The oil and fuel rising costs could lead to a 10% increase in airfares worldwide, according to Delta Air Line’s head, Ed Bastian. In the last few weeks, oil prices have reached a 14-year high after Russia’s invasion of Ukraine.

Higher costs, higher fares

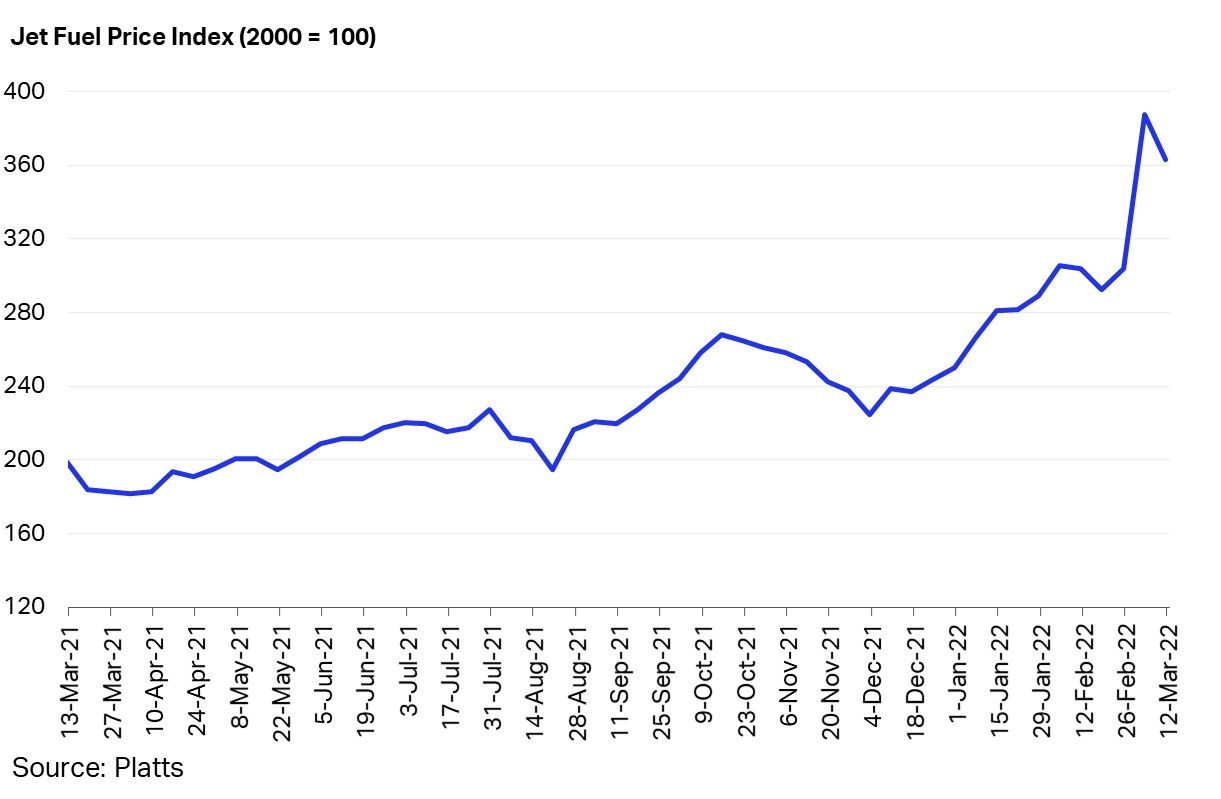

In the last few weeks, fuel and oil prices worldwide have skyrocketed, and the airline industry is starting to feel the pressure. According to the International Air Transport Association’s (IATA) jet fuel price monitor, the price for fuel is 19.5% higher in March than a month ago and 82.5% higher than a year ago.

While some carriers, like American Airlines, believe rising fuel prices will not have a long-term impact on the industry, others, like Delta Air Lines, expect higher fares.

Domestically, the rise in fuel prices could lead to an increase between 5% to 10% in fares, or around US$25 per ticket, said Ed Bastian to the BBC. On international flights, the increase could be a bit higher, he added.

Stay informed: Sign up for our daily and weekly aviation news digests.

Delta is planning to introduce fuel surcharges on international flights “as the market conditions permit” and increase US ticket prices.

Long-term impact?

Ed Bastian believes it is too early to draw any conclusions regarding the impact of the rising fuel prices. Earlier this week, he said to the Financial Times,

“It’s a little early to tell what’s going to happen to oil prices and consumer demand over the summer. You’d never want to be in a position of cutting capacity when you’re having such robust demand.”

That’s a similar approach to American Airlines, which stated that the company will continue to be fully exposed to fluctuations in aircraft fuel prices.

Nonetheless, American Airlines’ CEO, Doug Parker, said earlier this week that the industry will continue to make money, despite the higher oil prices. He added,

“In 2010, oil prices were around US$80 per barrel; the airline industry made US$4.8 billion, which was a record in earnings for the industry. Next year, oil prices went up to US$111.26 per barrel. Earnings fell. It takes a while to react. The reaction to higher oil prices is less capacity and higher prices. So when it runs up quickly like it just did, it takes a while to respond, but we respond, and indeed, in 2012, we got back nearly to 2010 revenue levels. We can make money with oil prices of US$100 or higher, and we will. That’s not a long-term impact on the industry’s ability to make money.”

Fuel in advance

Fuel represents somewhere between 22% and 38% of an airline’s total expenses. Along with labor, it is among a carrier's highest costs.

For airlines, it is essential to operate fuel-efficient aircraft and execute other strategies that can help them mitigate the volatility of the jet fuel price.

Many airlines undertake fuel hedging strategies, seeking to acquire fuel at a specific fixed price. Nonetheless, these strategies have risks, especially if airlines misinterpret the market and future oil prices. British Airways and easyJet both said recently that they had bought fuel in advance, acquiring up to 60% of their fuel needs, told the BBC.

Meanwhile, Delta will not undertake these fuel hedging strategies because “sometimes you win, and often you lose,” said Bastian.

-N836MH-(2).jpg)