An increasing number of airlines are removing IFE screens from their cabins, in a bid to save weight and reduce fuel burn. But what about those carriers who never had them in the first place? Advances in screen technology and tempting opportunities for ancillary revenue generation could see more LCCs adding seatback screens to their planes in the future. Here’s why.

Taking seatback screens off the plane

Over the past few months, we’ve seen a number of major carriers taking inflight entertainment screens out of their cabins. Etihad, American Airlines and Qantas to name just a few have all taken seatback IFE off their planes in favor of Bring Your Own Device (BYOD) entertainment instead.

Unsurprisingly, this has divided passenger opinion. The younger and more tech-savvy aren’t bothered, as most are happy to use their own devices. But the less well equipped and those traveling with young kids have lamented the loss of the facility.

Speaking to Dr. Joe Leader, CEO of the Airline Passenger Experience Association (APEX) for our recent podcast, he explained how passengers will vote with their feet on issues like this. He said,

“As we’ve seen in this in the past, passengers will try them out once, but often move back to other options once they realize, they don’t simply want the lowest price, they want the best value, and I think airlines really are beginning to understand that more and more. You’ve heard in the news some airlines re-considering decisions and I hope they continue to do so.”

Indeed, American Airlines has been reconsidering its removal of IFE screens from cabins, although as yet has not swung things back the other way. However, there’s one segment of air travel providers who never did have entertainment on board – the low-cost carrier.

Most LCCS don’t provide IFE (although there are some exceptions) but with technology moving forward at a blistering pace and the potential to generate a huge amount of revenue, could this all be set to change?

A question of weight

Many of the airlines that are busily removing IFE screens are doing so to meet environmental goals. Taking weight off the plane means reducing fuel burn and, of course, associated CO2 emissions. But could advances in technology spell the end of this argument? Dr. Leader thinks so, telling me,

“If you ask me by the end of 2020’s, we’ll see more seatback solutions than ever before because we’re coming up to a generation of extremely thin screens that are nearly as thin as seatback plastics. By the time you look, it’ll be eight to nine years out. Even some airlines are taking off inflight entertainment are putting it right back on.“

Thin and light screens are a gamechanger for IFE. One of the most pressing reasons to take seatback screens off of aircraft is the weight they add to the plane. However, new technologies are already showcasing just how far things have come, and how this argument won’t hold water for much longer.

Announced last year, Safran’s RAVE ULTRA displays offer edge to edge viewing and the slimmest design in the skies. Safran says that it’s no thicker than your average cell phone, and offers around a 30% weight saving compared to other screens.

And it’s not just Safran either. LG Display has, at this year’s Consumer Electronics Show (CES) revealed its premium OLED displays for aircraft cabins. Bendable, scalable and incredibly lightweight, it's setting the bar for the future of IFE screens.

Of course, this is just the tech of today. If you consider that, 10 years ago, 1080p was considered the pinnacle of viewing quality. Now, modern TVs are working in 8K ultra high definition, with around 33 times more pixels than the TVs of the noughties. You can imagine that, as time moves on, IFE seatback screens will only get better, lighter and more attractive to airlines to install.

Revenue opportunities

If there’s no downside from the weight of the IFE units anymore, what are the benefits to the low-cost carrier of investing in seatback screens? The answer is simple: ancillary revenue.

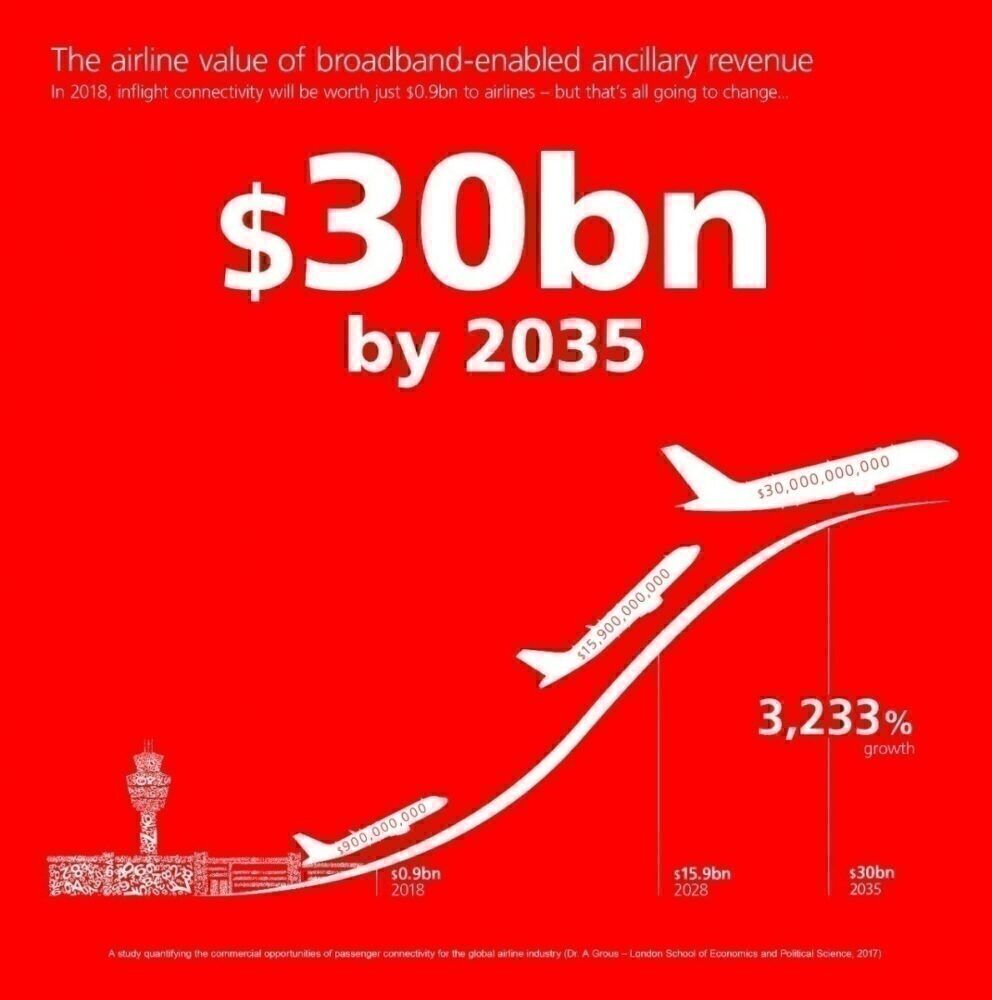

Aviation connectivity experts Inmarsat got together with the London School of Economics last year to model the potential for connectivity to generate additional revenue for airlines. Based on the IATA forecast that airline passenger numbers will near double by 2035, the study identified an estimated $30bn of revenue available to airlines each year.

As well as direct revenue through selling broadband access packages, Inmarsat and the LSE identified a number of other distinct revenue streams. One was premium content, where passengers would be able to purchase on-demand videos to stream in flight. Another was advertising, which can generate revenue both by the number of impressions (views) the ad gets and from any click-throughs to advertisers' websites.

One of the most interesting revenue streams, however, comes in the form of ecommerce. Passengers on connected aircraft who decide to make purchases could generate revenue for airlines through a revenue sharing/affiliate marketing agreement. While some of this might be general purchase, there is a key area that is set to explode in the coming years, and that’s destination shopping.

Destination shopping is something you do on your way to your holiday, to use while on holiday. It may include booking hotel rooms, car hire or even ordering something you’ve forgotten to pack. With advances in same-day deliveries from companies like Amazon, it’s possible your new flip flops could be waiting in your hotel room before you even get there.

Inmarsat’s research further identified a key group of travelers,’ generation Z’ (born 1997 and later) as the key group of passengers for airlines going forward. By 2028, 1.2bn of these youngsters will be flying each year, which will make them the largest demographic of travelers.

More importantly, this group of travelers has been identified as being the most likely to shop for their trip last minute. Inmarsat showed that if these passengers know there’s a reliable connection and the facility to browse on board, 70% would opt to buy items and make bookings for their trip whilst on board the aircraft.

That’s a solid revenue stream, and something that would be immensely interesting, in particular for low-cost carriers. With cheap fares often being sold for less than the cost of operating the flight, LCCs are always looking for ways to generate ancillary revenue, which could well see the appearance of the IFE screen on more low-cost carriers in the future.

What do you think? Should LCCs invest in IFE screens and connected aircraft? Let us know in the comments.