Speaking to investors on Thursday, Allegiant's management laid out the details in their recent aircraft order campaign in which the Boeing 737 MAX came out victorious. The airline weighted the 737 MAX against the Airbus A220 and Airbus A320neo family of aircraft and weighed various factors. Ultimately, the MAX checked the most boxes for Allegiant, and coupled with its short-term delivery availability, the Allegiant team decided to go big on the aircraft.

Allegiant weighs three aircraft families

Allegiant Air has been looking at several aircraft for the last few months as it decided now was the time to grow. Coming out of a crisis in which leisure reigned supreme and the airline became one of the first to return to its growth plans, the new aircraft order was, in the words of Allegiant's management, a question of "when not if." Allegiant currently is an all-Airbus operator, flying 108 Airbus A319 and A320ceo jets.

The order campaign involved both Airbus and Boeing, with Airbus coming to the table with two products and Boeing coming with just one. It is not uncommon for airlines to look at several different models before making an order, even if one model might make the most sense from a fleet simplification perspective. In this case, the Boeing 737 MAX beat out what would have been the assumed "winner" of any campaign: the Airbus A320neo. Here's what Allegiant weighed.

Allegiant looked at various criteria when deciding on the aircraft it would order. It needed a new, in-production aircraft that would, preferably, have short-term delivery availability, be a flexible fleet from a family and up-gauge optionality, offer low unit and trip costs, and be highly reliable. This was on top of the traditional pros and cons associated with individual families. Allegiant weighted costs and reliability against the existing Airbus A320ceo family fleet.

The Airbus A320neo family

This would, on paper, appear to be Allegiant's best choice. It would let the airline remain committed to a single fleet type while gaining added fuel efficiency and lower maintenance benefits. It met Allegiant's desire for low costs and high reliability. However, the A320neo family had some shortcomings.

One of the biggest strikes against the A320neo family was a lack of availability. Airbus did not have delivery slots for Allegiant until the middle and later part of the decade, and Allegiant was looking to get aircraft sooner rather than later. Given the popularity of this family of airplanes and some limitations on Airbus' ability to significantly ramp up aircraft production to counteract that, if Allegiant chose this family, it would not have the planes to support its ambitious near-term growth goals.

Another thing Allegiant noted was that this family would have had the highest acquisition cost, mostly because there are only two variants that Airbus is actively offering. This is the A320neo and A321neo. Based on Allegiant's presentation, there seemed to be some uncertainty around the A319neo, which has not sold well and has largely been overshadowed by the Airbus A220-300. The A320neo and A321neo come at a higher cost than the A319neo.

The A220-300

Allegiant then looked at the Airbus A220-300. This appeared to be the best offering Airbus could provide in terms of near-term availability. However, given the low production rates on the aircraft, it would have extended the delivery schedule. The A220 met Allegiant's bar for low unit costs, low costs per departure, and high reliability. However, Allegiant had some concerns with spare parts coverage of the aircraft.

One of the biggest strikes against the A220-300 is that there is uncertainty around the flexibility of the family. The A220-100 is likely too small for Allegiant, but the A220-300 is the largest A220 variant Airbus currently offers. While there has been plenty of commentary from Airbus that the A220-500 has become something the manufacturer is looking at, Airbus has not officially launched the A220-500, thus leaving uncertainty over the timing of deliveries. For Allegiant, this lack of flexibility was concerning.

The winner: the Boeing 737 MAX

The Boeing 737 MAX family fit the airline's base requirements. It had short-term availability, offered low unit costs, low trip costs, high reliability, and high spare parts coverage. While it did add the dual fleet complexity, the need for new aircraft sooner rather than later, and the lack of availability of new A320neos, this appeared to have been a headwind that Allegiant was ready to accept. However, Allegiant has pulled off mixed-fleet operations with successful financial results.

The order for the 737 MAX includes 30 of the smaller 737-7s and 20 of the larger 737-8 200s. The gauge and family flexibility of the 737 MAX is key. In addition to the -7 and -8, the MAX family includes the in-operation MAX 9 and the MAX 10, though that aircraft is awaiting certification and entry into commercial service. The same is true for the MAX 7, though Boeing is making progress on certification, and MAX 7 deliveries are expected to start this year with Southwest Airlines. Allegiant will take its first MAX aircraft in 2023.

Stay informed: Sign up for our daily and weekly aviation news digests.

Allegiant grows without sacrificing its model

Allegiant is plotting a roughly 10% growth rate per annum. Out to 2025, this would put the airline at a fleet of approximately 170 aircraft by the end of the year. The 50 firm MAX jets would make up approximately 30% of that planned fleet and will help lower the airline's average fleet age. At the same time, Allegiant has made it clear that it will not stop shopping for opportunistic, used aircraft. The airline's fleet plan out to 2025 includes 22 placeholder aircraft that it expects will mostly be used Airbus A320s. Even when the MAX family is fully delivered, the airline expects to be majority-Airbus.

There is a lot of flexibility in the Allegiant fleet plan. By 2025, Allegiant believes it may be time to start retiring some of its Airbus A319s and older 177-seat Airbus A320s. Allegiant expects roughly 20 A320 retirements between 2023 and 2025, though it has not yet outlined A319 retirement plans.

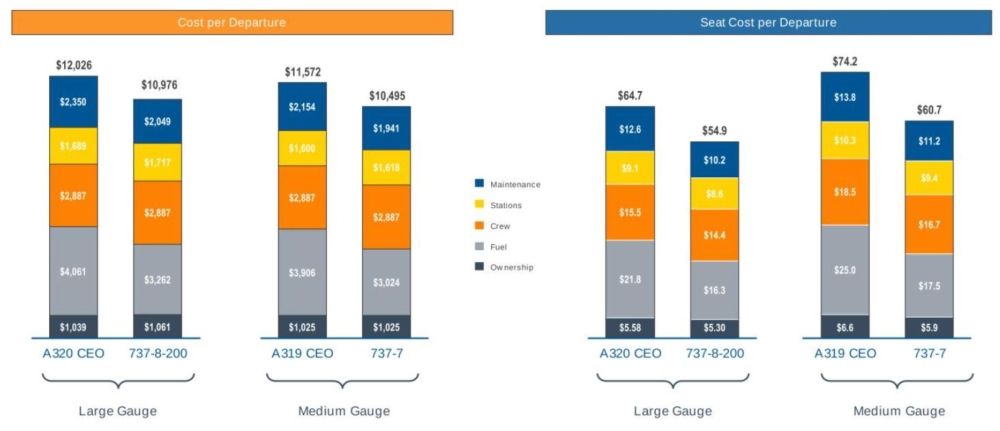

In terms of operating economics, Allegiant expects to see some favorable results with flying the MAX compared to its existing fleet. The airline released an expected cost per departure comparing the A320ceo to the 737 MAX 8-200 and the A319ceo to the 737-7:

Estimating a fuel cost per gallon of $2.18, Allegiant expects the MAX 8-200 to have a cost per departure of roughly $10,976 while the A320ceos have a cost per departure of around $12,026. The MAX 7 comes in at $10,495, while the A319ceo comes in at $11,572. Notably, Allegiant highlights little difference in the ownership costs.

Allegiant does not expect to need to shed its model of low-cost operations on point-to-point routes. Instead, it appears that its model will be intact, with Drew Wells, Allegiant's Senior Vice President of Revenue and Planning, discussing the airline's use of the aircraft in its network:

"However, we don't need increased utilization for these aircraft to make an immediate impact on our financial results. Using 2019 utilization and geographic deployment, we would expect to see meaningful EBTIDA lift simply from using newest generation MAX aircraft."

Looking at EBITDA (earnings before interest, taxes, depreciation, and amortization), Allegiant expects that the deployment of the MAX and reduced utilization of the existing A320ceo fleet will give it a mid-decade EBTIDA target of $7 to $7.5 million per aircraft while flying the MAX 8 at roughly 8.1 hours of utilization per day and the MAX 7 at roughly 7.3 hours per day.

Allegiant chose the MAX for a variety of reasons. While there will be some cost headwinds of the new fleet induction, the airline's management team has handled a mixed fleet before and cited strong support from Boeing and engine manufacturer CFM in getting to a deal. When all is said and done, Allegiant sees the MAX coming into its fleet without upending its model, allowing it to still run low-frequency, low-utilization schedules while growing EBITDA aircraft to ambitious targets.