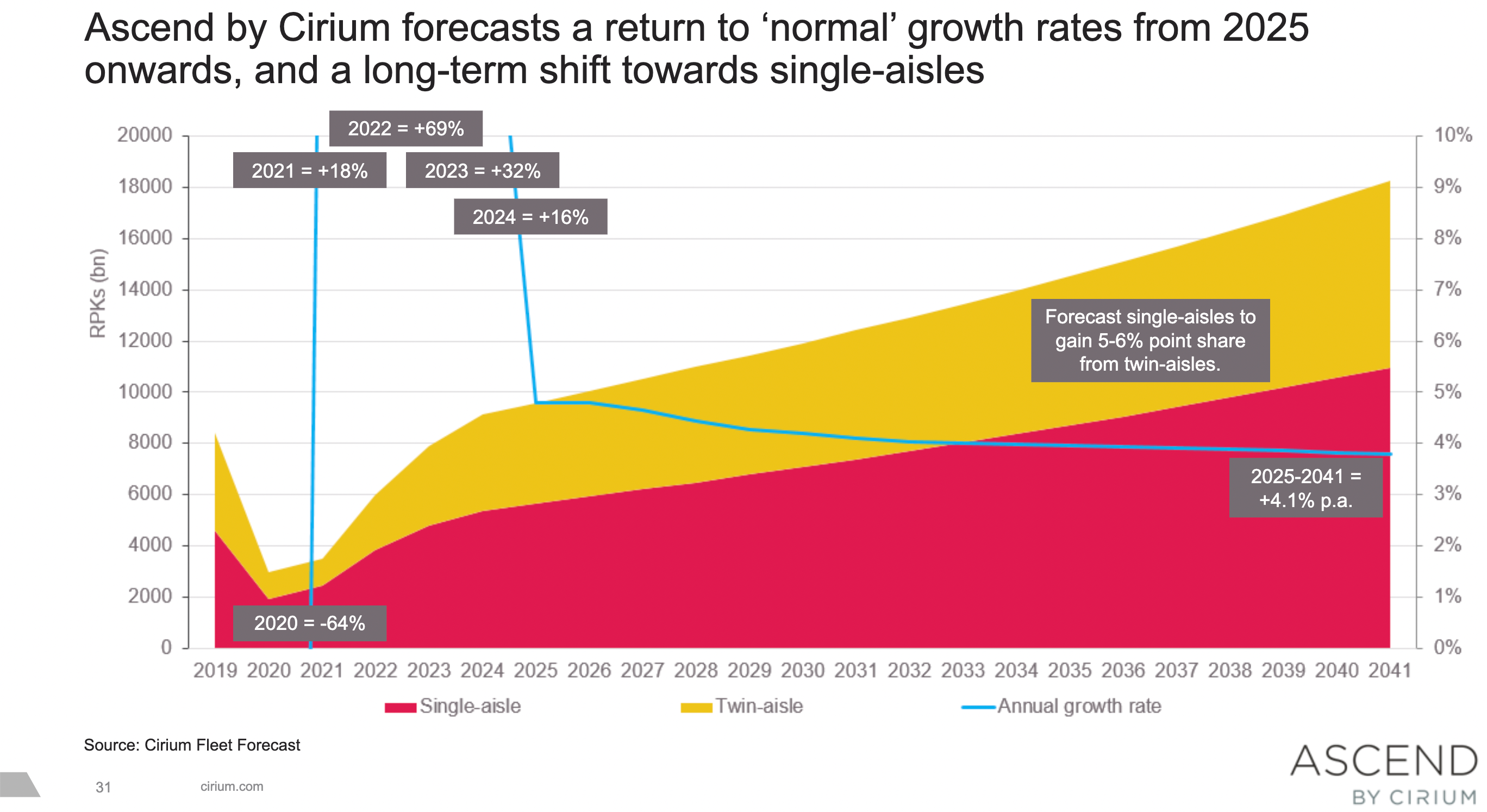

We have seen a robust recovery in 2022. There have been record-breaking numbers supported by exciting hiring sprees. However, not all markets are recovering as swiftly as others. With this in mind, normal growth rates aren't expected until the middle of this decade.

A few more years of sensitivity

2019 was a healthy year for airlines. However, passenger numbers dropped considerably in 2020 following the rise of the pandemic. 2021 brought signs of progress, but the road to recovery wasn’t fully underway until this year.

Looking ahead, the spikes will continue as challenges ease. It won’t be until 2025 till the situation is expected to even out.

Ascend by Cirium senior consultant Richard Evans shared the following in a company presentation this week:

“The first year when we exceed the level of 2019 is 2024. From 2025 until the end of our forecast, we have an average annual growth rate of just over 4%.”

Get all the latest aviation news right here on Simple Flying.

This year, the Russia-Ukraine war has had a domino effect across the industry. Along with airspace bans, it has caused supply chain woes and increased fuel costs. Moreover, China, a major international influencer, continues to implement its stringent COVID policies, restricting travel and hindering business practices.

On a social scale, several countries are going through recessions backed by high living costs and rising inflation. Thus, these factors are all combining to lower gross domestic product (GDP) forecasts, which in turn limits the number of opportunities to be had across aviation. All in all, GDP has a close link to traffic growth rates.

Nonetheless, there are certain airlines that will benefit from these shifts. For instance, Ryanair has often said that it thrives in a recession due to its low costs. Even though the carrier raised its fares slightly, they are still far more attractive than traditional full-service outfits. So, we can expect low-cost carriers (LCCs) to continue reporting full cabins even if growth rates are generally slower.

Narrowbody popularity

These LCC triumphs match the notion that there is a long-term shift toward single-aisle aircraft. LCCs traditionally prefer narrowbodies such as the Boeing 737 and Airbus A320 families.

Evans added:

“We've actually seen the market share of single aisles be higher now than at the end of our forecast, but that's because of the different recovery speeds. So, we haven't seen the long-haul market completely recover yet. Compared to 2019, we've got a 5-6% share point share gain for single aisles from twin aisles. Compared to where we stand today, some would say, 'Ah single aisles are losing market share,’ but that's not the trend, that's the way recovery is working out.”

Get the latest aviation news straight to your inbox: Sign up for our newsletters today.

Balancing operations

Narrowbodies were garnering greater attention even before COVID. Still, with models such as the 737 MAX and A321LR offering long-range opportunities, it’s not a surprise to see that they are taking more of a share. Their presence will only increase after the likes of the A321XLR are introduced.

We are currently seeing single-aisle jets prosper on long distances. Notably, the A321LR has become a mainstay across the Atlantic Ocean, flying with the likes of Aer Lingus, TAP Air Portugal, Air Azores, SAS, and JetBlue. Operators tout the efficiency to be had with such an aircraft on transatlantic hops.

Both Boeing and Airbus will be busy preparing to meet demand over the next two decades, with the former forecasting over 41,000 new deliveries by 2041 and the latter expecting over 39,000.

What are your thoughts about the forecast of passenger activity this decade? What do you make of the overall trends? Let us know what you think of the prospects in the comment section.