Over the span of just a few last days, Europe’s three major airline groups have posted their financial results from the first quarter of the year. Air France-KLM, Lufthansa Group and IAG have either failed to remain profitable or posted significant decreases in profits. All aforementioned groups blame the poor financial situation on high oil prices and lower than expected fares.

Lufthansa

Lufthansa group posted an adjusted EBIT loss of €336 million, compared to a positive €52 million in the same period last year. ASK and RPK have both grown at 6%, leaving the load factor unchanged at 77.9%. The group blamed the worsening of the result on,

“Market environment in Europe characterised by overcapacities, intensive competition and correspondingly high pricing pressure on short-haul routes”,

They also reminded investors about the bankruptcy of Air Berlin a year ago, which boosted profitability in Q1.

On the other hand, during the investor call Lufthansa claimed to have strong order books for the second quarter of the year, a reason why group’s yearly outlook remained unchanged. One of the signs of this is the designation of A340’s to fly on short-haul routes.

Air France-KLM

The French-Dutch group has posted a loss of €303 million in the first quarter, consequently announcing voluntary redundancies of 400 staff. Despite an impressive turnaround last year, Air France-KLM also lost money in the first quarter.

In their financial report, the group has also named a shift of Easter to Q2 as a reason for a 2% reduction in passenger unit revenue. Fuel expenses were up 5.9% and reached €1.2 billion. Interestingly, KLM posted a 0.1% decrease in revenues, whereas Air France increased them by 4.1%, however the latter still contributed to the total loss five times more than its Dutch counterpart.

IAG

On a more positive note, The International Airlines Group saw an increase in revenues and managed to make an operating profit of €135 million in the first quarter. However that profit is still 60% lower than a year before (down from €340 million). IAG’s CEO Willie Walsh noted high oil prices and foreign exchange headwinds as main challenges the group has faced.

Key Driver: Aviation fuel

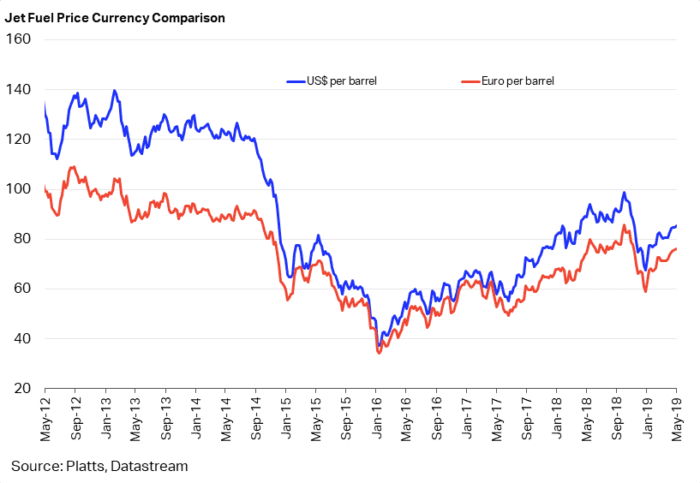

Jet fuel prices are at around $80 a unit right now, matching early 2015 levels. They have, in fact, doubled since January 2016, making it increasingly difficult for European airlines to remain profitable. As noted by Willie Walsh, exchange headwinds, (in a form of a strong dollar and a weaker pound) additionally increase leasing, fuel and maintenance costs. The recent strengthening of the dollar can be observed on the graph, as US$ per barrel and Euro per barrel graphs have converged and are almost on identical levels.

Airlines do not anticipate a decrease in the prices. In fact, Air France’s expected expenses on jet fuel are as following: 2018: Fuel bill €4.9bn; 2019: Fuel bill €5.6bn; 2020: Fuel bill €5.9bn.

Key Driver: Rapid ASK growth

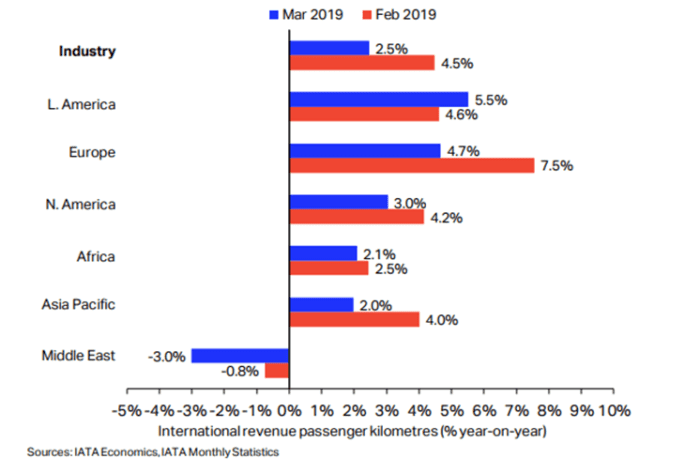

IATA states that for the last five months, RPK in Europe has been rising faster than anywhere else. However ASK is growing even faster. Available Seat Kilometres have increased by as much as 7.1% year on year, the highest growth in any region around the world. Fleet expansions, new airlines and low cost dynamism have contributed to this issue.

Such rapid ASK growth outpaced the demand, which has been reflected by the fall in load factor of 0.5%. Significant supply increases have put downward pressure on the fare prices, causing problems for traditional carriers such as Lufthansa and British Airways.

Conclusion

All in all, the combination of high jet fuel prices, a stronger dollar and rapid ASK growth put significant pressure on the profitability of the major European carriers. The bankruptcies of Germania and WOW Air seem to prove that as well. Overall, the profits should increase in the second quarter, however the upcoming years could be quite challenging.