With August seat volume at just 39% of what it was in 2019, Etihad Airways has a long way to go in its recovery. The Abu Dhabi hub carrier has 61 passenger destinations, down from 78, with no sign yet of the A350-1000. We see what Etihad is planning.

A long way to go

The United Arab Emirates' Etihad Airways has a long way to go until it returns, let alone exceeds, 2019 capacity. This coming August, seat volume is at just 39% of what it was in August 2019. There is much ground to make up, even before passengers, revenue, and loads are considered.

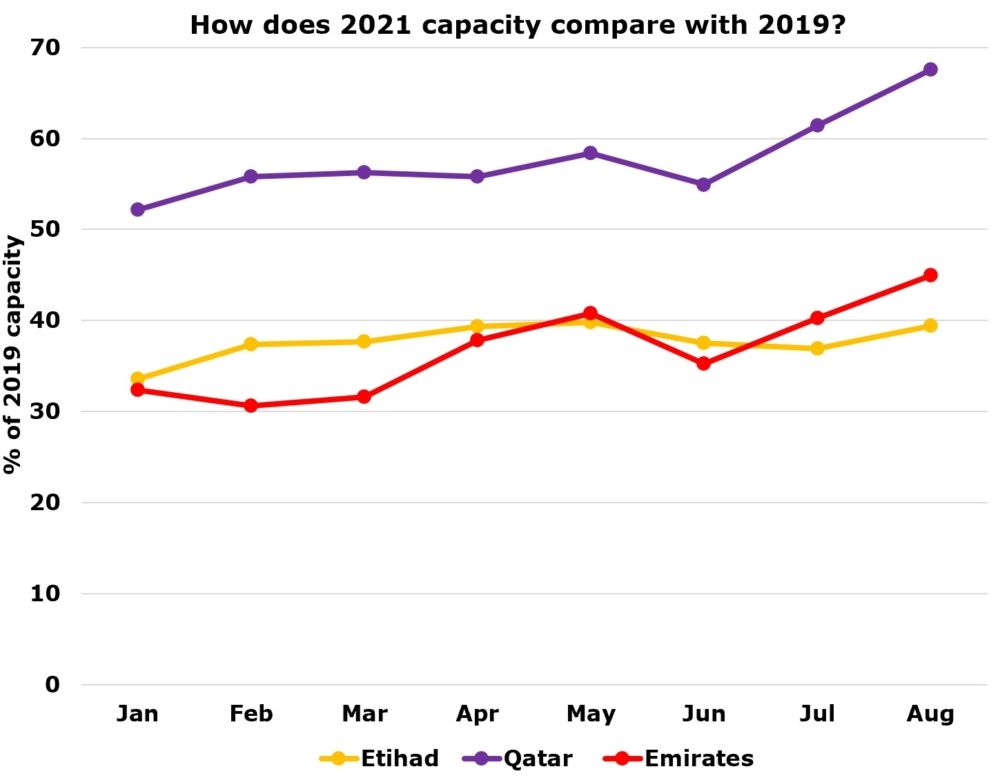

While Qatar Airways has consistently had much higher capacity levels, as shown in the following figure, both Etihad and Emirates have been more cautious in adding it back. Perhaps caution is sensible under the circumstances.

Stay aware: Sign up for our weekly new routes newsletter.

In August, Emirates is at 45% of pre-COVID capacity (still low), based on analyzing OAG data, while Qatar Airways is at 68%. (Emirates' narrowbody partner flydubai is at a significant 84%.)

What about further ahead?

Looking at the rest of the year, Etihad has scheduled 52% of 2019 capacity in September, rising to 55% in October. However, both seem overly high in relation to the first eight months of the year and they're likely to be cut further. Airlines are now removing capacity much closer to departure than previously.

Stay informed: Sign up for our daily and weekly aviation news digests.

61 destinations from Abu Dhabi in August

This coming August, Etihad has 61 bookable passenger destinations from its Abu Dhabi hub, down from 78 in the same month in 2019. This means that, while its network is reasonably intact, destinations are served far less often than they were before. We previously explored the carrier in North America.

Cairo has jumped seven places to become the top route, relegating London Heathrow to the second spot on account of the UAE being on the UK's red list. Nonetheless, Heathrow is still due to see three flights a day towards the end of the month, although this currently might seem optimistic.

- Cairo

- Heathrow

- Frankfurt

- Milan Malpensa

- Jakarta

- Amman

- Lahore

- Amsterdam

- Paris CDG

- Islamabad

Nine countries cut... but four added

Unlike in August 2019, Azerbaijan, Belarus, Hong Kong, Kazakhstan, Nepal, Nigeria, Serbia, South Africa, and Sudan are now not served. In contrast, Austria, Bangladesh, Israel, and Qatar will now be in Etihad's network.

Bangladesh and Qatar have both returned: Dhaka was last served between 2006 and 2018, while Doha resumed after the blockade. There are four properly new routes for 2021: Mykonos; Santorini; Tel Aviv; and Vienna.

Air Arabia Abu Dhabi

It's noteworthy that while Etihad cut Azerbaijan, Air Arabia Abu Dhabi, Etihad's joint venture partner with whom it codeshares, has taken it up. It operates twice-weekly in August.

Indeed, one aspect of Air Arabia's purpose is to serve destinations that were either previously served by Etihad or unserved from Abu Dhabi, mainly within a four-hour radius and often heavily driven by visiting friends and relatives (VFR) demand.

While Etihad may have found a route to be unprofitable or to not have contributed adequately network-wise, it may be considered important enough to be served by a lower-cost platform – in the form of Air Arabia with Etihad's codeshare and connectivity. This approach also explains why Air Arabia Abu Dhabi is beginning Faisalabad and Multan, both in Pakistan, in August.

What are your views on Etihad? Let us know by commenting.