Set to take off in April, Canadian ultra-low-cost carrier Lynx Air has put its initial routes on sale. There are seven in all, involving five cities with 39 weekly flights in the peak summer. Utilizing the B737 MAX 8, Lynx will compete with between three and five airlines per route. Air Canada and WestJet strongly dominate the markets, but with little lower-priced alternatives – even with Flair operating all seven routes. Lynx must ensure it achieves unit costs lower than unit revenue.

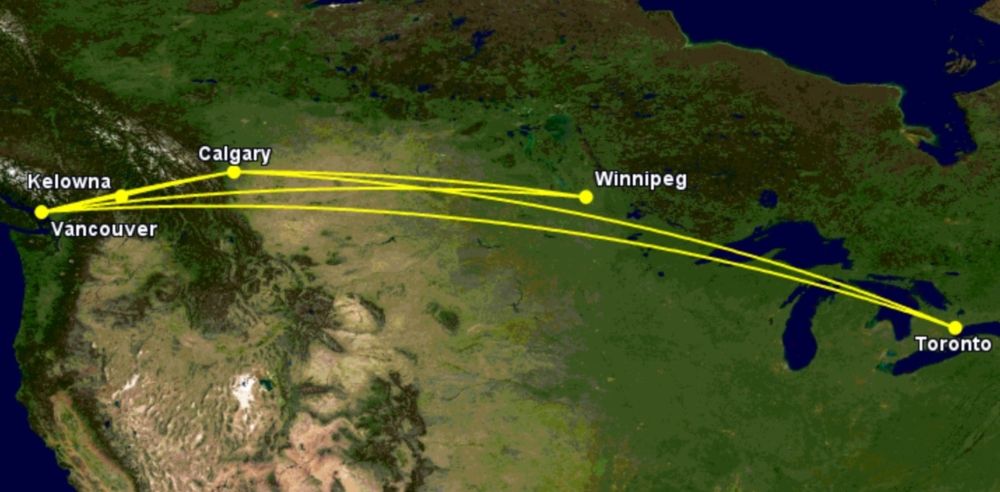

Lynx's initial network

Lynx will take to the sky on April 8th from Calgary to Vancouver. This summer, it'll be one of four airlines on the airport-pair, joining Air Canada (with the most flights), WestJet, and Flair. Indeed, all initial routes, detailed below, will see face-to-face competition with Flair.

- Calgary to Kelowna: starts April 15th, 3x weekly in August; competing with WestJet, Air Canada, Flair

- Calgary to Toronto Pearson: April 14th, 1x daily; Air Canada, WestJet, Flair, Air Transat

- Calgary to Vancouver: April 8th, 2x daily; Air Canada, WestJet, Flair

- Calgary to Winnipeg: April 19th, 4x weekly; WestJet, Air Canada, Flair

- Kelowna to Vancouver: April 15th, 2x weekly; Air Canada, WestJet, Air North, Central Mountain Air, Flair

- Toronto to Vancouver: April 28th, 1x daily; Air Canada, WestJet, Air Transat, Flair

- Vancouver to Winnipeg: April 19th, 2x weekly; WestJet, Air Canada, Flair

Lynx's network approach contrasts vividly with most startup airlines, which actively target unserved markets. For example, Australia's Breeze will avoid well-served major airport-pairs. Instead, it'll overwhelmingly focus on creating brand-new non-stops in leisure markets, with the rest in significantly underserved markets.

Stay aware: Sign up for my weekly new routes newsletter.

It'll compete directly with Flair, but...

Despite competing with Flair on every route, ultra-low-cost carriers – which use their lower seat-mile costs to provide stronger price-based competition – will still have only a small proportion of flights in most markets. It's especially low compared with most other major countries, which wasn't lost on Lynx.

When the startup is included, about 10% of Vancouver-Winnipeg flights will be about by ULCCs, analyzing Cirium data shows. On Calgary-Toronto, only about 8%. Lynx sees the gap for more price-based competition to grow markets. For ULCCs, it is always about growing markets, not 'taking' passengers from other airlines.

Fares from $39 including taxes

Fares on shorter routes start at CAD$39 (USD$31), including taxes. They start at CAD$59 ($47) or CAD$79 ($63) on longer routes. These fares include one personal item to be placed under the seat in front, but like most ULCCs and LCCs, they exclude optional add-ons.

As always, the very low fares (from $39+) will have limited availability. Nonetheless, Lynx's average fare will be meaningfully lower per route than competitors, perhaps 25-35%. It'll be this that's crucial to growing demand and for carving out a hopefully defendable position for the future – but only if it can achieve even lower costs.

What do you think about Lynx? Share your thoughts in the comments.