British Airways ceased short-haul flying from London Gatwick in April 2020, focusing instead on Heathrow. Although discussed for years, it has been revealed that it may create a lower-cost unit to operate from Gatwick, enabling a more cost-effective platform to compete more successfully. We take a look at the situation.

What is happening?

While BA will maintain its long-haul network from Gatwick, its short-haul operation may instead be operated by a lower-cost unit, potentially as soon as summer or winter 2022. This has been discussed in recent years as a result of less favorable financial performance versus Heathrow.

Stay aware: Sign up for my weekly new routes newsletter.

While far from clear, this unit could be along the lines of Iberia Express but with recognizably BA branding. Don't expect anything dramatic, as it is likely that the cuts will be 'unseen'. Whatever happens, a lower-cost platform to better confront the enormous competitive pressure even before COVID is considered broadly makes sense, although it is a highly reactive move.

Enormous competitive pressure

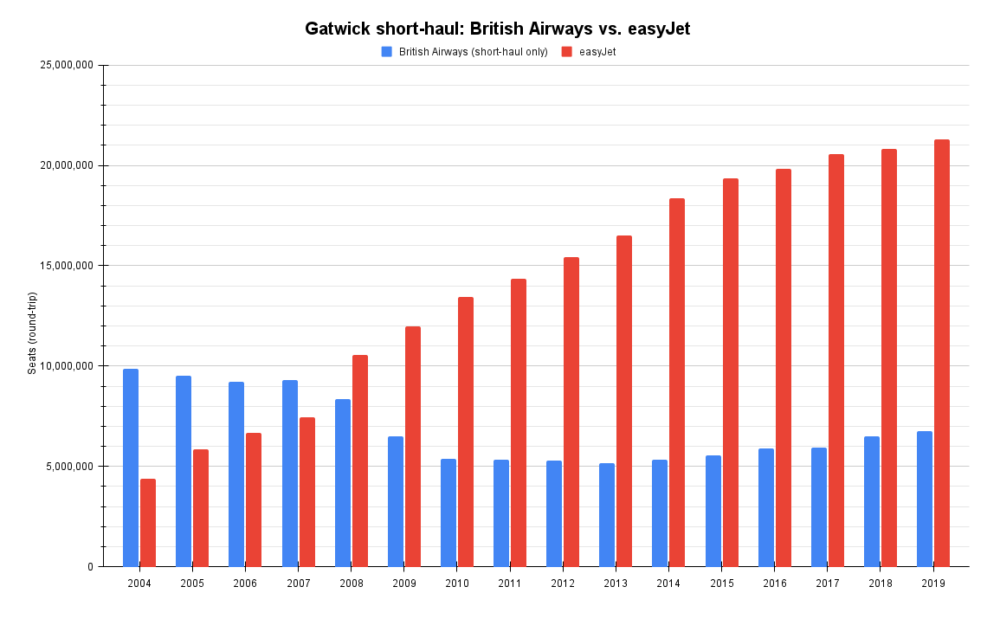

In 2019, the last normal year, BA's short-haul operation at Gatwick had almost 6.8 million seats, OAG data indicates. This meant BA short-haul had 13% of the airport's total seats, down from a high of 36% in 2004.

While BA had 13% in 2019, the highest level since 2012, easyJet had 40%, over double what it had in 2004. However, much more important than simple airport domination is the degree of route overlap. This is where the pressure facing BA is clearest to see.

Nine in ten BA routes had competition

Two years ago, BA had 54 routes from Gatwick, with 48 – nearly nine in ten – having head-to-head competition with at least one other airline. As you'd expect, BA competed most acutely with easyJet, with the pair facing each other on 47 routes. (Only BA's routes to Algiers, Bergamo, Cologne, Genoa, Limoges, and Tirana had no direct competition but plenty of indirect competition from other London airports.)

How could a lower-cost unit save money?

The concept of an airline lower-cost subsidiary stretches back many years. They have often been considered a last resort rather than a proper strategic weapon, which can be seen by so many of them being created reactively rather than proactively to a competitive threat. This has often undermined effectiveness, likewise insufficient separation with the parent.

Make no mistake about it. If it happens, the new unit, whatever it is, will probably be about further reducing labor costs and conditions and increasing labor productivity. Normally, higher aircraft seating density is also a key way to reduce seat-mile costs, but BA's A320s normally have around 180 seats anyway.

Will they be retrofitted with 186? Will A319s be replaced with A320s? Will IAG's Boeing 737 MAXs replace them all? Expect renewed labor, airport, and ground handling contracts to be key, along with higher labor productivity and seat load factors.

What are your thoughts on the situation? Let us know in the comments.