Phoenix has bucked the trend. It is one of the US’ fastest-growing airports this summer and it is now well above pre-pandemic levels. This is mainly from big growth by Frontier, Delta, and Alaska, while Phoenix’s biggest carriers – American and Southwest – have both declined. For American, this is part of a longer-term pattern.

Phoenix is the US' seventh-best performing airport this summer. It has exceeded its pre-pandemic level, with almost 1.2 million additional seats versus summer 2019 (S19). It is in good company, with fellow major airports Miami, Salt Lake City, and Dallas Fort Worth ahead of it in the added capacity charts, while Denver is not far behind.

Given Phoenix's outdoor nature and the city's large size, it isn't much of a surprise that Phoenix has done so well. It owes its growth to four airlines:

- Frontier: 612,250 added round-trip seats; +135%

- Delta: +406,348; +20%

- Alaska Airlines: +328,886; +54%

- Spirit: +62,160; +59%

Stay informed: Sign up for our daily and weekly aviation news digests.

Frontier leads Phoenix's growth

Frontier is Phoenix's fifth-largest airline this summer, with a shade over one million seats. It has jumped one place and overtaken Alaska Airlines, despite that carrier's decent growth too.

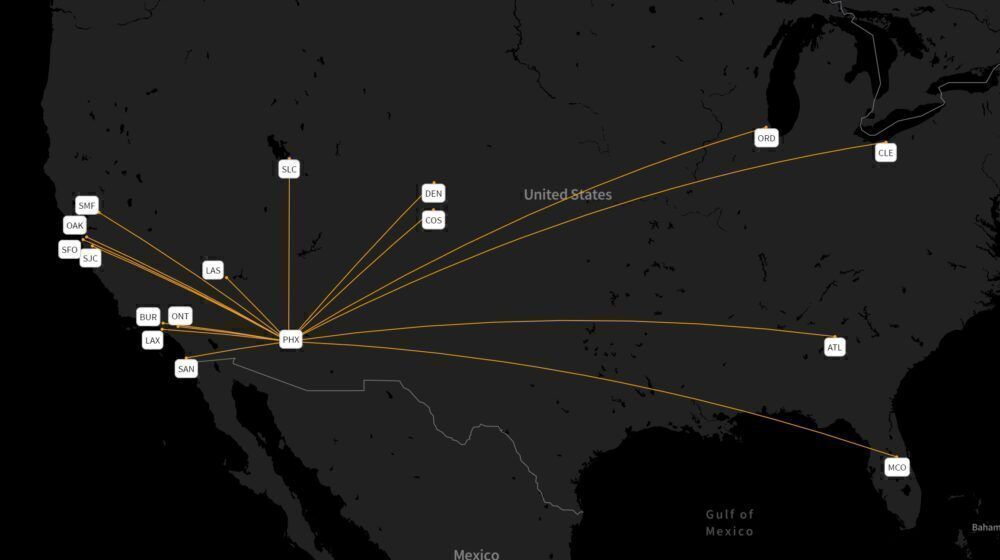

Frontier has 16 routes from the airport, up by four in S19. As is often the case, there has been a lot of route 'churn'. Atlanta, Burbank, Los Angeles, Oakland, Ontario, Orlando, Sacramento, Salt Lake City, San Diego, San Francisco, and San Jose (California) have all been added. Burbank was announced in the past day; it'll launch on July 15th and will be seven-weekly.

Meanwhile, while Cincinnati, Des Moines, Fort Myers, Grand Rapids, Madison, Milwaukee, and Raleigh Durham have all been dropped.

No growth for American or Southwest

Conspicuous by their absence are Phoenix's two largest airlines, American Airlines and Southwest. They have 78% of the airport's capacity this summer, but cuts mean they're down by nearly 300,000 seats. For American, this is part of a longer-term trend of decline at its Arizona hub.

American at Phoenix

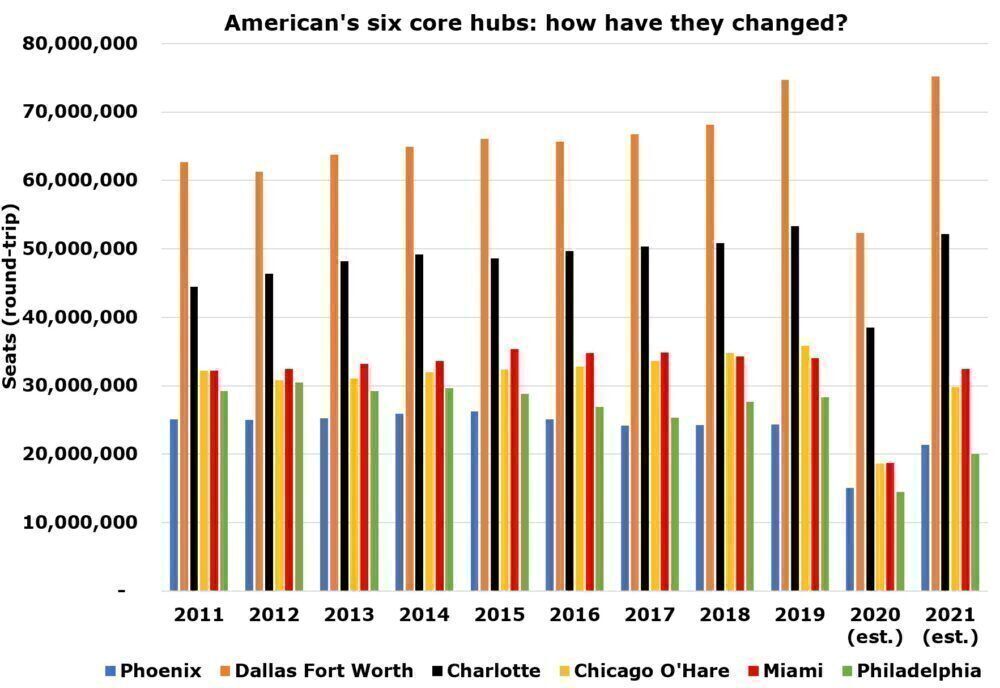

If the whole of 2021 is looked at, American has 21.4 million seats at Phoenix, based on the latest data from May 10th. This makes the hub its fifth-largest, behind:

- Dallas Fort Worth: 75.2 million

- Charlotte: 52.2 million

- Miami: 32.5 million

- Chicago O'Hare: 29.8 million

Because of bigger cuts, Philadelphia is now smaller (20.1 million seats). The airport, a former US Airways hub like Charlotte and Phoenix, was crucial for American's A330s, which were also inherited from the now-defunct carrier.

Phoenix didn't grow between 2011 and 2019

Looking at the pre-pandemic 2011-2019 period in the figure above, all of American's core six hubs grew except Phoenix (-707,000) and Philadelphia (-1.9 million). And now, American’s Managing Director of Global Network Planning, Jason Reisinger, told Simple Flying that its Northeast Alliance will not affect Philadelphia.

As always, the stronger got stronger, with Dallas up the most (11.9 million), followed by Charlotte (8.9 million). It's obvious that these two hubs are by far the most important money-wise, helped by American's huge dominance at them. The carrier's dominance at Charlotte is helped by the enormous use of regional jets, as recently shown by Simple Flying.

How do you think Phoenix will grow in the future? Comment below!