Startup long-haul low-cost airline Norse Atlantic Airways has disclosed an initial three routes to the US. All are from Oslo: Fort Lauderdale, Stewart, and Ontario. The use of secondary airports is highly intriguing. Norse Atlantic is driven by filling the gap left by Norwegian, but will it avoid the same mistakes? Long-haul low-cost is difficult enough to make work at the best of times.

The first three US routes revealed

Norse Atlantic's first three routes were disclosed in its submission to the USA's Department of Transportation (DOT) for a foreign air carrier permit. This comes ahead of the carrier receiving its air operator's certificate, which it anticipates receiving in November.

If it receives permission to serve the US, the routes, shown below, are expected to begin in spring or summer 2022 using two-class Boeing 787s, of which it expects an initial three. Of course, start dates, frequencies, schedules, and pricing will be disclosed later.

- Oslo to Fort Lauderdale (for South Florida)

- Oslo to New York Stewart (for the New York area)

- Oslo to Ontario (for the Los Angeles area)

Following in the gap left by Norwegian

Norse Atlantic's first three routes are all driven by the gap left by Norwegian, which scrapped long-haul flying to concentrate on its core and successful short-haul markets. Indeed, the startup carrier's whole business plan is driven by the exit of Norwegian and the consequent opportunity. (Unserved markets in the wake of Norwegian's exit also helps to explain Finnair creating a base at Stockholm Arlanda.)

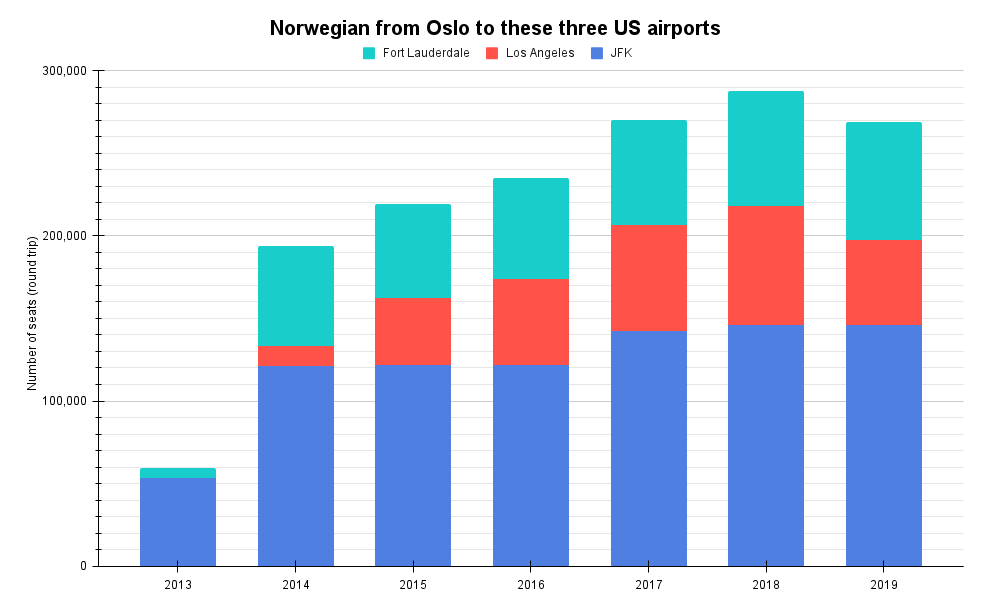

Norwegian operated from Oslo to Fort Lauderdale and JFK between 2013 and 2020 and to Los Angeles from 2014 to 2020, according to OAG data. The fact that all three operated for years hopefully suggests good enough underlying performance. However, notice the different airports that Norse Atlantic has filed to serve, which we discuss below.

All three cities markets remain unserved from Oslo. However, SAS will operate Oslo-Newark twice-weekly from October, rising to five-weekly in November. And its winter-seasonal service to Miami, which began in 2016, will resume once-weekly in early November using A330-300s. Aircraft will route Copenhagen-Miami-Oslo and back.

Stay aware: Sign up for my weekly new routes newsletter.

Not too surprising that Norway is first

It isn't too much of a surprise that Norway is where Norse Atlantic first plans to take off. The country is, after all, its home nation, and requesting permission from the US to initially fly from major markets like London or Paris would raise serious eyebrows.

Indeed, the Biden Administration has already been urged to block the carrier given the 'flag of convenience' controversy surrounding Norse Atlantic's plans, just as they did Norwegian. Its intention was summarized in its application to the DOT:

"Norse Atlantic is a long-haul carrier planning to offer affordable fares and a more environmentally friendly service to transatlantic passengers. Initial operations will begin with three Boeing 787 aircraft in a two-cabin configuration (economy and premium) and will expand over time to other points in Europe to meet developing passenger demand and route expansion."

Secondary airports are intriguing

While Norse Atlantic's actual markets – South Florida, New York, Los Angeles – aren't surprising, that they involve secondary airports is less expected. After all, Norwegian often served secondary US airports – cheaper, less congestion, quicker turns, and more likely to offer significant incentives – from across Europe, but changed.

While secondary airports are commonplace for European short-haul low-cost carriers, the economics are much more challenging to make work for long-haul, as exemplified by Norwegian's experience. In fact, secondary airports can also be hard to make work within the US domestic market, at least if taken to an extreme level like Skybus.

Norwegian's 737 flights: secondary US airports

In summer 2017, Norwegian began transatlantic flights by Boeing 737s from six European airports: Belfast International; Bergen; Cork; Dublin; Edinburgh; and Shannon. The destinations were Hartford, Stewart, and Providence (for the Boston area), although not all European airports were connected to all three airports.

Hartford was cut in 2018, while Hamilton (for greater Toronto) was added in 2019. Because of poor route performance, transatlantic 737 routes ended in summer 2019. Poor performance wasn't helped by the delayed arrival of much more fuel-efficient B737 MAX 8s, with next-generation B737-800s often used instead.

Secondary airports were also used for B787s

Norwegian had served Fort Lauderdale and Oakland (for wider San Francisco) for years. Fort Lauderdale came online in April 2014, initially from Oslo, Copenhagen, and Stockholm, later also from Barcelona, Gatwick, and Paris CDG. Oakland, meanwhile, began in May 2014, at first from Oslo and Stockholm and later Barcelona, CDG, Copenhagen, Gatwick, and Rome.

In 2019, Norwegian decided to focus on profitability rather than growth. This saw multiple routes cut and prioritizing where it was making money. It decided to increase capacity slowly, helping to improve loads and ancillary revenue per flight from the greater passenger volume and ultimately higher total revenue per available seat mile. Its US revenue grew by 23% in the third quarter of 2019.

Moving to Miami and San Francisco

Norwegian moved from Fort Lauderdale to Miami and Oakland to San Francisco in 2019. This was, in part, driven by competition and because the bigger airports are better known internationally. Emirates recently shifted its Fort Lauderdale operation to Miami, a much larger market with higher fares despite more long-haul competition.

Like Emirates, Norwegian's move was ultimately to achieve higher fares and awareness and stronger overall performance, even if it meant higher costs. And it seems to have worked.

Booking data suggests that Norwegian achieved a 41% higher base fare from San Francisco than Oakland and 30% more from Miami. It is therefore intriguing that Norse Atlantic has chosen a secondary airport approach – for now, anyway.

What do you make of Norse Atlantic's plans so far? Let us know in the comments.