The end has come for South Africa's Comair and its lower-cost subsidiary, kulula. There is reportedly no reasonable prospect that they can be saved and the writing has been on the wall for some time.

Combined, Comair – a British Airways franchisee – and kulula was South Africa's second-largest operator. As such, their exit significantly impacts South African aviation, primarily domestically. After all, kulula was purely domestic, while Comair only had three international routes: Johannesburg to Harare, Mauritius, and Victoria Falls.

Stay aware: Sign up for my weekly new routes newsletter.

A loss of 19,000 domestic flights

Between June and December 2022, Cirium data shows that South Africa planned over 79,000 domestic flights. However, the loss of Comair and kulula means that'll fall to 60,000, down by 19,000. A quarter of the country's domestic flights will go, although able competitors may be reasonably quick to pick up some of the pieces.

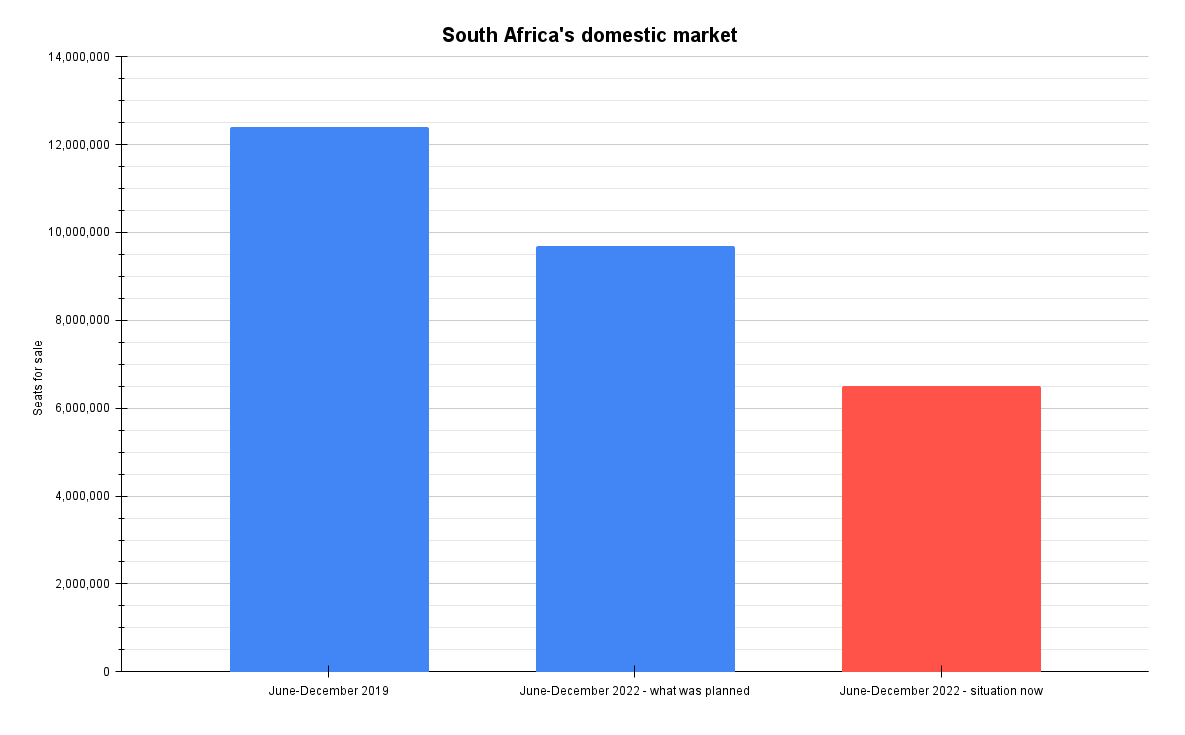

It is worse still if seats for sale are examined. As Comair and kulula operated larger narrowbodies – mainly the B737-800 but also the older iteration, the B737-400 – their end means a drop of 3.2 million domestic seats. A third of capacity will go. Barring the actions of others, there will be 6.5 million for sale, down from 9.7 million.

Discover more aviation news.

An enormous impact

When combined, Comair/kulula was South Africa's second-largest operator by seats for sale. Less than a million separated them from the market leader, Safair, whose own development has been rapid thanks to South African Airways' significant, ongoing, and well-publicized woes. SAA still only has two domestic routes: the core markets of Johannesburg to Cape Town and Durban.

Then there's Mango, SAA's lower-cost subsidiary, which was an important player domestically, with over one in every five domestic seats in 2019. It remains grounded, although a financial lifeline means it might spring back to life. However, major stumbling blocks remain.

Half of what it was

The picture for South Africa is bleak. Cirium shows that, even before the Comair/kulula situation, the nation's domestic market had only 78% of the seats it had in June-December 2019 from the pandemic and SAA being a shadow of its former self. Take out Comair/kulula, and that reduces to barely half. That's an enormous impact, and it'll be challenging and time-consuming to fill.

Without further development, Safair will have 61% of domestic seat capacity, up from 22% in 2019. Independent Airlink, with by far the nation's most expansive network, will have 24%, not helped by using small, low-capacity aircraft as befits its disparate operation. The pair will have 85% of South Africa's domestic market, effectively creating a duopoly. CemAir, another fast-growing operator, will do more.

What is your take on the situation? What do you hope happens going forward? Also, what were your experiences of flying Comair and kulula? Let us know in the comments.