Inflight WiFi provider Gogo has confirmed that it plans to sell off the commercial division of its business. The company intends to keep hold of the business aviation arm of its operations. This comes just days after Gogo posted an $86m net loss for the second quarter of 2020.

A significant loss

Gogo’s second-quarter earnings call brought with it some of the most significant losses the company has seen to date. Its revenue declined 55% year on year, to a consolidated figure of $96.6 million. Its net loss for the quarter totaled $86 million.

The company has been working on cutting costs where it can, which has included a reduction in its workforce. With commercial aviation the worst affected by the COVID pandemic, that sector of workers has been disproportionately affected by cuts. Thorne noted that 20% of the commercial airlines’ division had lost their jobs, out of an overall workforce shrink of 14%.

Speaking at the earnings call, CEO Oakleigh Thorne noted that there had been some signs of hope in the commercial division. He said,

“There are green shoots starting to emerge. We’re seeing a really solid bounce back in our business aviation division and a slower recovery, but a recovery nonetheless in our commercial aviation business.”

Later, he agreed that the commercial arm of the business is an attractive growth industry, particularly with future models moving towards free WiFi onboard. However, he noted that,

“For IFC players to capture this attractive growth potential and drive innovation, the industry would benefit from fundamental changes through either horizontal or vertical business combinations.”

Gogo Commercial Aviation will be sold

Gogo’s CEO confirmed that the company is in talks to consolidate its commercial aviation business. He said they were looking to combine the arm with either another service provider, a satellite operator, or with an avionics provider. He noted that these discussions had been taking place for some time, but that COVID had accelerated talks.

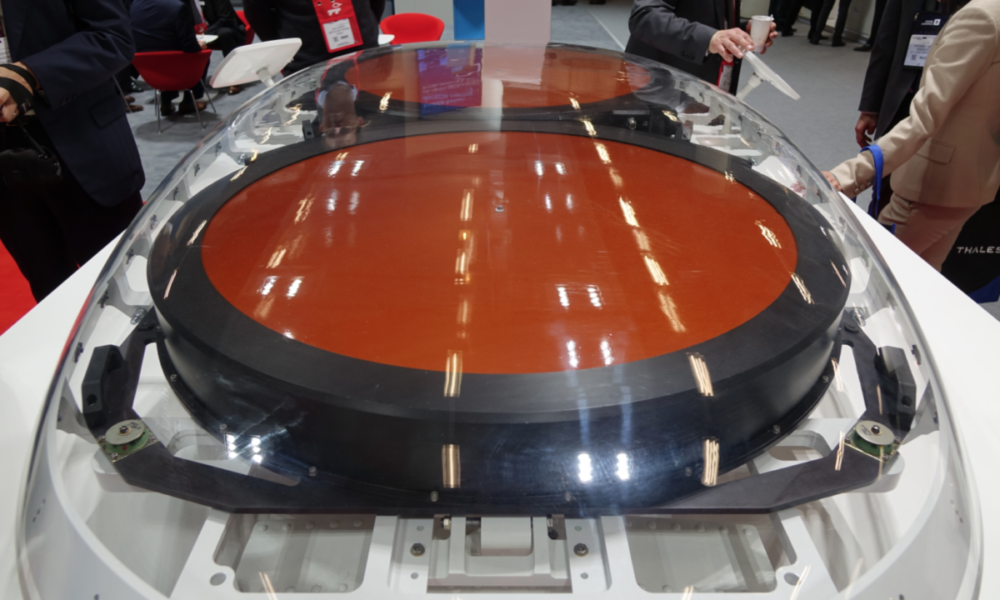

Thorne believes Gogo Commercial Aviation is a solid package. He noted the company’s large market share, the industry-leading product of Gogo 2Ku, and the asset-light nature of the business that will enable it to leverage the multi-spectrum, multi-orbit future that the satellite industry is heading towards. And it seems Gogo already has some interested parties in the pipeline. Thorne said,

“Several parties expressed interest in CA business in the second quarter. And as a result, we retained BDT & Company as our primary advisors, and launched a formal process this summer to evaluate our strategic options for that business. We’ve been in extensive discussions with multiple parties and feel optimistic that a deal may happen.”

Gogo has already made preparations for the sale, with Thorne saying that, in July, the company completed a legal separation of the two businesses. The arm had operated separately from business aviation since 2018. Interestingly, Gogo’s air-to-ground network (ATG) is operated under the business aviation segment, so any buyer would be beholden to paying Gogo a subscription to continue to use this network.

For the rest of the call, Thorne stood by his indication that he would not be drawn on further comment, saying that, “…we will not be providing regular updates on this matter until it is appropriate to do so.”

Who would you like to see take over Gogo’s commercial aviation arm? Let us know in the comments.

This article is brought to you by Simple Flying Connectivity, a new category on Simple Flying dedicated to inflight connectivity. Click here to read all of our inflight connectivity content.