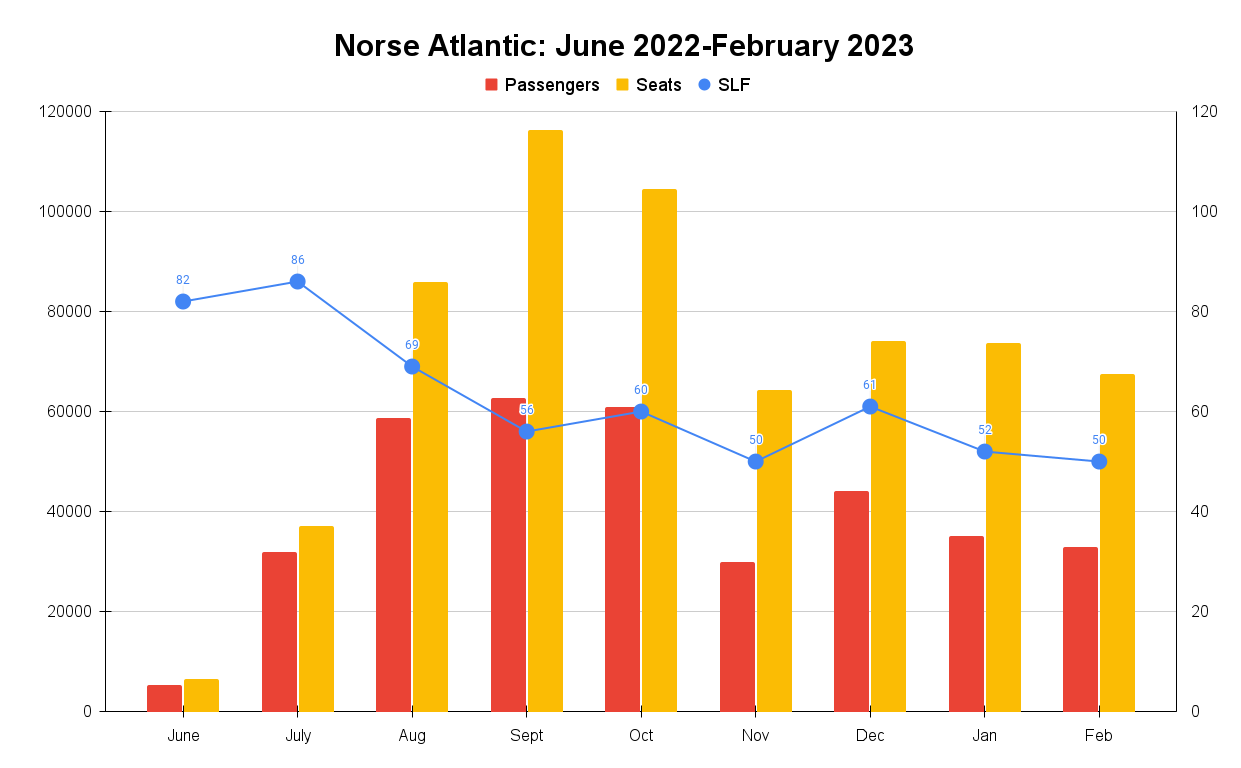

Norse Atlantic carried over 356,000 passengers between June – when it began operating – and February, according to the carrier's own figures. However, it achieved a network-wide average seat load factor (SLF) of just 63% in this time – meaning it only filled 6 in 10 seats for sale.

Norse requires very deep pockets and must significantly improve winter performance. It must also ensure it doesn't expand too quickly and thinly and into too many new markets at the same time. It'll launch eight new transatlantic routes from three European cities this summer, some of which (e.g., Paris CDG-JFK, Rome-JFK) are already highly competitive with record levels of flights.

50% SLF in February

It is exceptionally hard to make a long-haul low-cost carrier work, even at the best of times. It cannot be overstated just how much harder it is versus a short-haul LCC, especially one like Norse, which is enormously (but not fully) reliant on point-to-point traffic.

Analyzing Norse's figures shows that it had a SLF of 61% or less in six of the past nine months. These include the important month of September, as shown in the figure below. Yes, it was very new, but it had way too many seats; capacity discipline is important. This is seen in June/July, months when very attractive lead-in fares were also common. More recently, it filled just half of the available capacity in February, down from 52% in January.

SLF is part of the airline route performance puzzle. Too much capacity relative to demand at particular prices means that an airline must take meaningful action. It cannot continue to have very low LFs: it is deadly. For Norse, this means cutting routes or frequencies or finding new opportunities in an attempt to boost performance.

Passenger volume is crucial to driving ancillary revenue (checked bags, meals, etc.) to supplement fare revenue. Clearly, very low SLFs mean that it doesn't generate the passenger volume needed.

Stay aware: Sign up for my weekly new routes newsletter.

All attention is on winter

Generally speaking, it is significantly easier for airlines to perform well in summer than in winter, as demand and fares are much higher. Conventional thinking dictates that any summer profits help to offset winter losses. For many carriers, getting winter right and performing well is an essential priority for sustainability. Norse is no different.

In a recent acknowledgment that winter needs much more work and that it is committed to it, the carrier said,

"We look forward to sharing initial winter plans with a focus on sun destinations [my emphasis]."

Generally speaking, long-haul winter sun from Europe means the Southern Hemisphere, although there are exceptions, such as Phoenix and Florida. It'll be fascinating to see where exactly it'll announce. It previously had slots at Dubai, a very popular and hot winter destination, but there are plenty of key sun tourist destinations in the Caribbean, parts of Africa, Thailand, India, and South America...

What does Norse's President say?

Recently, I posted on LinkedIn about Norse addressing winter performance, to which the carrier's newly appointed President, Charles Duncan, responded,

For low-cost long-haul to work, we have to have profitable flying in winter, which is much more challenging to do than in summer. As I have been telling our team, we need to spend 10 months out of 12 focusing on winter. Exciting news will be forthcoming as we continue to refine our plans."

We'll know Norse's winter 2023 plans in the near future. Where would you like them to fly? Let us know in the comments.