Indonesia has always been an interesting if somewhat overlooked airline market. Fuelled by rapid economic and middle-class growth, 102 million Indonesians boarded a domestic flight in 2018, making that domestic market the fifth largest in the world at the time.

For such a large market, relatively few commercial airlines operate within it. And like all markets, the Indonesian domestic airline market is not without its quirks. COVID-19 hit Indonesia's airlines for six, but as long time Indonesia watchers will tell you, COVID-19 was just the latest in a rolling series of dramas impacting Indonesia's domestic airline industry.

As signs of life emerge within that industry, IBS Software recently commissioned Brendan Sobie of Sobie Aviation to write a white paper on Indonesia's airline industry. The white paper provides a handy snapshot of what's going on within Indonesia's domestic airline industry and where the various airlines are heading.

Garuda's woes continue

Garuda is Indonesia's best-known airline and arguably its most trouble-plagued. The airline is undergoing a high-drama restructuring, and its future is not assured. In its heyday, Garuda was Indonesia's biggest airline but was overtaken by the Lion Air Group some time ago.

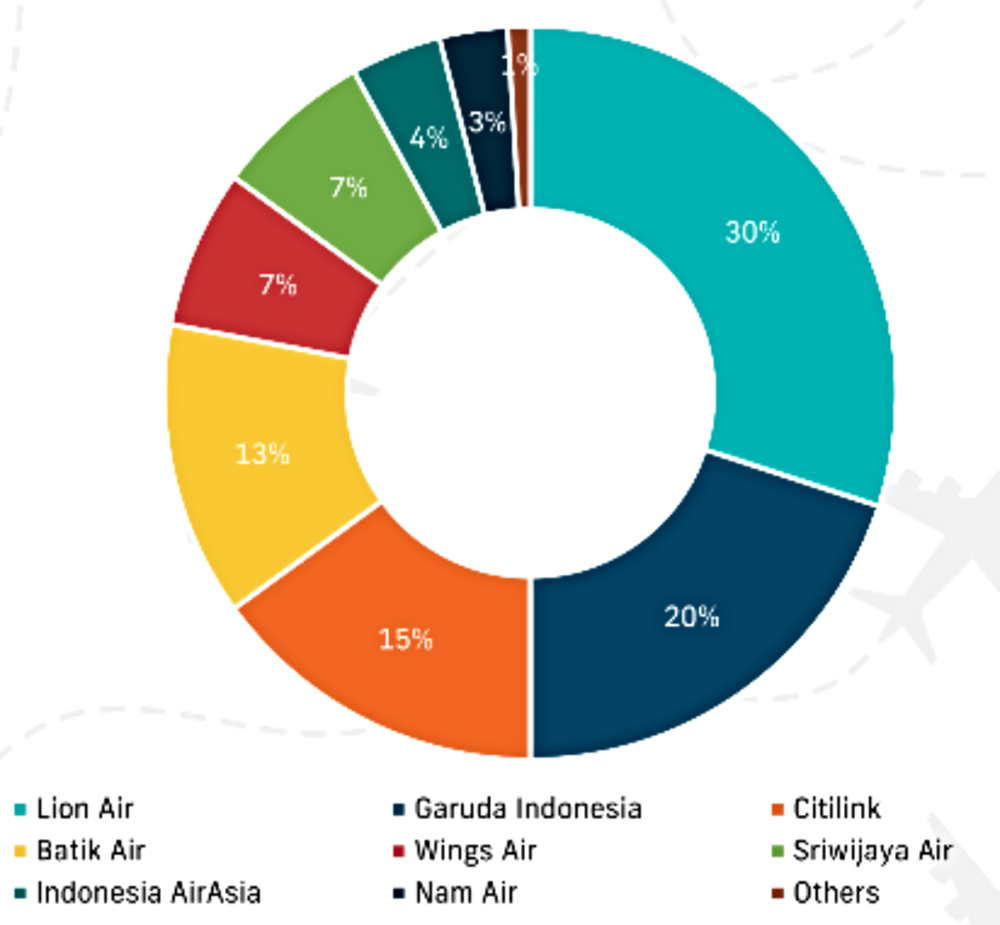

Garuda's market is likely to shrink further soon. In 2019, Garuda commanded a 20% domestic market share. But the airline is in downsize mode. Garuda wants to trim its fleet by about 50% to some 70 planes as part of the restricting process.

The surviving fleet of Boeing 737-800s and Airbus A330s would service Garuda's anticipated 10% domestic market share post-COVID-19 - if the airline survives at all.

Garuda Group pins its hopes on Citilink

If Garuda does manage to work its way through the restructuring process, the role of its low-cost subsidiary will grow. Unlike its parent company, Citilink plans to hold onto the vast bulk of its Airbus A320 aircraft and is even eyeing expanding its fleet with unwanted Garuda planes.

Indonesia is a price-sensitive airline market that puts low-cost carriers in the box seat and helps explain the success of competitors like Lion Air. In 2020, Indonesia's low-cost airlines snatched a 60% domestic market share for the first time.

The Garuda Group acknowledges the inevitable by reducing the role of its full-service legacy carrier and expanding the part of its low-cost airline. Before COVID-19, CitiLink had a 10% domestic market share. That is expected to grow to 20% post-COVID. Already, Citilink is flying the bulk (70%) of the Garuda Group's passengers.

Pelita lurks as a potential Garuda successor

Earlier this year, reports surfaced of Indonesia's Government was eyeing Pelita Air Services as a possible replacement for Garuda should it wind up. The Indonesia Government has stakes in both airlines. Pelita Air is a subsidiary of state-owned oil giant Pertamina.

The Government later denied those reports, but Brendan Sobie says Pelita plans to expand its charter operations into regular passenger flights early in 2022 using a fleet of about 15 Airbus A320s.

"Pelita technically is a startup but is viewed by some as a full or partial replacement to Garuda, depending on the outcome of the Garuda restructuring, given its ties to the Government," Sobie says.

"There are also ties to the Garuda Group given Pelita is now led by a group of executives that formerly worked for Garuda and Citilink."

Stay informed: Sign up for our daily and weekly aviation news digests.

The ascendancy of the Lion Group airlines

Indonesia's ascendant airline is the Lion Group. The group includes Lion Air, Batik Air, Wings Air, and new startup Super Air Jet. On its own, Lion Air had a 30% domestic market share in 2019. Overall, the group's airlines will command a 60% domestic market share post-COVID.

Lion Air and the smaller Wings Air are your atypical Indonesian low-cost carriers and directly compete with Citilink. Lion Air is perhaps best (and unfairly) known for the crash of its Boeing 737 MAX shortly after takeoff from Jakarta in October 2018.

The airline overcame that disaster. Just months ago, the family behind the Lion Group launched Super Air Jet, another low-cost airline, also operating A320 aircraft with a single class 180 passenger cabin.

Super Air Jet plans to be flying 10 of the Airbus jets by the end of this month and 50 by the end of next year. That's a turbocharged growth rate, and it's worth noting these planes aren't just wishful thinking - the airline has already locked leases in.

Lion Air is undergoing its own restructuring process, albeit without the drama associated with the Garuda Group's restructuring. They've substantially downsized the overall fleet, renegotiated leases, and cut costs.

It might seem to be an odd time to launch a new airline in such an environment. However, Lion Group knows the future of Indonesia's domestic airline industry will lean heavily towards low-cost airlines. They believe Super Air Jet will increase its dominance in the low-cost market.

Indonesia's third-largest airline group

Little known outside Indonesia, Sriwijaya Air is Indonesia's third-largest airline group. In 2019, Sriwijaya commanded a 5% domestic market share while its regional subsidiary NAM Air had a 2% market share.

The Group operates a mixed fleet of Boeing 737s and ATR 72 aircraft, including some almost vintage 737-500s. But as Brendan Sobie noted, these planes are unencumbered. That gives Sriwijaya considerable flexibility now and in the future.

"If recapitalized, Sriwijaya could accelerate fleet renewal, taking advantage of low lease rates on 737NGs or 737 MAXs and resume expansion," says Sobie.

But Brendan Sobie also said, having surrendered some valuable slots before COVID-19, Sriwijaya is vulnerable to aggressive competitors like the Lion Group. Lion could potentially put enough competitive pressure on the Sriwijaya Group to shrink it in a post-COVID-environment.

Indonesia AirAsia mops up the remaining market share

Indonesia AirAsia mops up the remaining domestic airline market share in Indonesia. Its market share was 4% in 2019 and 3% in 2020. In fairness to Indonesia AirAsia, the airline pivoted towards intra-Asia international flying before the onset of COVID-19.

But the pandemic did the airline no favors. In July 2021, Indonesia AirAsia suspended all its flying. Five months down the track, very few of its aircraft are back in the air. Sobie says Indonesia AirAsia will need significant capital injections to resume growth and restore capacity.

But the AirAsia Group isn't interested in pumping any more money into its loss-making affiliates. While the AirAsia Group is interested in selling down its stake, its local partner also isn't interested in pumping more money into the airline.

Indonesia AirAsia is a good example of the country's commercial aviation scene - it's like an ever-evolving high stakes soap opera. It's interesting to watch, but locals on the ground would probably prefer stable, reliable, and enduring local air services.