US plane maker, Boeing, has predicted huge Middle East growth over the next two decades. Boeing's Middle East prediction says that the area will need in the region of 2,990 new aircraft in the next 20 years.

Such growth would triple the existing fleet of aircraft in the region. This also comes with the knock on effect of needing more crew, pilots and ground staff to maintain and operate all these new planes, not to mention growth in the supply chain too.

The services market outlook in the Middle East

Their report on the Services Market Outlook (SMO) 2018-2037 – Middle East Perspective, showcases a growing requirement for services aimed at reducing operating costs and increasing fleet productivity. In addition to almost 3,000 new aircraft, Boeing’s report predicted that:

- The Middle East would drive 8% of global demand for aviation services, valued at $745bn

- Aviation in the Middle East would grow at 4.6% annually

- 218,000 personnel (including 60,000 pilots, 63,000 technicians and 95,000 cabin crew) would be required in the Middle East by 2038

Ihssane Mounir, senior vice president of Commercial Sales & Marketing for The Boeing Company, commented on the Boeing SMO findings;

"The Middle East is an unmatched location to connect the growing markets of Asia, Europe and Africa. This feeds the appetite in the region for new commercial airplanes and the services to operate and maintain those jets."

As part of their Services Market Outlook, defined as a long term forecast to guide business planning and share industry trends, Boeing have been looking at the wider aviation market too. Overall, they expect the commercial aviation market to be worth around $8.8 trillion between now and 2037, with annual spends doubling over that time.

A unique position

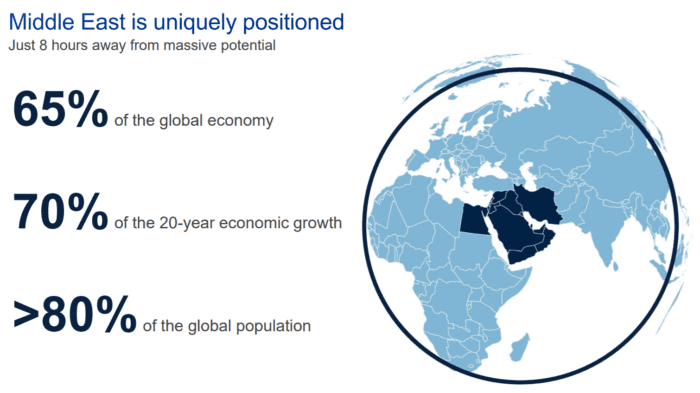

Boeing highlighted the Middle East’s unique position geographically in the world. The location of the region on the borders of Africa, Asia and Europe gives the region the opportunity to create hubs connecting east, west, north and south, in a way that many other regions simply cannot.

Within eight hours flying time of the Middle East, carriers can reach 65% of the global economy and around 80% of the world’s population. And with fifth freedom flights and new airline partners, Middle East carriers can look forward to literally connecting anywhere with anywhere.

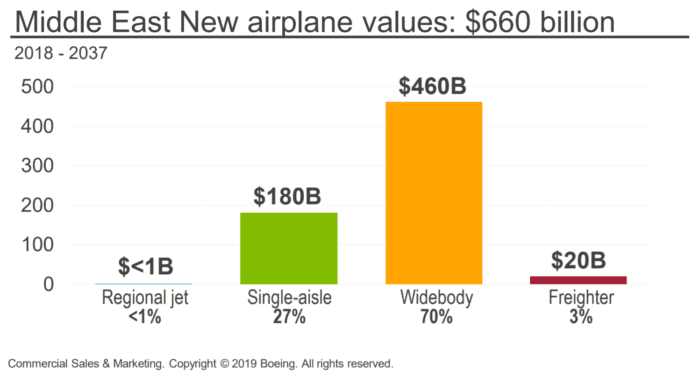

This has led them to estimate the need for 2,990 new aircraft over the next 20 years, an investment that they estimate to be worth $660bn. Taking into account the Middle East’s love for the widebody jet, the split of investment has been predicted at:

- 70% widebody orders, valued at $460bn

- 27% single aisle orders, valued at $180bn

- <1% regional jet orders, valued at less than $1bn

- 3% freighter jet orders, valued at $20bn

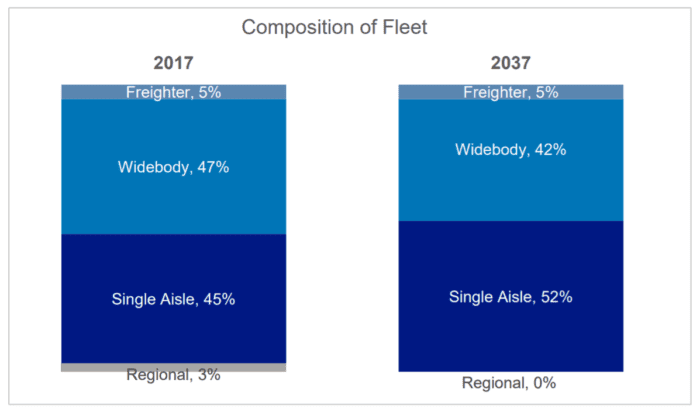

These predictions show that, despite widebody aircraft typically being the jet of choice, the advent of highly efficient, comfortable narrowbodies will influence the mix over the next two decades. By 2037, they predict widebody use will have dropped from 47% down to 42%, while single aisle jets will increase from 45% to 52%.

With an aging widebody fleet and a growing need to refresh them with aircraft that are fit for the future, Boeing’s predictions are looking pretty realistic, foretelling a promising future for aviation in the Middle East.