Emirates have just released their half-year performance figures for 2018-2019. While the Emirates Group has told of steady revenue growth, profits have been affected by the rising cost of oil. That does not mean that Emirates have not posted a profit. In fact, the total profit by Emirates amounted to US$62 million, while the Emirates group as a whole posted a profit of US$296 million. This marked a decrease in profitability of 53% in comparison to the same period last year.

[ege_cards_related id="6"]

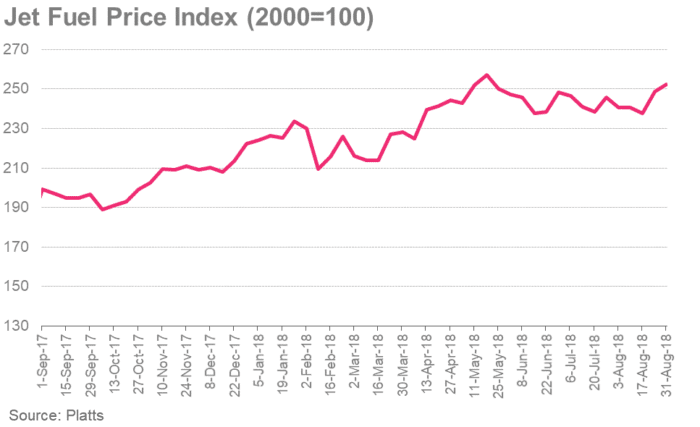

Rising Fuel Costs

The main impact to Emirates' profits has been the increasing cost of fuel. The airline has an annual fuel bill that currently amounts to around US$10bn. Emirates buys their fuel at market rate as opposed to investing in a fuel hedging fund. While this means that if the price of fuel goes down, the airline pays lower costs. It also means that should the cost increase as is the case, then the airline pays the higher rate.

In addition, Emirates does not fly the most fuel-efficient aircraft. The airline only operates B777 and A380 aircraft. Both of these are long-haul aircraft. This means that even when flying relatively short flights, the airline is using a vast quantity of fuel. Especially when the A380 is used with its four engines. Previously Tim Clark, Emirates President, told Air Transport World “Remember, 18 months ago [the cost of fuel] was down to $30 [per barrel]. Now it has more than doubled. It is hitting us quite badly, but we are managing it.”

Cash Reserves Drop US$1bn

The cash reserves held by Emirates have been hit by the rise in fuel costs. While the once stood at US$6.9bn at the end of March, this figure had dropped to US$5.9bn by the end of September. The Chairman and CEO of the Emirates Group, His Highness (HH) Sheikh Ahmed bin Saeed Al Maktoum, told a press release of the decrease in profitability.

"Emirates and dnata grew steadily in the first half of 2018-19. Demand for our high quality products and services remained healthy, as we won new and return customers across our businesses and this is reflected in our revenue performance. However, the high fuel cost as well as currency devaluations in markets like India, Brazil, Angola and Iran, wiped approximately AED 4.6 billion from our profits."

He went on to note that the next 6 months will be tough for the airline. “The next six months will be tough, but the Emirates Group’s foundations remain strong. I’m pleased to note that our home and hub in Dubai continues to attract travel demand, as the airline saw 9% more customers enjoying Dubai as a destination in the first half of 2018-19 compared to the same period last year. We expect this demand to remain healthy... Moving forward we are firmly focussed on sustaining our business. We will do this by being agile to capitalise on opportunities, and investing to serve our customers even better with high-quality products that they value.”

[ege_cards_related id="2"]

Do you think that Emirates will have a better next half year, or will fuel prices continue to hit Emirates? Let us know your thoughts in the comments below!