which has inevitably led to much retaliation as Russia becomes increasingly isolated.

70% of Russia's aircraft are affected

According to ch-aviation.com, Russian airlines have 1,003 passenger and freight aircraft, both active and inactive (i.e. stored or undergoing maintenance). Of these, approximately 706 are by Airbus and Boeing, meaning seven in ten are by the manufacturers. Some 24 airlines are affected, particularly Aeroflot, S7, Rossyia, UTAir, Nordwind, and Pobeda.

The implication of the spare part and supply ban is obvious. And when combined with airspace prohibitions, it will, as intended, severely limit operations and, in some instances, ground airlines entirely.

But it isn't known how many stored parts carriers already have, if they can obtain more from elsewhere, the extent of the impact when the Irish-registered equipment are returned by March 28th, and for how long Airbus and Boeing aircraft can feasibly be used.

Stay aware: Sign up for my weekly new routes newsletter.

Two-thirds of domestic market is affected

In March 2022, Russia has approximately 49,821 domestic scheduled flights (take-offs and landings combined), according to the latest Cirium data. Of these, Boeing and Airbus equipment have 33,167, or over two-thirds (67%):

- Airbus: 16,985 round-trip domestic flights in March 2022

- Boeing: 16,182

- Sukhoi: 7,976

- Bombardier: 3,080

- Embraer: 2,553

- ATR: 1,963

- Antonov: 922

- LET: 122

- Helicopter (Mi-8): 16

- Yakovlev: 16

Airbus and Boeing have a huge share

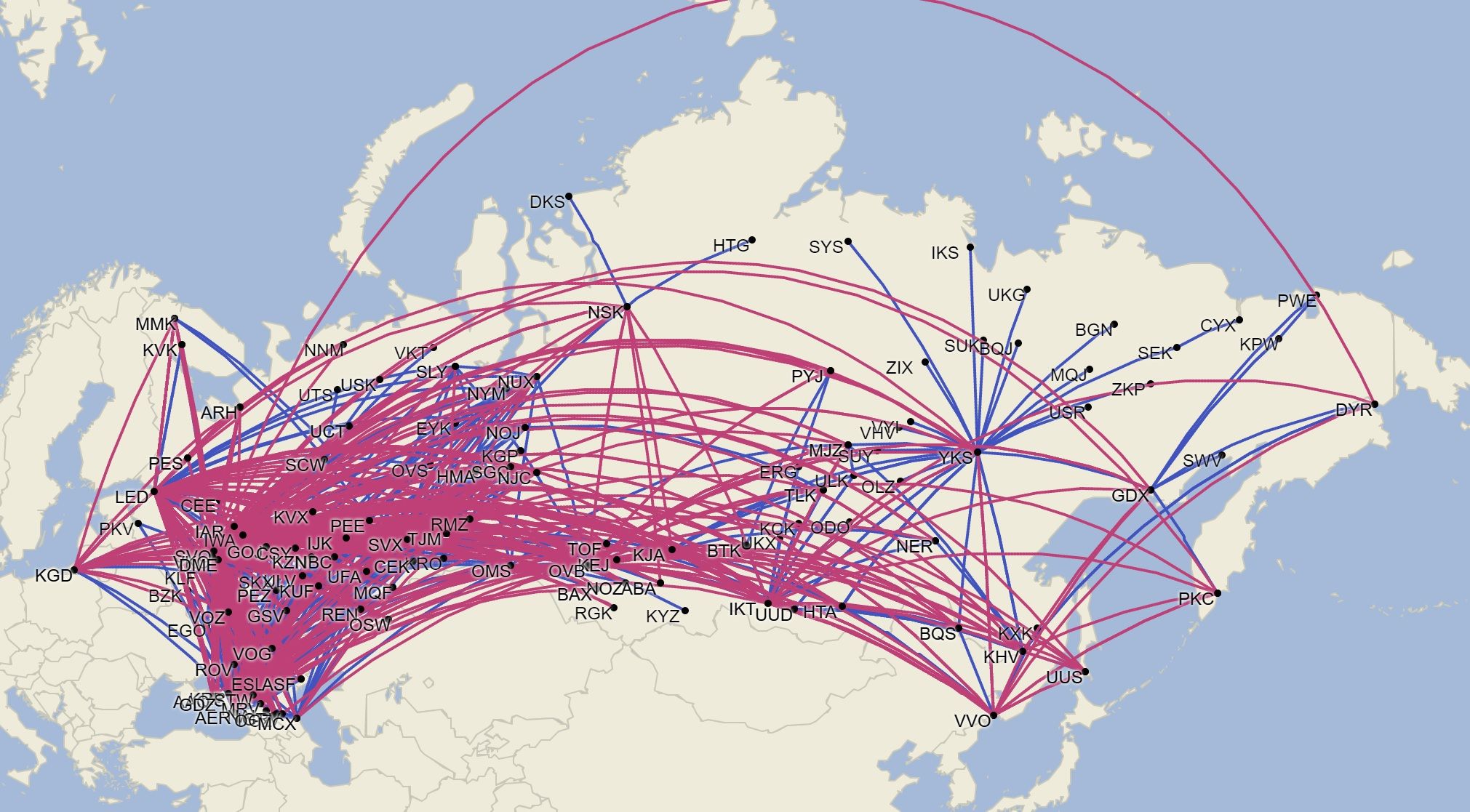

Airbus and Boeing have a huge share, and the implication on Russian aviation if other foreign manufacturers impose a ban is clear. It also shows that Russia cannot fall back on its large domestic market – helped by its 145 million-plus population and unbelievably large and spread out geographic area – as international markets are increasingly prohibited.

After all, domestic flights by Russian equipment amount to 'just' 8,930 flights or fewer than one in every five. It's a far cry from 18 years ago, when they were responsible for 97%, primarily because of the long-gone Tupolev. It raises the obvious question: if necessary, how many of the withdrawn aircraft are or could become airworthy?

On 83% of Moscow's domestic flights

As you might imagine, Airbus/Boeing aircraft are especially dominant in Moscow, helped by Aeroflot's large Sheremetyevo hub and the fact that the Russian capital – with 20+ million people in its metro area – necessarily has the lion's share of the country's operations. Indeed, the two manufacturers have 83% of all domestic flights from Moscow, 16 percentage points higher than for the whole country.

If things continue or get worse, and if they exist for a significant period of time, it is possible that Russia will become another Iran or Venezuela: reliant on old and inefficient aircraft and unable to replace or to grow. It would be quite a different direction.

What are your views of it all? Let us know in the comments.

.jpeg)