TSA screening numbers have started to plateau as passenger growth stalls. The United States, currently experiencing another surge in coronavirus cases, has seen weeks of growth come to screeching halt as leisure travelers reconsider their options amid a worsening virus. Meanwhile, airlines have started to see bookings for the remainder of the summer start to decline, with many pulling back August schedules in anticipation of reduced travel demand.

Passenger travel has plateaued

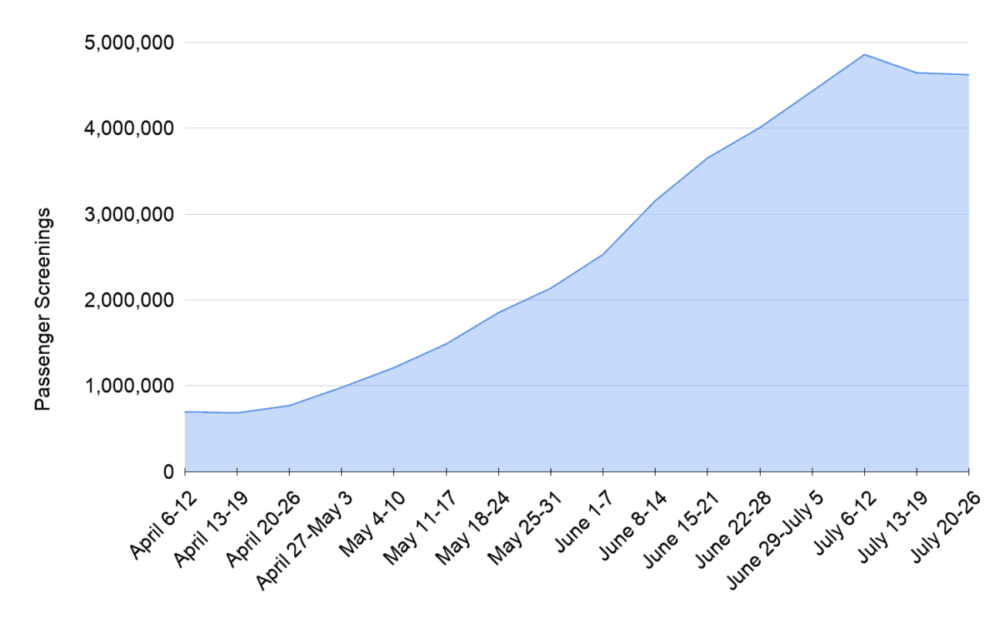

Passenger numbers were on an upward trend throughout May and June as more and more states started to open up, airlines began to rebuild their schedules, and travelers started booking flights. Leading up through the July 4th weekend, that demand continued to grow until, unfortunately, coronavirus once again took the headlines in the US with surging case numbers leading to a plateau in travel during July.

Stay informed: Sign up for our daily aviation news digest.

The above data looks at passenger traffic from Monday through Sunday of each week. There was steady growth as can be deduced from the relatively stable increase in traffic leading up to the July 4th weekend. However, after that, passenger traffic plateaued– though not anywhere near where 2019 numbers were.

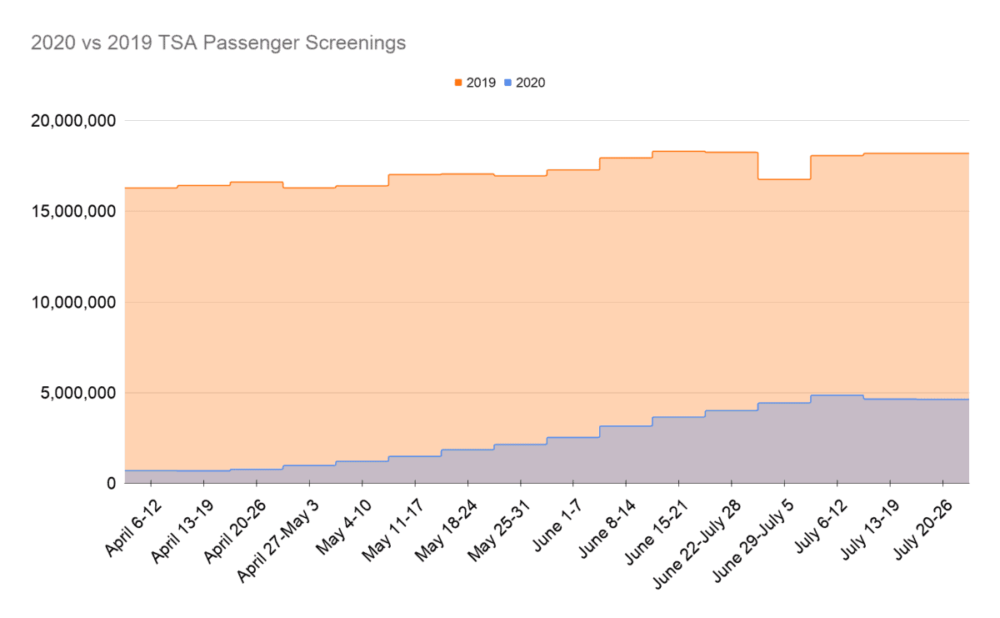

The below chart compares the same weeks in 2020 vs. 2019:

At its peak in 2020, weekly passenger numbers did not even cross 5 million in a week. Meanwhile, the lowest number of screenings per week in May was over 16.2 million in a week. The best week for 2020 saw 4.8 million screenings, while 2019's best week thus far was over 18 million. This is a staggering gap of 14 million passengers in a week.

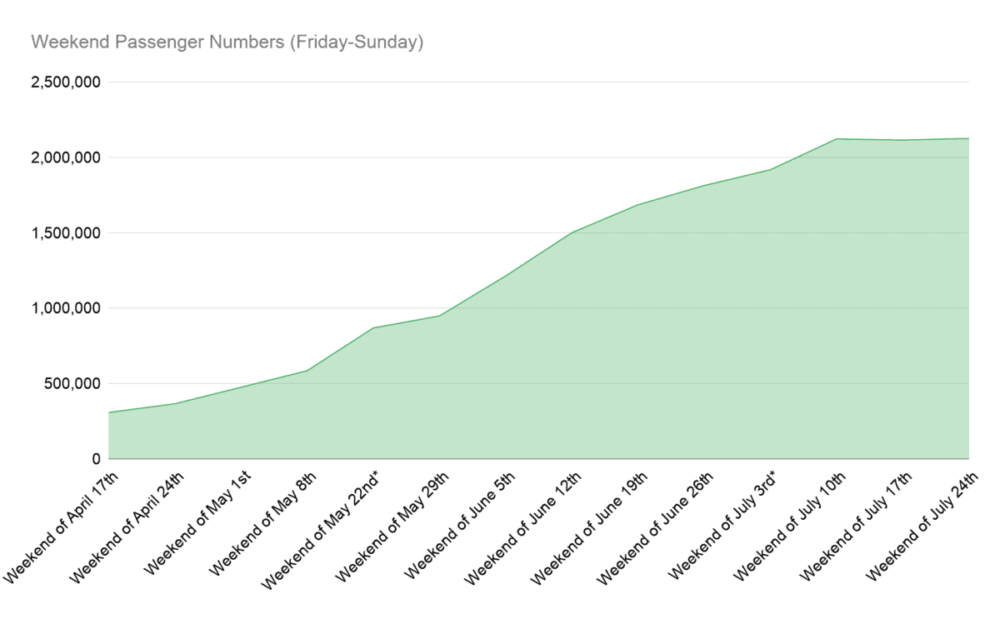

Weekend-to-weekend growth has stagnated with plateauing numbers, as well.

Why growth matters in 2020

Many will look at 2019's weekly numbers and see little change from week-to-week. Note that July 4th was a week later in 2019 than it was in 2020 and that holiday's passenger numbers are represented in the spike marked July 6th through 12th. The TSA records data based on the aligned weekday, not the aligned date, causing this slight discrepancy.

Nevertheless, 2019 was an excellent year for US airlines with sky-high profits (including profit sharing), and load factors. However, when airlines reach the peak of travel demand, then growth is much slower, and airlines had pretty much hit the ceiling for passenger counts in 2019.

In 2020, that is nowhere near the same situation. Growth matters because of how much of a gap there is in week-to-week passenger numbers between 2020 and 2019. Just after the July 4th holiday, passenger numbers did see an uptick to the highest levels thus far during the summer before slight decreases– the first weeks since April without growth.

If we consider 2019 as the ceiling for passenger numbers, then there is a lot of room for carriers to grow. However, passengers just are not coming during the industry's most profitable months, wreaking havoc on airline revenue and capacity.

What airlines are looking for

United Airlines is hoping recovery will recover to 50% of 2019's level before improving after a vaccine is made widely available, and people actually get one. However, getting to 50% requires a substantial increase in demand than what is currently being seen. United also noted a stall in passenger demand amid rising cases. Alaska Airlines also saw the same with lower bookings for the coming future. Delta Air Lines has already pared back its August schedule.

At the end of the day, airlines are heading into the end of the summer and then the start of the fall. Winter is, historically, the toughest time for airlines. Without strong second and third quarters, it is going to be a tough rest of 2020.

As for when passenger numbers will start to hit even 50% of what it was in 2019, it will likely be in 2021 (if not later) when passenger numbers get closer to 10 million a week, assuming there are no other shocks. A full recovery, based on these numbers, definitely looks a few years out.