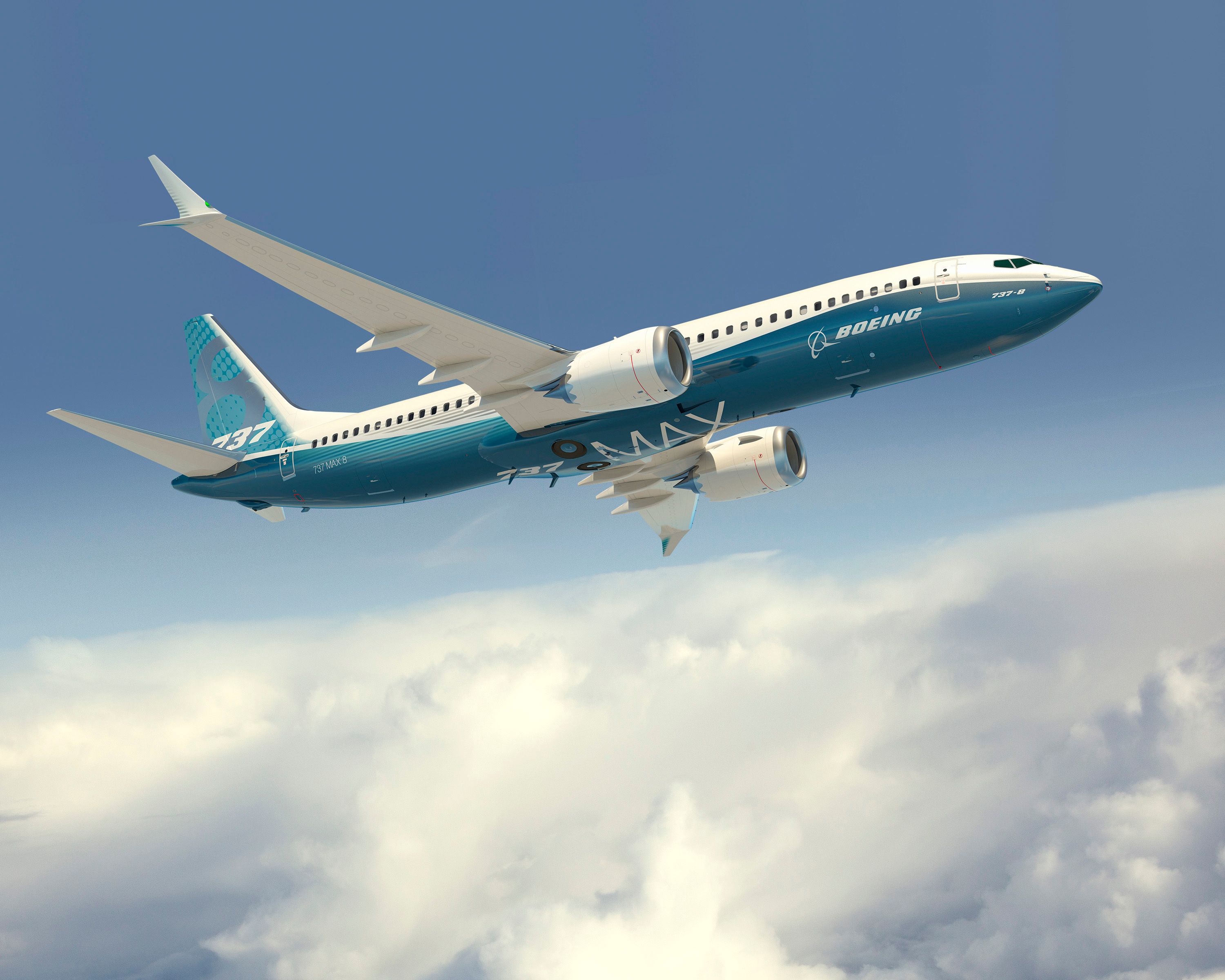

Boeing has announced that it will reassign multiple 737 MAX aircraft that were promised to Chinese buyers to other non-Chinese airlines as a trade ban between the US and China persists. The planemaker claims it cannot keep the planes in storage any longer without turning a profit.

Billions in storage

Over 140 737 MAX aircraft are in storage awaiting transfer to Chinese airlines. This leaves $5 billion tied up in these planes. The aircraft have accumulated over the past three years as no Boeing jets have been delivered to the Chinese market since 2019.

Many of these planes have been repainted with a neutral white livery to sport other air carriers' colors. The repainting process alone is a significant loss to the company. However, it believes the temporary loss will be worth it when it receives capital from the new buyers. The manufacturer wants to move the aircraft soon to unlock cash and free up storage space.

Dave Calhoun, the CEO of Boeing, stated that the company needs to move the aircraft quickly. The more time they spend in storage, the larger the loss for Boeing. Since the pandemic, the company has experienced many production delays, and the low number of aircraft delivered in the past two years has added pressure on the company to move the grounded 737s.

Risky decision

Boeing was reluctant to decide to redistribute the aircraft to other buyers as it was afraid the move might jeopardize relations with its Chinese buyers. If the trade ban lifts and Boeing does not have the promised products, the airlines will likely turn to rival aerospace giant Airbus.

The two behemoth aerospace companies currently form a duopoly over the Chinese commercial aviation market. Boeing has historically dominated in the inevitable war for market share. However, as the company has been shut out of the populous nation, Airbus has begun to claim more and more of the market. It is likely that if the ban continues much longer, Airbus may soon gain the upper hand.

Debt recovery

For the first time since 2018, Boeing is on track to report positive free cash flow. The past several years have been turbulent for the company. From the 737 MAX accidents to production delays during the pandemic, the airlines' debt level has climbed to $57 billion. Since production has resumed on a full scale, the airline has begun to generate more revenue than it loses in production costs.

The latest plan to free up cash tied in the stored 737s is anticipated to ensure the existence of this cash flow and help put the company back on track to continue its expansion plans. Boeing claims that it will continue to be the world's largest aerospace company for years as it continuously innovates and expands its influence. The 737 family has proven to be the company's largest asset that continues to bring in billions in revenue yearly.

What do you think of Boeing's decision to reassign the stored 737s? Let us know in the comments below.

Source: Bloomberg