Edit: Since the time of publishing this article, the Brazilian court has reached a verdict, read below for updates.

Brazil's 4th largest airline, Avianca Brasil*, filed for bankruptcy protection earlier this week.

This is different from declaring bankruptcy (in which the airline would be trading insolvent) but rather that they could go bankrupt if creditors repossess aircraft or demand payment.

This essentially buys the airline a little bit of time to make a big profit to repay debts and allows them to keep trading. It also covers the situation if creditors refuse to extend credit and an agreement cannot be made.

Who is Avianca?

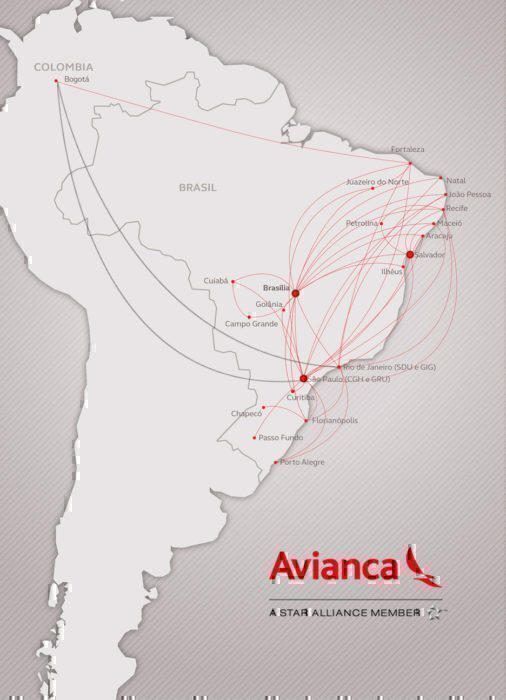

Avianca is the world 2nd oldest airline (After Dutch KML) and recently celebrated 90 years of continued service. They have the following subsidiaries:

Avianca Brasil* is actually not a subsidiary of the main airline, but another airline that is held by their parent group, Synergy Group. Synergy group is owned by Bolivian-born investor German Efromovich. Avianca (the main airline) is part of Star Alliance and has many codeshare routes with United.

[ege_cards_related id="18"]

This distinction is important as Avianca (the main airline) is currently operating fine with a fleet of 130 planes, and 138 on order. Avianca Brasil* on the other hand, is struggling with their 54 planes.

Why is Avianca Brasil struggling?

The story is very much the same as all the other airlines that have had financial problems this year...

Rising fuel prices. Unlike other airlines, however, Avianca Brasil has to buy the fuel in US dollars, despite earning the more volatile Brasilian Real from their passengers. This means that they make far less profit per route and struggle to make many of their routes profitable.

This means they have started to delay or default on payments to their leaseholders (who own the jets in their fleet). These leaseholders are understandably upset and have canceled their contracts with the airline and are taking action to repossess the planes... or trying to.

Unlike previous airline Cobalt, who when the lease operators tried to repossess the planes got blocked from taxing them to the runway (with ground service trucks), Avianca Brasil has opted to go a different route and ask for Bankruptcy protection from the Brazilian courts. As part of that filing, it has been revealed that three different aircraft leaseholder companies are actively sueing the company and are seeking to repossess up to 30% of the entire airlines fleet. This would mean Avianca Brasil would not be able to fly some 77,000 passengers.

One of the aircraft leasing companies, Aircastle Ltd, revealed on Monday that it had terminated leases for 11 aircraft Avianca Brasil was flying and had begun “exercising remedies” to repossess them. This would involve asking the Brazilian aviation regulator to strip the aircraft from the national registry, and thus prevent the aircraft from flying.

“Avianca Brasil has had issues, and many investors were expecting the company to renegotiate its leases,” Cowen Equity Research

The Brasilian aviation regulator, ANAC has said that they might have to restrict the sale of any new tickets on the airline until the company could improve its finances. Naturally, this would be a total disaster and almost guarantee the company would go bankrupt.

“The company insists that its operations continue normally and have not — and will not — be impacted,” - Avianca Brasil

Only the courts will decide if it is worth protecting this airline. We certainly hope a new agreement can be reached between the airline and its aircraft leaseholders.

[ege_cards_related id="10"]

UPDATE: Brazillian court rules that Avianca Brasil must return 20% of all aircraft (whilst holding onto the remaining 10% leased aircraft to continue operations).

Avianca Brasil says it does not plan to appeal the ruling and hopes to find an out-of-court settlement.

United Airlines has given Efromovich (Owner of Avianca) a personal loan $456,000,000 USD (Just interjecting here, how bonkers is it that United gave a personal loan to a person of half a billion USD), secured against ownership shares in the Avianca group.

Of course, if Efromovich can't recover the airline, Avianca might fall under United. This would make United one of the biggest carriers in the world and have massive control of the Americas marketplace. You might even think that United might want this loan to default.... but i'll leave my tinfoil cap for another time.

What do you think of these developments?

*Brazil in English, Brasil in Portuguese, I'll use it interchangeably throughout the article.