Pan-African low-cost carrier Fastjet could be all set to sell off its Zimbabwe subsidiary, in a move restructure the airline and cut down on costs. This will mean that the airline, which once flew over four different countries, is now just down to a single hub.

Who is Fastjet?

Be prepared to forgive yourself if you have not had to utilize the services of Fastjet. Despite their ubiquitous name and goals of flying across the entire African continent, the airline only has four Embraer E145 aircraft, each with a seating capacity of 50 seats.

The airline did previously operate an Airbus A319 (as pictured above), but it found that the capacity on some of its routes did not come close enough to justify such a large aircraft.

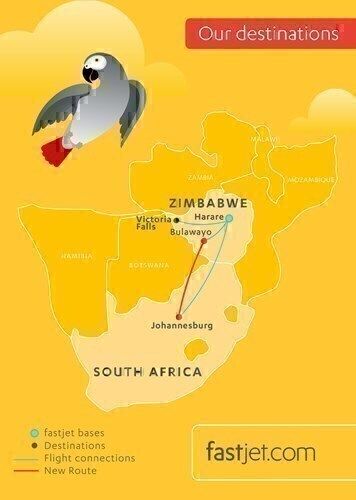

Fastjet had previously operated in four different countries in Africa: South Africa, Zimbabwe, Tanzania, and Mozambique. Currently, the airline serves four destinations in two African countries:

South Africa

Johannesburg – Harare (its Zimbabwe hub)

Zimbabwe

Harare – Bulawayo

Harare – Victoria Falls

What are the details of the sale?

Fastjet plans to release control of its Zimbabwe subsidiary, with the option to buy back the controlling share in the future once its operations are more secure. As researched by ATW Online, the CFO Kris Jaganah issued this statement during a trading conference.

"The group will have sufficient resources to meet its operational needs until February 2020, However, the headroom of available cash resources is minimal, and the projections are very sensitive to any assumptions not being met. If the group is unable to carry out the restructuring proposal by the end of February 2020, it would be unable to continue trading as a going concern."

The news that the airline plans to shut down its Zimbabwe subsidiary is a little bit alarming, as it looks like that makes up 75% of the airline's entire route network.

Solenta Aviation Holdings would be one of the potential buyers. They already own 60% of the group so this remaining amount for $8 million would secure their controlling stake.

“The disposal would also relieve the group of c.$5.4 million of current liabilities and c.$3.2 million of future aircraft capital expenditure, which will be raised and funded by the new investor consortium directly. In addition, the group would be granted an option to buy back its shareholding in Fastjet Zimbabwe on the same divestment economics to which it would be sold, three to five years after the effective date of the sale,” Jaganah said.

This approx $8 million dollars will then be used for capital expenditure throughout 2020 and well into 2021.

The airline in Zimbabwe, rather than being sold and shut down, would also continue to run under the Fastjet branding, as part of the group as a contractor airline (as we see with regional aircraft in the US)

What do you think of this news? Let us know in the comments.