Qatar Airways (QR) is eyeing Australia as a strategic market where the Gulf carrier could potentially increase capacity and frequencies. However, Australian flag carrier Qantas (QF) firmly stands against the proposal. Let's look closer at this dispute.

Australia: a contended market

Australia is at the center of a dispute between two major international carriers, Qatar Airways and Qantas. But what is precisely the controversy about?

The Gulf carrier's CEO, Akbar Al Baker, has proposed increasing the airline's frequencies to Australia, reaching 21 flights per week from its hub, Doha Hamad International Airport (DOH). The Qatari airline submitted the request to the Australian federal government on Tuesday, October 25th, stating that the carrier is ready to double its flights to the island nation, adding new routes to its current network.

However, the Australian flag carrier, Qantas, is anything but happy with this proposal. Therefore, the airline is working to have Qatar's proposal denied by the Australian government. Qantas is building its motivations on commercial grounds, stating that allowing Qatar to double its frequencies to Australia would be unfair vis-à-vis those non-government-owned airlines trying to win back market shares following the COVID-19 crisis.

Qatar's CEO goes hard on Qantas

On the one hand, allowing Qatar to increase frequencies and, therefore, capacity to Australia would benefit the Gulf carrier, remarkably less than a month away from the start of the FIFA World Cup in Doha. On the other side, more capacity to/from the Gulf hub threatens Qantas's market power in its home country.

To justify his request to increase frequencies to Australia, Akbar Al Baker has stated Qatar Airways would provide Australians with a valid alternative to Qantas. Indeed, according to Qatar Airways CEO, Qantas has cut capacity to 50% compared to the pre-pandemic period and doubled its average fares to benefit its shareholders.

In Al Baker's opinion, by cutting capacity and increasing fares, Qantas is not providing an efficient service, also considering the $21 billion the carrier received in 2020 and 2021 to face the challenges induced by the COVID-19 pandemic.

All is fair in love and aviation

Qatar Airways seems particularly keen on developing its presence in Australia. But does the Gulf carrier want to expand in the Australian market to the point of breaching the law?

According to a senior source from Qantas, the answer to this question is "yes." Indeed, Qatar Airways has reportedly ignored an existing bilateral agreement on a current route between Doha (DOH) and Melbourne (MEL). According to the source, the existing bilateral agreement envisages a stop-over in Canberra (CBR). Nonetheless, Qatar Airways has reportedly flown directly from its hub to the trip's final destination, bypassing the stop-over in the Australian capital city.

Bilateral agreements, commonly known as bilaterals, have now been, for a significant part, substituted by Open Skies agreements. Bilaterals stemmed in the 1940s and are still used today by some states to regulate air transport services between them. Based on bilaterals, governments handle matters such as market entry by determining which airline can be designated to use the traffic rights in place between the two countries. Additionally, some bilaterals also determine frequencies and the capacity each airline can offer on specific routes.

Australia, Qatar Airways, and its competitors

It might not come as a surprise that Qatar Airways wants to strengthen its presence in Australia. Indeed, this country represents a key market for the Gulf carrier.

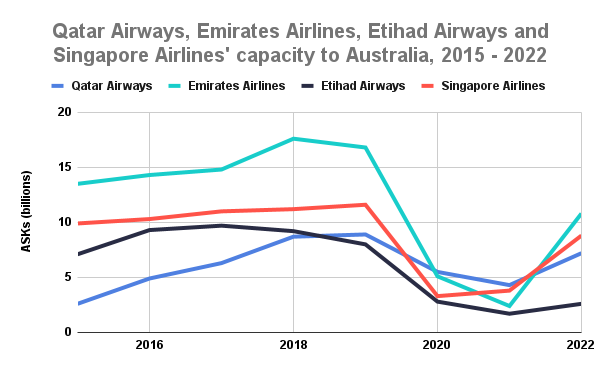

According to the Official Airline Guide (OAG), in 2022, Qantas will deploy the most capacity from Australia, with a total of 14.7 billion Available Seat Kilometres (ASKs). Emirates Airlines (EK), one of Qatar Airways' strongest competitors, is the second-strongest airline on the island, while Singapore Airlines (SQ) places third with 8.9 billion ASKs.

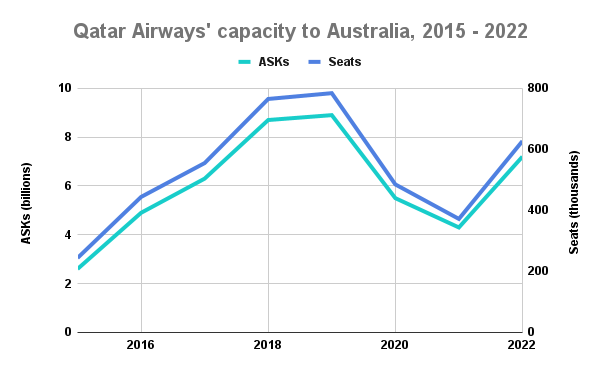

Focusing attention on Qatar Airways, it is evident from the graph below that the airline has been progressively increasing its capacity to Australia, both in terms of ASKs and seats offered. However, by the end of 2022, the Gulf carrier's capacity to Australia will be lower than it was in 2018. Therefore, Qatar Airways' intention to double its frequencies to the country is likely to be a strategic move aiming to strengthen its position in the key Australian market rapidly.

Considering Australia's top foreign carriers, over the period 2015 - 2022, Emirates has deployed the most capacity to the country. By the end of 2022, Emirates will still be the leading carrier per ASKs, although its capacity will be 20% lower than in 2015. Qatar Airways will place third, with ASKs 17% lower than they were in 2018. Singapore Airlines will rank second, although its capacity to Australia will be lower than in any year since 2015.

The Kangaroo Route

But why is Australia such a strategic market for the airlines mentioned above? The answer lies in the so-called Kangaroo Route, i.e., the route connecting Australia to Europe.

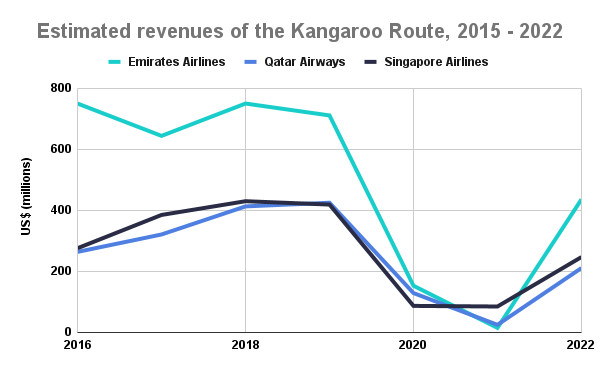

In 2019, Emirates Airlines was the leading carrier on this route, carrying 1.2 million passengers and yielding $711 million. Qatar Airways was Emirates' strongest competitor, carrying 1 million passengers and generating $425 million in revenues.

As one could expect from the above analysis, the third strongest carrier on this route was Singapore Airlines, which flew 641,000 people from Europe to Australia and back for a total of $419 million. In 2022, the ranking will not change, with Emirates, Qatar Airways, and Singapore Airlines still being the top three carriers connecting these two ends of the world.

Simple Flying reached out to Qatar Airways for further comment. We will update the article with any additional announcements from the airline.

Source: Skynews.com.au

.jpg)

-Boeing-777-3DZ(ER)-A7-ABF.jpg)

-Airbus-A380-800---A6EON-(1).jpg)

.jpg)