The outlook for the aviation industry at the start of the summer season was that airlines were on track for a $48 billion loss, or thereabouts. But as the year has progressed, we’ve seen green shoots of recovery in many markets around the world, notably in Asia and the USA. Has this changed the situation going forward?

Does IATA’s prediction still hold true?

Back in April, the International Air Transport Association (IATA) made some stark predictions for the rest of the year. The association forecast that losses would reduce, but also said that the financial pain for airlines was not over yet. Despite expecting a reduced cash burn of $81 billion (compared to $149 billion in 2020), IATA projected a $47.7 billion loss across the year for all airlines.

At the time, IATA’s director general Willie Walsh stated,

“This crisis is longer and deeper than anyone could have expected. Losses will be reduced from 2020, but the pain of the crisis increases. There is optimism in domestic markets where aviation’s hallmark resilience is demonstrated by rebounds in markets without internal travel restrictions.

"Government imposed travel restrictions, however, continue to dampen the strong underlying demand for international travel. Despite an estimated 2.4 billion people travelling by air in 2021, airlines will burn through a further $81 billion of cash.”

But how is that playing out in reality? So far in 2021, we’ve seen strong signs of a recovery in aviation, particularly in the United States. Passengers passing through TSA checkpoints have frequently exceeded two million a day since early June, still a way off the 2.5 million-plus per day in 2019, but a world away from the 600,000 or so in 2020.

However, digging into the trends reveals that, despite the positive changes of late, airlines are still hurtling towards the same level of losses that IATA predicted before the summer began.

Stay informed: Sign up for our daily and weekly aviation news digests.

Capacity shrinks away

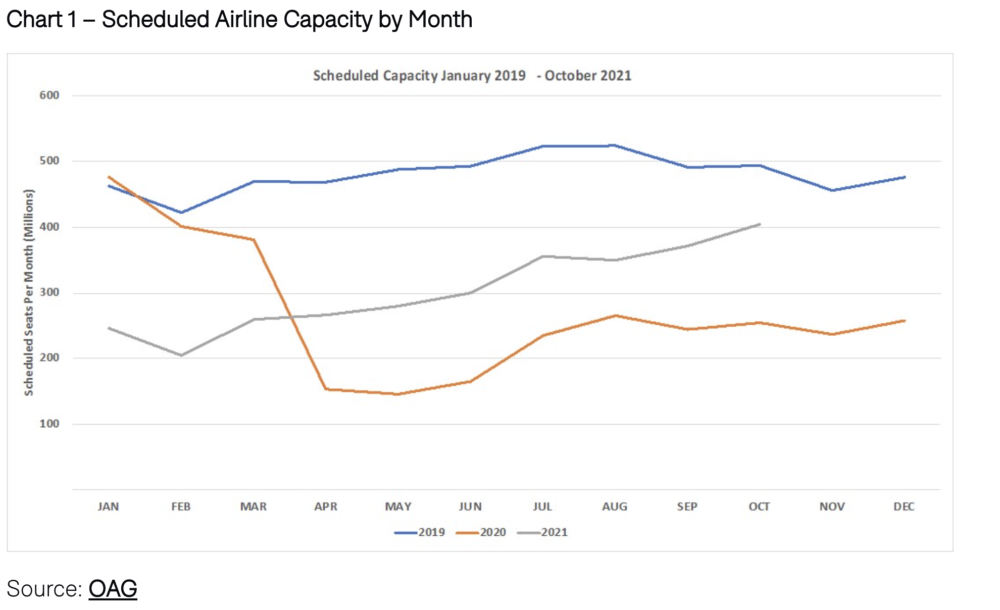

In a report for OAG, John Grant explains that although available seats are currently above the 76 million mark, it’s still a long way off where we were this time in 2019. Globally, the capacity of airlines remains around two-thirds lower than it was back then, and in many markets, passenger load factors remain painfully low.

Week on week, global capacity has risen, but only ever so slightly. The 0.5% growth seen in available seats is largely down to Southeast Asian capacity being added, to the impressive tune of 37.6%. Aside from this region, just about every other region has experienced a drop in capacity. The US domestic market remains relatively robust, but the changes noted by Grant only serve to highlight the choppy recovery being seen around the world.

Dropping down most significantly is the Latin American region of the Caribbean. Week on week, capacity has reduced by 7.7%, the most of any region. North America has dropped 1.8% of its capacity as the school holidays draw to a close, while Central America and Lower South America both lose in excess of 2% capacity.

A couple of markets do stand out, however. According to OAG data, both Russia and Greece are actually operating with more capacity than they had in 2019. Greece is up by just 0.1% while Russia is seeing 0.9% more scheduled capacity than in the same week of 2019. Week on week, the biggest climbers are Indonesia, with 38.7% more capacity, the UK with 5.1% added and the UAE with 3.8%.

Although the top airlines for capacity remain the US majors, all have pulled capacity back in the last week. With concerns over the delta variant still hampering forward planning, we could see more capacity pulled out of the networks as we move into fall.

Unless something significant changes, such as the UK-US corridor being established, chances are IATA’s prediction will hold true and airlines will indeed be facing a global loss of around $48 billion by the end of the year.