With US low cost carrier JetBlue finally confirming a launch date for their London flights, rival carriers are bound to feel worried about what this new competitor will bring. British Airways, one of the leading airlines for flights across the pond, are gearing up to stay competitive.

Although JetBlue’s London flights aren’t starting until 2021, rival carriers are undoubtedly already thinking of the impact they’ll have on their business. In the transatlantic market, British Airways and their alliance partners American Airlines, Finnair and Iberia have the lion’s share.

According to BA, the Oneworld airlines operate almost 130 transatlantic flights per day. BA and AA between them operate almost half the seats between London and New York, all on aircraft with lie flat business class seats.

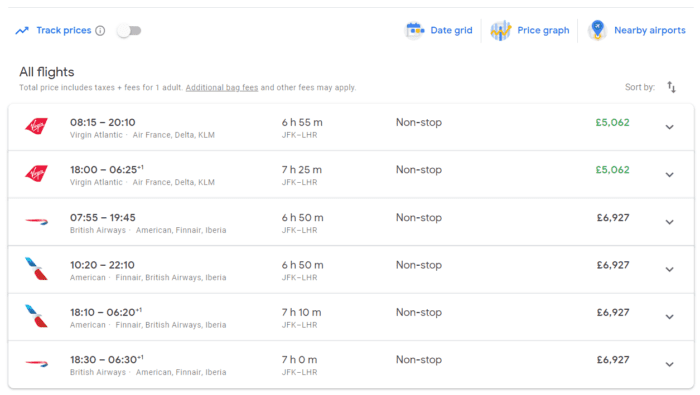

A quick look at Google Flights and it’s clear that these nonstop lie flat seats come at quite the ticket price. Around £6,900 ($9,000) seems to be the norm for BA and AA, which is not a fare to be sneezed at. Although we don’t know what JetBlue plan to charge for lie flat comfort, it’s likely to be considerably cheaper than this. And it’s this factor that’s got BA’s boss, Alex Cruz, slightly worried.

A premium passenger worry

In terms of JetBlue’s entry into the transatlantic game, the biggest concern for British Airways is undoubtedly the ‘Mint Effect’. Mint is JetBlue’s business class and has a track record of being able to squeeze the profits of some of the biggest airlines out there.

When JetBlue launched Mint in the 2014, it shook up the transcontinental premium market in the US. Prior to Mint, business class fares from coast to coast (JFK-LAX or JFK-SFO, for example) were in the region of $1,000.

Mint took those prices down to as low as $599, forcing other carriers to lower their prices in order to compete. Several years on and the price has gone back up a bit, but the average still sits lower than it was before, somewhere in the region of $750. It’s likely that something similar could happen to the transatlantic market too.

With their new A321LR starting to be delivered, JetBlue have an aircraft that can fly transatlantic with its Mint product on board. This could be dangerous for BA, jeopardizing one of their most lucrative routes and forcing them to lower their fares.

When they start taking their A220s, JetBlue also have the opportunity to fly into to London City airport. This could be a game changer for the airline, putting it in direct competition with BA1, only at much less eye-watering prices. We’ve already speculated on the benefits to an all business transatlantic flight; perhaps JetBlue and their A220 are the ones to do it?

What are BA to do?

BA have a challenge on their hands. They need to ensure they retain their transatlantic customers, but without damaging their bottom line. Speaking to Skift at their European Forum this week, it was reported by The Points Guy that Cruz said:

“If you repeatedly create a sensation or feeling of ripping people off, the moment that customers have an option to travel in a similar experience, they’ll leave. So you need to make sure that the overall proposition of what you have to offer — not just the ticket price, but everything that comes with it — it has to be correct otherwise you will lose customers.”

When it comes to competition from JetBlue, British Airways are going to have to handle the situation carefully. It’s unlikely they’ll be able to beat them on price, particularly in premium, and probably shouldn’t try. Instead, their product needs to be the very best it can be, demonstrating the additional value to be gained by choosing BA.

The Norwegian effect

Of course, it’s not only JetBlue who are putting the pressure on BA. For some years now, the British airline has felt the squeeze from disruptive rival Norwegian Air. Their rock bottom transatlantic fares saw them overtake British Airways for transatlantic passenger numbers in October last year, shifting 1.67 million passengers compared to BA’s 1.63 million.

Despite IAG’s best efforts to buy them out, the Nordic airline remains stoically independent. Norwegian rejected two offers by British Airways’ parent company over the course of 2018, and in January this year IAG made a stock market statement saying it would make no further offers and, indeed, would be selling it’s 3.93% holding in Norwegian.

Overall, the future is shaping up to be tough for the airline, putting a small dampener on their centenary celebrations. They’re facing being squeezed from both directions, in both their economy and their treasured premium class too.

But British Airways have a lot going for them. According to the Guardian, they far outpace Norwegian in customer service, notching up just 63 complaints per million passengers last quarter compared to Norwegian’s 526 per million. With their cabins being refreshed, lounges improved and new aircraft on the way, BA still have a lot to offer the discerning traveler.