While the aviation industry reels from its worst downturn in memory, there is one thing that could help airlines. The price of jet fuel is down nearly 70% from last year, giving airlines much-needed breathing space in this crisis. But could we see airlines making use of these low prices to start new long-haul routes in the future? Let's find out.

How much does jet fuel matter?

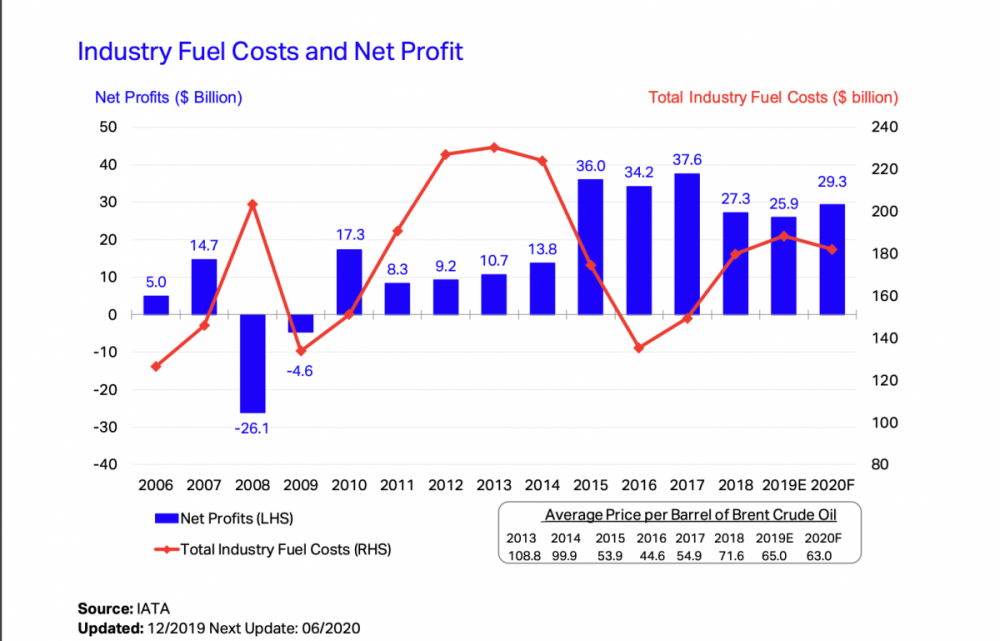

The first question many may ask is how much do airlines really spend on jet fuel for each flight. While we've all seen the pesky fuel surcharges on our ticket prices, airlines do actually spend a lot on fuel. According to IATA, airlines around the world spent 23.7% of their expenses on jet fuel on average, totaling $188bn in 2019.

While these figures may vary by airline, a 70% drop in the price of fuel will likely save millions every year. Profits are also closely tied to fuel prices; the industry has seen profits peak when jet fuel prices are low and fall as price rises (pandemics and recessions aside). Once the industry does recover, airlines could look for new avenues to invest their profits.

Time to open up new routes?

The last decade has seen the introduction of some of the most long-range and efficient aircraft ever developed. Airlines have jumped on this opportunity to start profitable, ultra-long-haul flights between popular cities but have largely avoided expanding to less popular routes. But lower prices could allow airlines to launch additional routes. A few examples include connecting Australia to Europe, South Asia to South America, and North America to Africa.

Low jet fuel prices could also put plans such as Qantas' Project Sunrise back on track following the events of this year. Other airlines could also speed up their new long-haul route plans, while hub-and-spoke carriers add even more destinations. One of the main drivers of this plan will also be ultra-efficient aircraft like the upcoming 777X and A350. The aircraft will allow airlines to sustain changes in fuel prices and ensure routes remain profitable even with reduced demand.

Overall

While low jet fuel prices do seem exciting for prospective new routes, airlines rarely like to start new flights that rely so heavily on fuel prices. Oil is a notoriously volatile commodity, the price of which routinely rises or falls 40-50% in the span of just a few years. Airlines generally launch routes which will be profitable regardless of fuel price fluctuations, but prices this low could push airlines to take a leap of faith and operate some new routes once the current downturn is over.