According to Airbus, the Asia-Pacific region will need over 17,600 new aircraft by 2040. Passenger traffic in the region is projected to grow at a rate of 5.3% per annum over the next 20 years, while the freight sector could double in size over the same period. This demand is attributed to high GDP growth rates, a tripling of the middle class and the retirement of inefficient older aircraft.

Over 17,600 new aircraft by 2040

With post-pandemic aviation growth expected to surge across the Asia-Pacific region, Airbus has projected over 17,600 aircraft will be needed by 2040.

The aerospace giant believes the region will require an estimated 17,620 new passenger and freight aircraft within this period. Boeing arrived at a similar figure of 17,645 in its forecast released last November.

Airbus said,

"In the next 20 years, passenger traffic growth of 5.3% per annum and accelerated retirement of older less fuel-efficient aircraft will see the Asia-Pacific region require 17,620 new passenger and freighter aircraft."

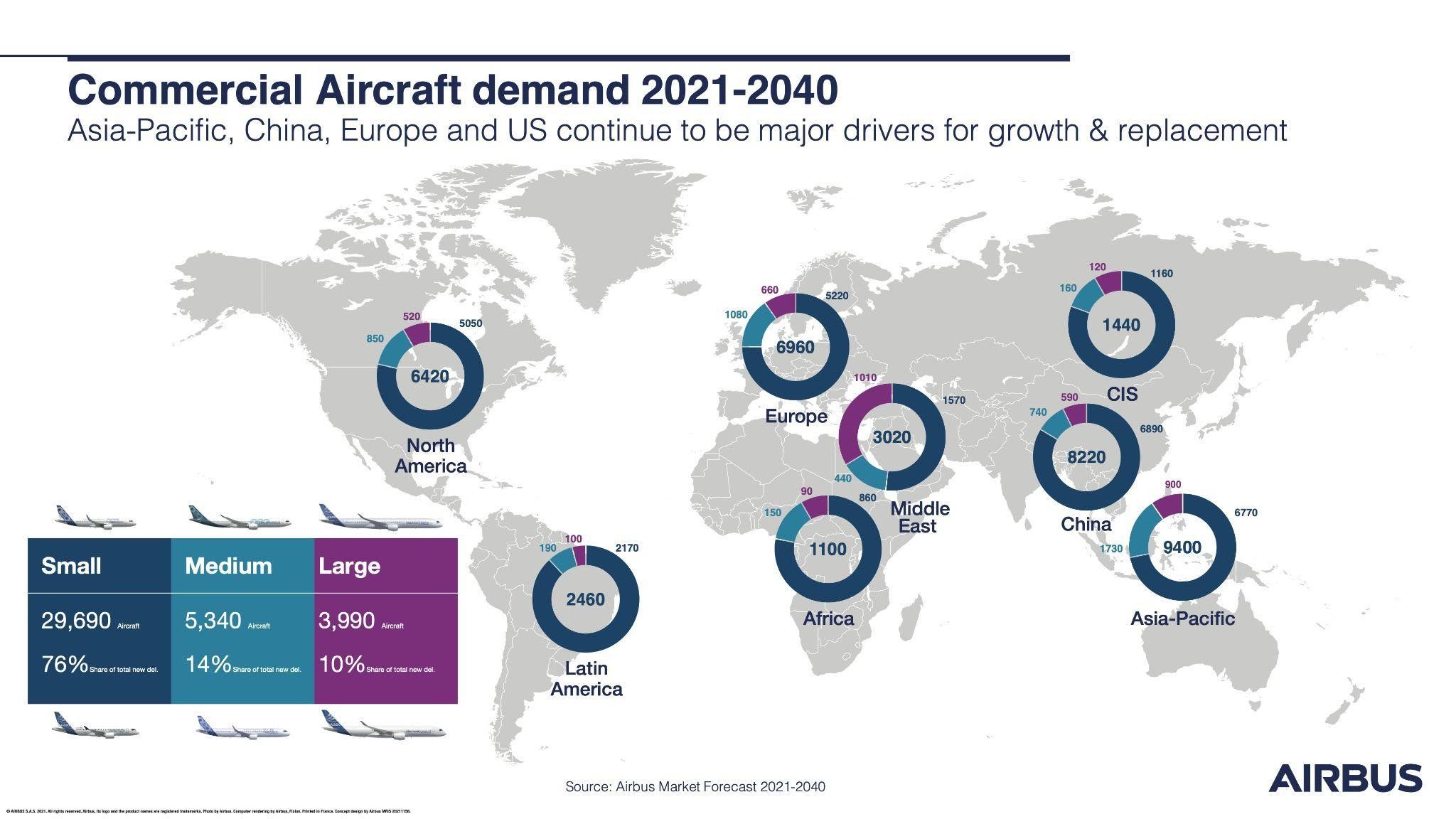

Of these 17,620 aircraft, Airbus estimates the need for:

- 13,360 Small aircraft

- 2,470 Medium aircraft

- 1.490 Large aircraft

Demand in the region will be driven by higher-than-average GDP growth rates and the emergence of a larger middle class. Airbus projects that "the middle class, who are the likeliest to travel, will increase by 1.1 billion to 3.2 billion and the propensity for people to travel is set to almost triple by 2040."

Airbus added,

"In a region which is home to 55% of the world’s population, China, India and emerging economies such as Vietnam and Indonesia will be the principal drivers of growth in Asia-Pacific. GDP will grow at 3.6% per year compared to the world average 2.5% and double in value by 2040."

Globally, Airbus estimates the need for 39,000 new passenger and freight aircraft by 2040, of which 15,250 will be for replacement. By this time, the company projects that most commercial aircraft in operation will be the latest generation, compared to today's level of around 13%.

Older aircraft retirement accelerated

Another major factor will be the retirement of older, inefficient aircraft. Airbus estimates that around 30% of new aircraft demand will replace less-efficient models.

Christian Scherer, Chief Commercial Officer and Head of Airbus International, said,

"We are seeing a global recovery in air traffic and as travel restrictions are further eased the Asia-Pacific region will become one of its main drivers again. We are confident of a strong rebound in the region’s traffic and expect it to reach 2019 levels between 2023 and 2025."

As airlines strive to meet carbon-cutting targets, acquiring fuel-efficient aircraft will play a key role in their sustainability efforts.

Scherer added,

"With an ever-greater focus on efficiency and sustainable aviation in the region, our products are especially well-positioned."

The cargo market

The Asia-Pacific freight market is expected to grow at a higher rate (3.6%) per year than the global average (3.1%), with Airbus projecting it will double in size within the next 20 years. This comes at an opportune time for Airbus, which recently received its first order for the A350F.

Particularly, express freight driven by e-commerce is set to grow even faster at 4.7% per annum. Airbus estimates the need for 2,440 freighters, of which 880 will be new-build, by 2040.

What do you think about Airbus' estimates? Do you believe the Asia-Pacific region will experience this level of growth over the next 20 years? Let us know your insights in the comments.