Low-cost airline operator Indigo Partners has commented publicly on its interest in Virgin Australia for the first time this week. The private equity firm's co-founder and managing partner, Bill Franke, confirmed a long-standing and current interest in the collapsed airline.

The Arizona based private equity firm is one of the shortlisted bidders in the Virgin Australia restructuring process.

Australia is "a very interesting market"

Oaktree Capital Management is said to be underwriting the Indigo Partners' bid. Oaktree is majority-owned by Brookfield Asset Management. Brookfield failed to submit an initial bid for Virgin Australia last week, having been frustrated at how the administrator was managing the sale process.

“We see Australia as a very interesting market,” Mr Franke told a seminar hosted by CAPA - Centre for Aviation mid-week.

While Indigo Partners doesn't have current operations in Australia, it has long been interested in flying here. They had teamed up with local business figures in an ultimately unsuccessful bid for Ansett after its collapse in 2001.

In 2018, Indigo Partners came close to buying HNA’s 20% stake in Virgin Australia. It also spoke to Etihad and Nashan Group about buying their stakes. Again that bid failed when other shareholders balked at Indigo Partners having a controlling interest in Virgin Australia.

Rumors have also circulated recently that Indigo Partners was looking at acquiring an Australian air operator's certificate and going it alone.

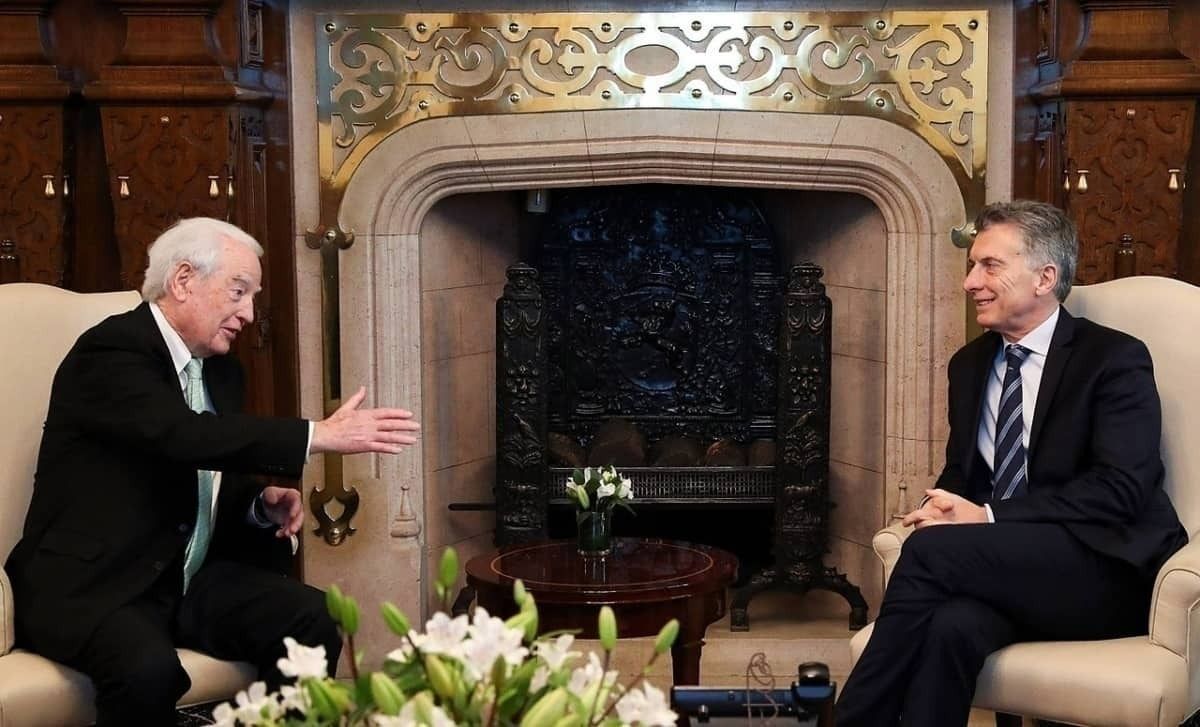

Bill Franke is here to help

After long declining to comment, Mr Franke has popped up, virtually at least. Border closures have seen him grounded in the USA, but local advisors are moving his bid forward. Mr Franke made his first public comments about his firm's interest in Virgin Australia to CAPA on Wednesday.

“We think the country needs two airlines, and we want to be able to assist Virgin Australia in being one of those two airlines.”

Bill Franke is a low-cost airline specialist. His firm has majority stakes in airlines like Frontier, Wizz, Volaris, and JetSMART. Should Indigo Partners ultimately be successful in its bid for Virgin Australia, would the restructured airline be taken back to its low-cost roots?

That's not the preference of Virgin Australia's receivers or the Australian Government. Both are keen for the airline to be sold as a going concern and for it to continue as a full-service airline. This publicly stated preference has raised a lot of eyebrows, many considering it both unreasonable and naive.

Not necessarily going downmarket, says Mr Franke

But Mr Franke knows he needs to sing from the right songsheet, saying the automatic assumption he'll take Virgin Australia down market is incorrect.

"I get asked all the time, are you going to keep international flying, are you going to become an ultra-low-cost carrier and the answer to that is: you’re going to have to fit yourself to the market and what the market wants.

"We have not made that analysis yet. We have to look at the Australian market in terms of what the consumer wants in the product."

But Bill Franke did point out that low-cost carriers have performed better in the 21st century than full-service airlines

Remaining bidders at odds with the administrator over the future direction of Virgin

Virgin Australia's administrators, Deloitte, are keen to preserve jobs at the airline and see as many creditors paid as possible. Virgin Australia's management, still on board and working with Deloitte, wants to see the restructured airline retain its international routes.

That's not what most of the shortlisted bidders want to hear, with the majority also pushing hard to downsize the fleet to a single type: Boeing 737s. They want to get rid of the leased widebodies and surplus 737s.

Mr Franke knows he has to stay onside with Deloitte if he is to succeed in buying Virgin Australia. Thus far, he's been very diplomatic about what he plans to do with the airline. But his experience in the industry and his preferred operating environment suggests an Indigo Partners owned Virgin Australia could be more Jetstar than Qantas.

As Mr Franke notes, that's where the money is.