As 2021 draws to a close, it’s time to look back on how Indian aviation fared in the second year of the pandemic. As expected, it wasn’t a steady graph, with several news-making stories creating peaks as well as plunging to concerning lows. While air travel is still not like how we knew it pre-COVID, in 2021, airlines in India seem to have evolved a little to live with the pandemic.

Weak moments

The year began with India seemingly winning the COVID fight as cases continued to fall and the aviation sector was ready to enter a recovery phase. However, the first few months were just the lull before a deadly storm as the devastating Delta variant began to tighten its grip on the country and consequently affecting the aviation sector.

Delta squashed whatever slight recovery was made, and domestic air traffic fell 71% in May compared to the same period in 2019, and international plummeted even further by 85.1%.

Much of the year also remained highly regulated when it came to airline fares and schedules. After several ups and downs since 2020, the Indian government finally allowed carriers to operate at full capacity on October 18th but continues to dictate the upper and lower ends of the fares.

While thankfully no airline went bust during the pandemic, there were some, such as SpiceJet, that had a particularly shaky year. From several employee protests over salary issues to reporting a net loss of ₹1,290 crores ($171 million) in the first six months, this is a year that the carrier would like to erase from memory as soon as possible.

Go First made an attempt to clear some of its outstanding dues by offering an IPO. The carrier received permission from relevant authorities in August but judging by the lukewarm response, postponed its scheduled IPO date of December 8th.

Then there’s international travel. India has closed its borders to scheduled international travel since March 2020. While a lot has improved since then due to travel bubble arrangements, COVID continues to loom large over scheduled flights. Just when the government was ready to lift restrictions on December 15th, rising Omicron cases around the world caused this to delay as well.

Stay informed: Sign up for our daily and weekly aviation news digests.

Not all bad

These testing times also displayed the resilience of the Indian aviation sector, with many key players taking significant decisions in the face of the pandemic.

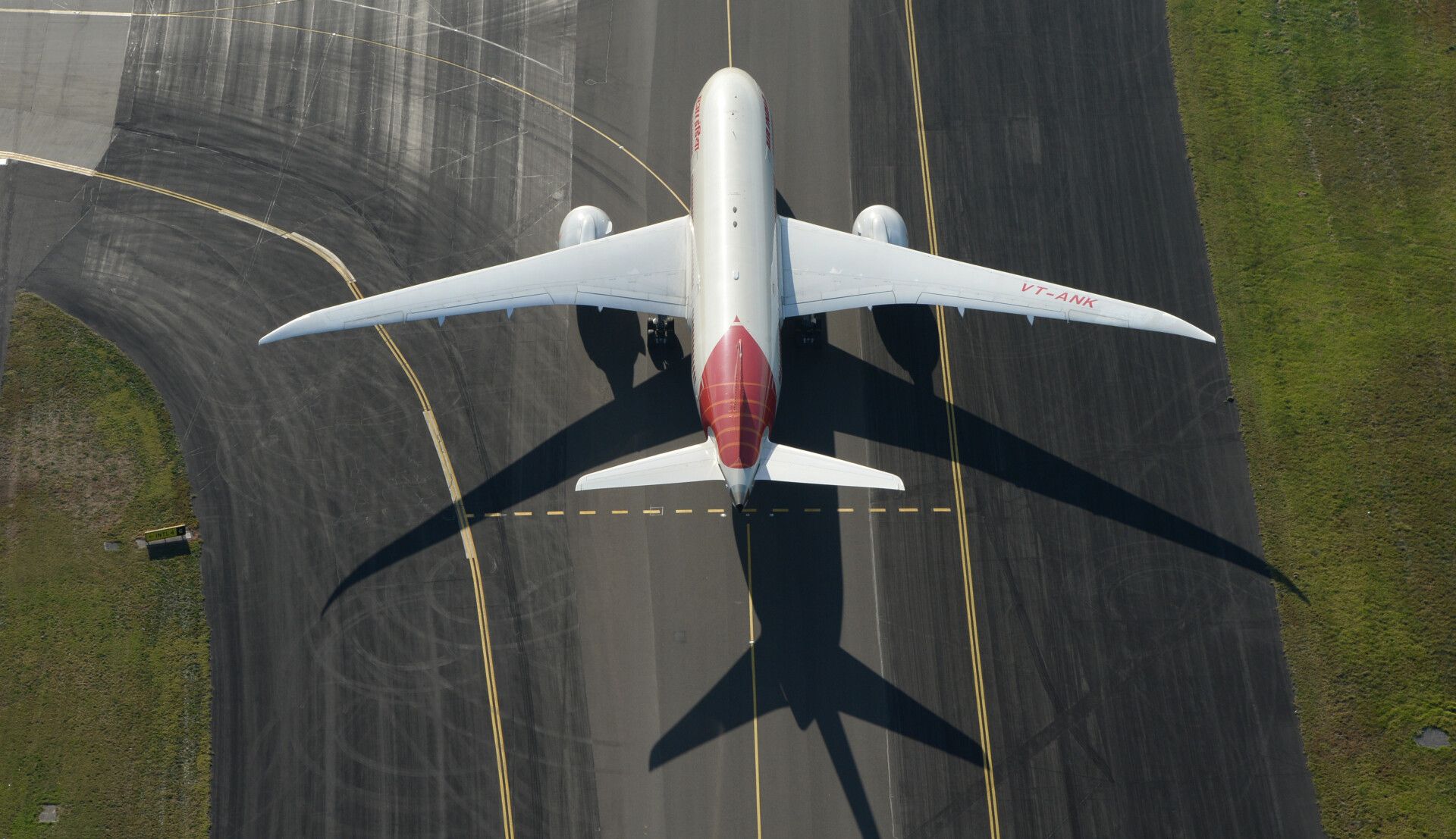

The Indian government finally managed to sell the loss-making national carrier Air India to the Tata Group. While some are skeptical of the Tatas steering AI to good health, many look forward to improved management, working culture, operations, and refurbished aircraft in the long term.

Akasa Air, backed by ace investor Rakesh Jhunjhunwala, also remained in the news all through the year for its speedy progress towards starting operations from next year. Showing its commitment to flying soon, Akasa placed an order of 72 Boeing 737 MAX airplanes in November and could change the dynamics of Indian aviation in the years to come, if not immediately.

Jet Airways loyalists had a reason to cheer as the carrier received approval from the National Company Law Tribunal (NCLT) in June for its revival plan. While much ground needs to be covered for Jet to restart operations, the carrier’s team is keen on fast-tracking its resolution plan.

In the second half of the year, domestic traffic began seeing good signs of recovery, buoyed by the festive rush and holiday season. October 2021 saw 72,000 departures compared to 49,150 in the same period a year before. As COVID cases declined and the vaccination rate grew, passengers felt more comfortable taking to the skies again.

Looking ahead

Indian aviation looks destined for significant changes not just in 2022 but for many years ahead. Some of the changes that Indian passengers would expect next year are the resumption of scheduled international flights, a revived Air India brand (and a possible merger with Vistara) under the Tatas, and a positive shakeup of the sector with new and old carriers planning to start operations.

But the one thing that COVID has taught the industry is to not be too comfortable too soon. The most immediate challenge facing Indian aviation, just like anywhere in the world, is the threat of the Omicron variant reversing the progress graph. Despite the upward trajectory of domestic traffic in India, it remains considerably lower than in 2019. For the immediate future, all eyes are on Omicron with hopes that the damage to aviation by this new variant is minimal.