While Japan's borders are still closed, and travel restrictions remain fairly restrictive, ANA's (All Nippon Airways) financial performance is at least moving in the right direction- posting a smaller quarterly loss than in previous periods. In fact, this latest figure represents the airline's smallest quarterly loss since the fourth quarter of 2019. Let's take a look at how the airline managed to achieve this.

"There have been signs of recovery in the airline industry, especially increased demand within the United States and European countries where an increase in vaccination rates has progressed. However, hurdles still remain on many international routes due to restrictions on entry and travel in a number of countries." - All Nippon Airways

Financial recovery (or at least stabilization)

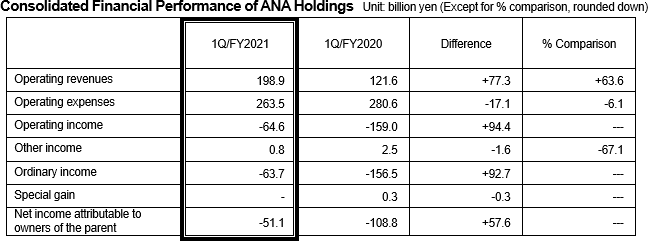

While it hasn't yet found itself posting a quarterly profit, ANA is reporting shrinking quarterly losses, with the airline losing 51.1 billion yen ($465 million) over the first quarter of the fiscal year 2021.

While it's no small amount, it was a huge step forward for the airline as the same quarter in 2020 saw it lose 108.8 billion yen ($980 million). This shows an overall reduction of 57.6 billion yen in losses.

Releasing more detailed figures, we can see that the airline's operating revenues are up by 63.6% from the same quarter last year, while its operating expenses were brought down by 6.1%.

Explaining the improvement

The reason for the airline's improvement over the past year is primarily explained by the fact that travel was all but shut down at the onset of the global health crisis. At the same time, due to the relatively rapid development of the pandemic, the airline was unable to find ways to rapidly reduce its costs.

Ichiro Fukuzawa, Executive Vice President and Chief Financial Officer of ANA Holdings, notes that the health crisis and accompanying immigration restrictions dampened demand for international travel. The airline chief notes that his company's turnaround was made possible by "the impressive growth of [its] cargo business, rebounding travel demand, and targeted cost-cutting measures." These, he says, have led to "the greatest improvement in quarterly financial results since COVID-19 started impacting our business in the fourth quarter of FY2019."

Stay informed: Sign up for our daily and weekly aviation news digests.

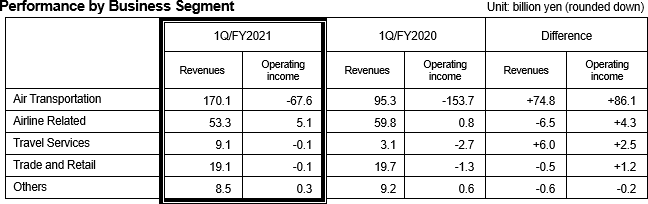

Cargo and domestic travel jump significantly

Indeed, fast-forwarding a full year, and ANA has had the time to reduce its operational expenditures. Just as importantly, the airline was able to pivot more towards domestic and cargo operations.

In fact, comparing Q1 2021 and Q1 2020, its domestic passenger operations rose by 123.5% while passenger numbers rose 150.3%. Comparing the two quarters on the cargo side, ANA increased its international cargo revenue by nearly 160% and its domestic cargo revenue by 64.3%.

For international passenger services, the airline notes that travel demand in all regions remained suppressed. However, it attributes its 36.5% increase in international passenger revenue to expatriates traveling between Japan and overseas, as well as connecting demand from Asia to North America, as the United States scaled up its vaccination efforts.