The boss of Copa Airlines, Pedro Heilbron, is bullish over the news that Avianca and Gol will consolidate under an IAG-like holding company, with Viva Colombia and Viva Peru also to be part of the Group. Each carrier will retain its brand and strategy.

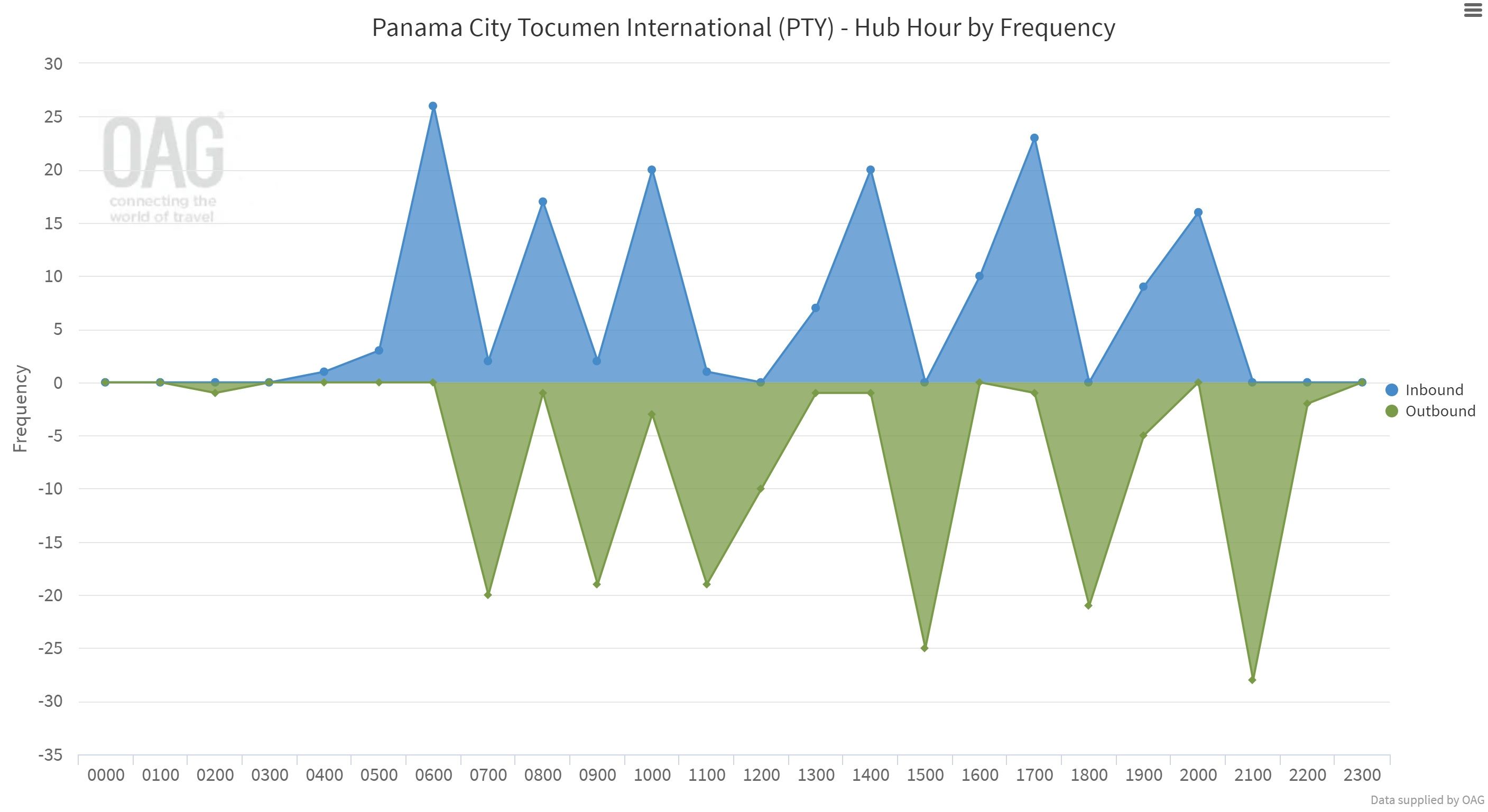

Speaking at Copa’s first-quarter earnings call on May 12th, Heibron said it simply needs to focus on its "very, very solid and resilient business model." This involves using narrowbodies to connect South America to North America, Central America, and the Caribbean via its Panama City 'Hub of the Americas.'

Remains resilient

As the news of Avianca and Gol joining the UK-based Abra Group came about shortly before the earnings call, Heibron said, "I won’t talk about whether we have to react or not." He had, after all, not long learned about the development: "I don't think anybody knew [about it] before it was announced."

Still, he didn't seem overly concerned, at least publicly, and commented on it in a broad way. Based on many past experiences:

Our answer is doing more of the same but just in a better, more effective, and more efficient way... it is not really losing its strength or its uniqueness... we have a proven, strong business model.

Stay aware: Sign up for my weekly new routes newsletter.

First-quarter performance: summary

Copa ended March with 93 Boeing 737s: 68 B737-800s, 16 B737 MAX 9s, and 9 737-700s. Its fleet fell from 102 pre-pandemic, mainly from removing its Embraer 190s and some B737-700s.

Despite "good demand," especially from leisure passengers and those visiting friends and relatives, traffic was down by 14% over 2019. As capacity improved slightly more, down by 12%, seat load factor fell by 1.8% to 81.5%.

Unit revenue totaled 10.2 US cents, down by 3%, while fuel-inclusive unit cost was 9.4c, up 7.5%. This squeezed margin. Notably, ex-fuel cost fell 1.6%, reflecting its cost-saving measures and far lower activity.

It ended the first three months with a nearly $20 million net profit on revenues of $572 million. Despite departures remaining down by 19% over 2019, its fuel bill rose by 12% to $192 million. $36 in every $100 was spent on fuel. Copa said the impact of fuel would be even worse going forward, reducing projected margins by half in the second quarter.

Discover more aviation news.

The rest of the year

Copa expects capacity across all of 2022 to be 98% of what it was in 2019. Between May 13th and December 31st, it has up to 157 daily departures from its Panama City hub across 78 routes, including Santa Marta in Colombia and Barcelona in Venezuela starting in June. Its network is broken down as follows.

- 35 destinations in South America

- 19 in North America (including Mexico)

- 16 in the Caribbean

- 8 in Central America (including one domestic)

On July 22nd, a day when 157 departures are planned, there will be flights to 60 destinations, with a median of two flights per destination. Ten routes have 6x departures or more:

- Cancún: 8 departures on July 22nd

- Bogotá: 7

- Punta Cana: 7

- San Jose: 7

- São Paulo Guarulhos: 6

- Guayaquil: 6

- Lima: 6

- Medellín: 6

- Miami: 6

- Santiago (Chile): 6

Have you flown Copa? If so, share your experiences in the comments.