After a promising end to the worst summer ever experienced by airlines, Europe's LCCs have once again had to cut their schedules. The cuts have seen around 20% of the recovered traffic lost and have been prompted by the second wave of COVID-19 currently spreading around Europe.

Everybody will be well aware that the aviation industry is going through its worst crisis, not just in a generation, but ever. Such devastation hasn't been seen since the Wright Brothers' flight all those years ago. Indeed, many global carriers were forced to suspend operations in the second quarter of the year entirely.

Initially, recovery looked to be going well

There had been some hope towards the end of August that things may be getting better faster than anybody expected. Indeed, on August 4th, Simple Flying reported that easyJet would be increasing its network following better than expected demand in the preceding month and a half.

Stay informed: Sign up for our daily aviation news digest.

easyJet's announcement was followed by Ryanair figures a month later that showed it carried 7.0 million passengers in August, just under half of what it carried in the preceding year. However, the biggest threat to this recovery was always the possibility of a second COVID-19 wave sweeping across Europe. Sadly, those fears are coming true.

Low-cost carriers slash flights

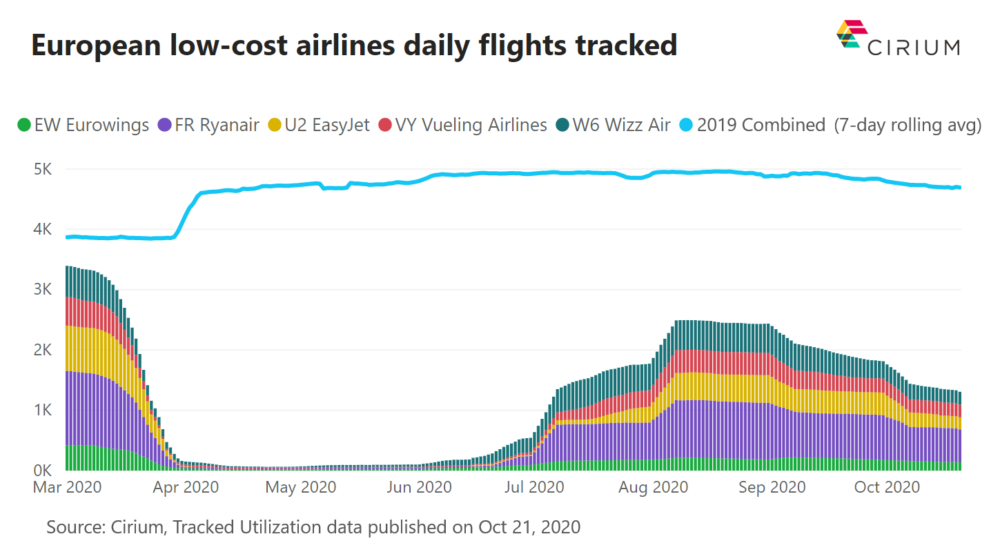

According to travel data and analytics expert Cirium, on peak days in august, Europe's low-cost carriers combined were operating over 50% of the flights they had offered in the preceding year. However, the second wave has put a swift end to this.

Cirium's latest stats show that as of October 20th, this figure had shrunk to less than 28%. While still much improved from most of April, May, and June, it won't be very pleasant to the airlines who are keen to get passengers flying once more.

Why are the carriers cutting their schedules?

You may be wondering why airlines are slashing their schedules. After all, indeed, some passengers on a flight are better than none? That's not the case. Resuming services is a very fine balancing act. If demand exists, airlines want to operate a flight to sell tickets and generate revenue. The longer that ticket sales are open for the flight increases the potential gain.

However, if an airline operates a flight that turns out only to have a few passengers onboard, they will lose money on the flight. This means that the airline will spend more than if the aircraft had just remained on the ground.

While not ideal, it is not the end of the world on one or two flights, but spread across many flights, impacting the airline. Airlines regularly monitor bookings and have seen the number of future bookings decline. This is likely due to the uncertainty of future travel restrictions.

What do you make of the drop in flights? Did LCCs recover services too quickly? Let us know your thoughts in the comments!