The Kenya National Treasury plans to reduce Kenya Airways' (KQ) state funding by $79.8 million, taking it from $239.5 million to $159 million, according to its 2022-23 supplementary budget.

The Kenya National treasury has released its debut Kenya Kwanza supplementary budget for the financial year 2022/23 with a proposed increase in spending from $26.7 billion to $29.6 billion. The government plans to cut domestic borrowing and increase external borrowing, resulting in a net borrowing reduction of about $541 million.

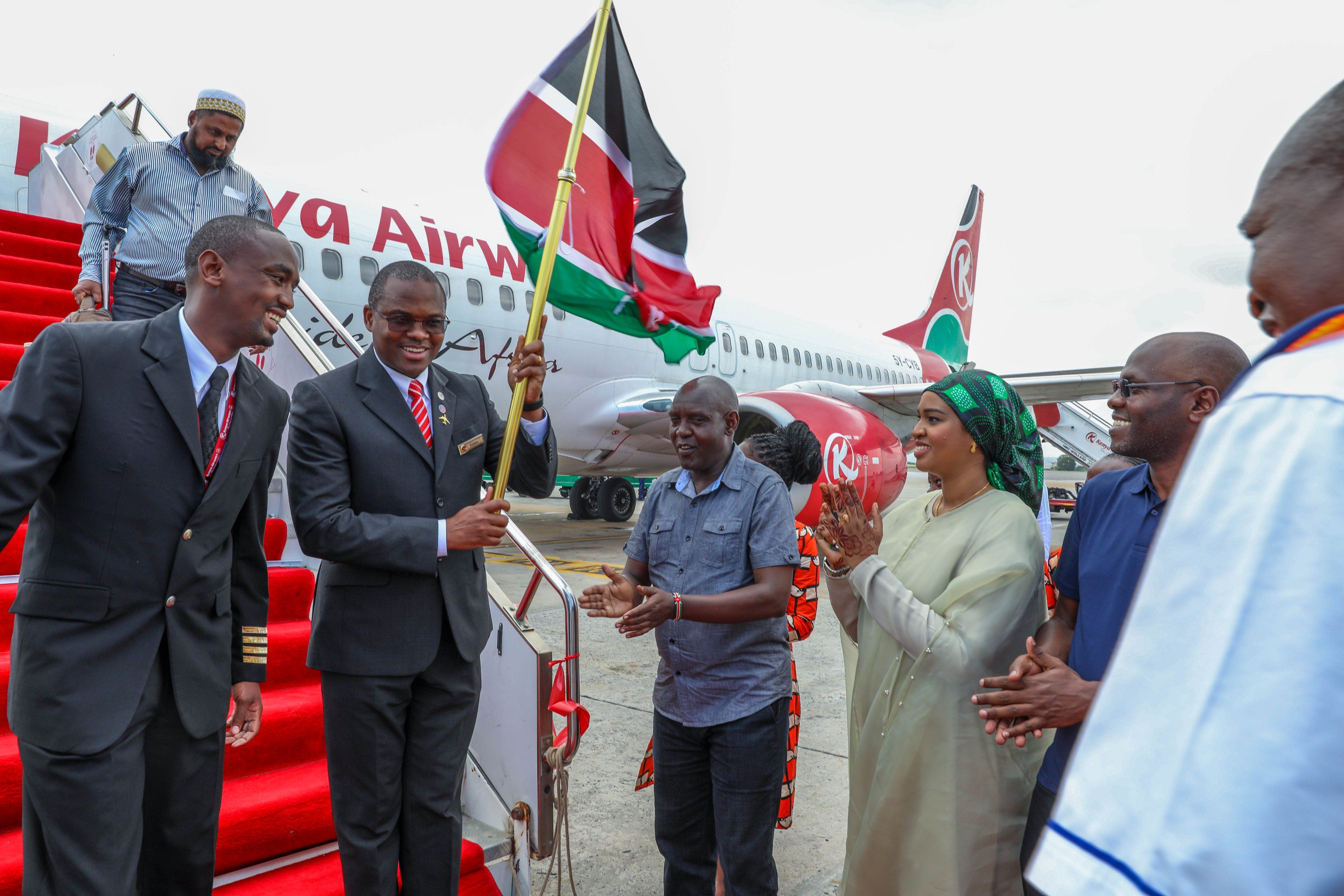

The treasury is reducing its support for the flag carrier in line with the government's strategy to lessen the airline's dependency on state funds by the end of 2023. Earlier this year, in its draft Budget Policy for 2023, the government said it would develop a turnaround strategy for Kenya Airways. In the strategy, the airline will receive $283 million in financial aid from the state to continue operations.

Kenya Airways' debt and turnaround plan

Despite being funded by the government, the airline continues to operate on significant losses, and in the first quarter of 2022, taxpayers spent nearly $207 million to save the airline. The funds were used for aircraft maintenance, employee salaries, settling utility bills, and daily airline operations, among other things.

The proposed turnaround strategy to save the insolvent airline focuses on saving taxpayers' money spent to keep it flying. Kenya's head of state, President William Ruto, said that the state was looking for a strategic investor to buy a controlling stake in the national airline. It was reported that the president pitched a plan to Delta Air Lines last year, in which he proposed a bid to sell the government's 48.9% stake in KQ.

As of November 2022, Kenya Airways' debt totaled $835 million in loans, letters of credit facilities, and convertible equity amounts. Before the airline can operate independently of state funds, state loans will have to be settled while focusing on fleet and network simplification, staff rationalization, and cost management. The $283 million from the government will prevent defaults for the settlement of lessors' arrears and working capital support.

Check out more African aviation news here

Default notice issued for airline's debt

The Export-Import Bank of the United States issued Kenya a default notice for delayed payment of a $454 million loan that the government borrowed to fund Kenya Airways. The flag carrier defaulted on the part of its $525 million loan from Exim, which the Kenyan government guaranteed. The Export-Import Bank is the official export credit agency of the United States federal government.

The National Treasury Principal, Chris Kiptoo, told parliament that Exim bank handed in the notice after Kenya failed to keep up to date with loan payments. Kiptoo added that;

"We have an outstanding balance of $462 million (Sh57.77 billion). A default notice has been issued by the guaranteed lender which is US Exim Bank which has called on the government of Kenya to pay. Now we don’t have, to say the truth, enough headroom to pay, but what is important is to pay."

As KQ continues to sink deeper into debt, Exim can issue a notice and demand full repayment of the loan on fears of the borrower's future ability to make payments. The loan was initially a 12-year facility, and the airline halted payments after its financial problems worsened during the pandemic.

According to reports, the cabinet has given its approval to pay the loan arrears and the loan balance to be replaced with a new one to rescue the flag carrier.

Source: ch-aviation, Business Daily

.jpg)