Boeing have released confirmation that their dividend payout has been approved. At $2.055, it’s the same level of payout as investors received in the last two quarters. With the 737 MAX disaster still unresolved and ongoing delays to their 777X program, how can Boeing afford to maintain investor payments at the same level?

The exact cost of the 737 MAX grounding is yet to be seen, but analysts are estimating that it could cost Boeing around £5bn. This is based on a return to service by August, which is looking highly unlikely. The longer it stays on the ground, the more Boeing will be out of pocket. However, while the balance sheet will be temporarily weakened, it seems that, at least on Wall Street, there is confidence that Boeing will return to a strong position.

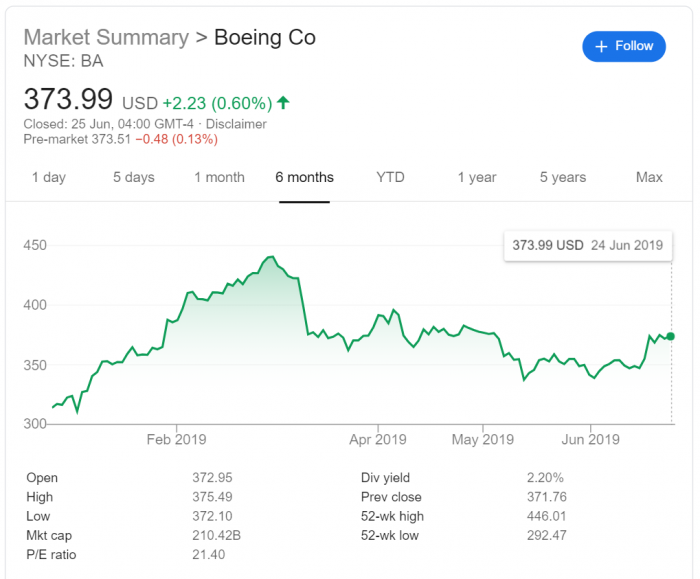

Steady shares despite PR nightmare

According to the release on Boeing’s website, the board of directors have approved a quarterly dividend of $2.055 per share. Looking at historical data, this is one of the highest quarterly dividend payments in the last five years.

The quarterly payment for the same period last year was $1.42, and the payment just before the new year was $1.71. This means that the stock has risen, despite the massive amounts of negative PR around the Boeing company recently.

Even more puzzling, the agreed share payout for the next quarter is equal to that of the first and second quarters, meaning the MAX debacle hasn’t hit Boeing’s share price at all – how can that be?

Investor confidence

Looking at the Boeing stock price over the course of the year, we can just about pinpoint the exact moment when the 737 MAX was grounded. That moment saw around $25bn wiped off Boeing’s stock market capitalization; almost a tenth of its value. However, since that moment, the price has climbed steadily, and is currently significantly higher than it was at the start of the year.

This demonstrates a level of investor confidence in the US plane maker, that they will overcome the 737 MAX issue, as well as the delays to the 777X, and will return to business as usual eventually. The real question comes down to how long all these things will take.

Of course, the 737 MAX is not Boeing’s only source of income, although it does account for around a third of Boeing’s revenue and half of overall profits, according to the Economist. In a way, Boeing is considered too big to fail, mainly because of the US’s reliance on it for the Department of Defense’s military aircraft.

Make no mistake; Boeing are losing money, as their Q1 report demonstrated. However, they seem determined to maintain dividend payouts, in order to keep their investors happy.

So how can Boeing still pay the same dividends?

Boeing is likely to be maintaining its comfortable dividend payouts by doing two things. Firstly, the company normally returns most of its free cash flow (around 95%) to its investors via dividends and share buybacks. In order to conserve cash, they may well be suspending share buybacks until the MAX is back in service.

Secondly, with such a big part of their income absent, analysts have estimated that Boeing will need to borrow around $1bn to pay dividends. For the company, it’s crucial to maintain investor confidence, which means keeping those dividend payments rolling, even if they’re a bit tight for cash themselves.

However, some analysts are warning that Boeing could be underestimating the risk associated with the MAX grounding. IBA estimate that, for airlines, the direct cost of grounding the MAX will be in the region of $150,000 per day, per aircraft. This includes lost profits, parking costs, staff costs, passenger rerouting and more. Airlines will be looking to claw that loss back, and a number have already started the process.

Despite this, investors still tout Boeing as a strong buy, thanks to the company’s solid position in the aerospace sector. Once the MAX returns to service, Boeing stock is expected to exceed $450 a share, despite the potential cost to the company of the grounding.