New entrant flypop has moved closer to launching scheduled passenger flights by saying on social media that it'll announce its first routes in April. If it does, it'll confirm where will be served and when. It comes as its second A330-300 (9H-PTP) arrived in Stansted for the first time before quickly departing to Beja, Portugal, to be readied for cargo flights.

What might flypop be doing?

The launch of flypop's passenger flights has been heavily delayed, but it seems it might be edging closer to the start. While it'll initially focus on India, it has repeatedly said that it will eventually serve more cities across South Asia, actively targeting the significant visiting friends and relatives (VFR) demand. British Airways and Virgin Atlantic added Pakistan, although BA will end Lahore.

Booking data shows that almost all London to India markets have more passengers who transit en route than fly non-stop or one-stop. In 2019, even Delhi and Mumbai had 250,000+ round-trip passengers who transited. Despite Air India offering low-frequency services from Heathrow to ten cities across the country – including Amristar, Goa, Kolkata, Kochi – there is little doubt most Indian cities are very underserved from London – for a clear reason, as discussed later.

It seems that flypop will focus on offering non-stops where there are none or very few while offering lower average fares than existing non-stop carriers. It'll be hard to compete against the fares and products of Gulf carriers. flypop will need to very actively promote lower fares and a significantly shortened journey versus transiting en route.

flypop's 'map of possibilities' has changed

It is always dangerous to read too much into what airlines say about potential destinations. What routes are mentioned doesn't mean they'll be served and – if they are – when they'll materialize. It may also be used to mislead intentionally, sensibly avoiding giving competitors a heads-up.

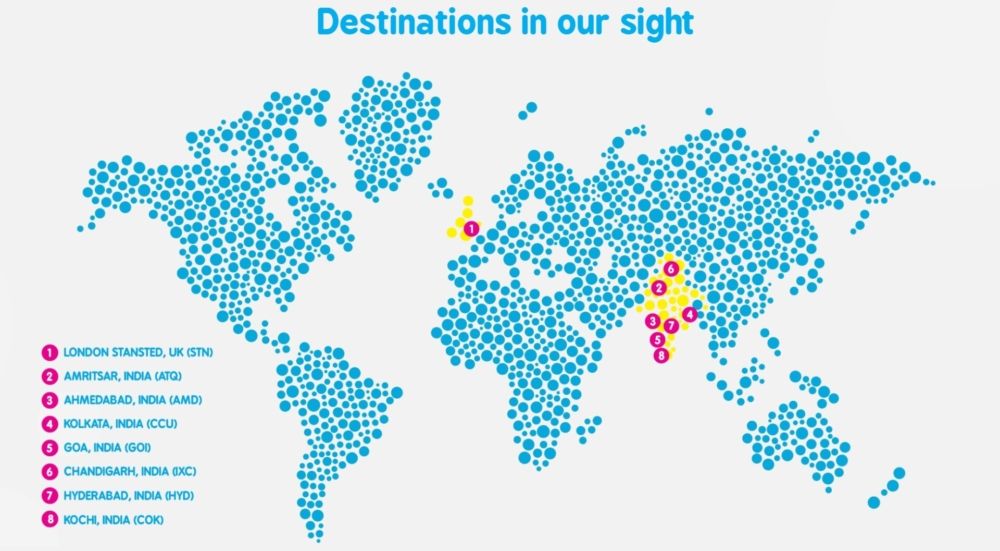

flypop initially mentioned that ten destinations might be served across India from Stansted: Amritsar; Ahmedabad; Bangalore; Chennai; Goa; Hyderabad; Kochi; Kolkata; Lucknow; and Pune. However, this has changed to seven, as shown below, likely because of bilateral challenges. Bangalore, Chennai, Lucknow, and Pune no longer feature, but Chandigarh – which has only one international route to Sharjah – now does.

Stay aware: Sign up for my weekly new routes newsletter.

India is less about traffic volume...

As you might expect, booking data shows that India is less about traffic volume and more about average fares, which include all transit passengers. It results from the nature of demand and the overall lack of premium demand. Most markets are driven by VFR traffic, the lowest of the low for fares and revenue per available seat mile (RASM).

- London-Ahmedabad: about 185,000 round-trip passengers in 2019, with an average one-way fare from Heathrow of approximately $189, excluding any fuel surcharge (kept by the airline) and government taxes

- London-Goa (and strong tourism): ~180,000; $187

- London-Kochi: ~111,000; $212

- London-Amristar: ~100,000; $170

- London-Kolkata: ~79,000; $247

... and more about average fares

Consider London to Amritsar, a city I have visited for the renowned Golden Temple. Existing demand is strong, but the 3,940-mile (6,341km) market had an average one-way fare of just $170. For context, that was similar to the 439 miles (707km) between Sydney and Melbourne.

In short-haul markets, it's straightforward to stimulate VFR demand and to grow markets, the backbone of LCCs. This will be crucial to flypop's success, helped by one-way fares from £99 – with such low prices obviously for promotions and very limited in number. It'll be offset by very proactive ancillary revenue generation. To stand a chance of working financially, the carrier will need extremely low costs and powerful (and cheap) promotions.

flypop needs extremely low costs

flypop says it'll be the lowest-cost airline on the planet, a title previously held by AirAsia X because of long sectors and large aircraft that pushed down the cost per ASM (CASM). To help achieve this, flypop has very low lease costs on its A330s, and it'll have an unbundled fare structure, an all-economy, very high-density layout, and high daily utilization by block hours.

However, long-haul, low-cost ordinarily needs some form of premium class to help drive up RASM and to offset lower-yielding passengers. At the same time, passenger feed is often believed to be necessary – especially with high-density aircraft with hundreds of seats to fill. flypop will likely try to circumvent this by having low frequencies (possibly seasonally) in what are high point-to-point markets.

It'll be exciting to see what routes are announced. What are your thoughts about it all? Share them in the comments.