The International Civil Aviation Organization (ICAO) expects that Latin America will lose up to 289 million passengers due to the current COVID-19 crisis worldwide. In an analysis, ICAO also dived into the capacity losses for the Latin American airlines. Let’s investigate further.

A dive into ICAO’s numbers

Last week, ICAO published its latest 'Effects of Novel Coronavirus (COVID-19) on Civil Aviation: Economic Impact Analysis’. It builds several scenarios of the recovery from the current crisis worldwide.

Overall, ICAO expects a reduction ranging from 51% to 52% of seats offered by airlines. It sees an overall drop of up to 2,981 million passengers in 2020 and potential US$400 billion losses for airlines.

The UN organization also dives into the estimated results of the first quarter of 2021. ICAO expects a loss of up to 681 million passengers in the first three months of next year.

Then, ICAO does a regional analysis. So far, Latin American airlines have lost approximately US$21 billion in passenger revenue, the third least worldwide. In comparison, Africa has lost US$11 billion, the Middle East carriers US$17 billion, North American airlines US$71 billion, Europe carriers US$77 billion, and Asia-Pacific operators US$97 billion.

Is ICAO too optimistic with Latin America?

Latin American carriers have been mostly grounded since the COVID-19 pandemic arrived in the region in March. In September, some airlines like Avianca flew again. In October, Copa Airlines restarted its commercial operations in Panama. Meanwhile, Aerolíneas Argentinas continues to be grounded in Argentina. Additionally, the three largest airlines in the region are under Chapter 11 reorganizations.

Despite that, ICAO’s estimates are somewhat optimistic for Latin America. It expects a 60% drop in international passenger capacity in the region for 2020, the lowest worldwide. ICAO also estimates a US$17 billion revenue loss.

Domestically, Latin American airlines’ capacity would drop 54%. This drop would be the second-worst worldwide. In comparison, ICAO expects a 37 domestic capacity drop for the Asia-Pacific airlines and a 38% drop for the European carriers.

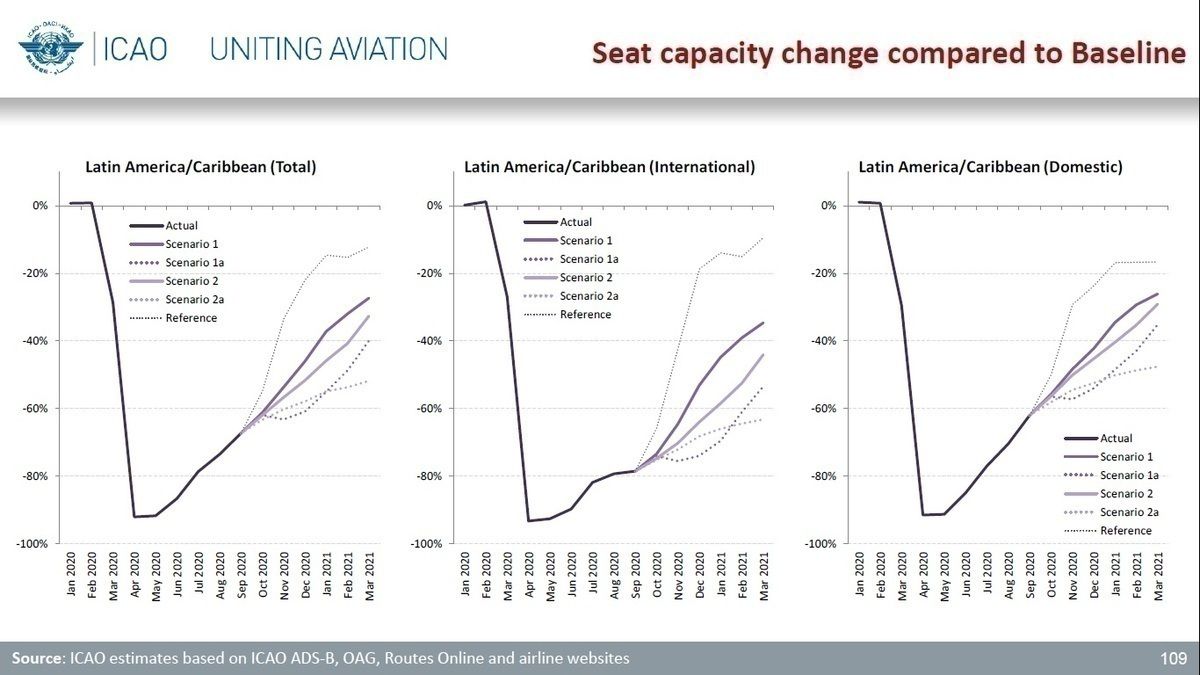

So, why do we say that ICAO is too optimistic about Latin American recovery? ICAO is presenting four different scenarios from January 2020 to March 2021. In three out of these four scenarios, Latin American carriers have the third-best seat capacity recovery recovering between 60% and 75% of their pre-COVID seats by March.

Does Latin America has a V-Shaped recovery?

It is too soon to tell if Latin America will have a V-shaped recovery, as many carriers are just ramping up their operations. Also, as we stated, other carriers are still grounded, like Aerolíneas Argentinas. However, there are some hopeful signs, like Volaris’ recovery in Mexico or Azul’s in Brazil.

For ICAO, Latin America’s seating capacity is still under 60% of what it was last year. Despite this, its most hopeful scenario sees a V-shaped recovery increase in the next six months. ICAO’s most optimistic scenario expects Latin American carriers to have a seating capacity decrease of 24.6% compared to March 2019. On the other side, the least hopeful scenario sees a 51.8% decrease.

Finally, on the passenger side, ICAO expects that the Latin American airlines will lose between 243 million passengers and 289 million passengers between January 2020 and March 2021.

So, what does it all mean?

In the end, 2020 is the worst year for the aviation industry. We’ve come to a time when we say that a 30% decrease in comparison with 2019 is good news. Ten months ago, no one expected that. Latin America’s recovery will depend on several factors:

- How the big three (LATAM, Avianca, and Aeromexico) emerge from their Chapter 11 reorganizations

- How low-cost carriers like Volaris, Viva Air, Azul, and Sky Chile seize the crisis

- The shape of the regional economies in the following months

- The trust Latin American passengers (but most importantly, the governments) have on the safety protocols imposed in the region

- A second or third wave of COVID-19 infections in the region

Do you expect to see a V-Shaped recovery in Latin America? Let us know in the comments.