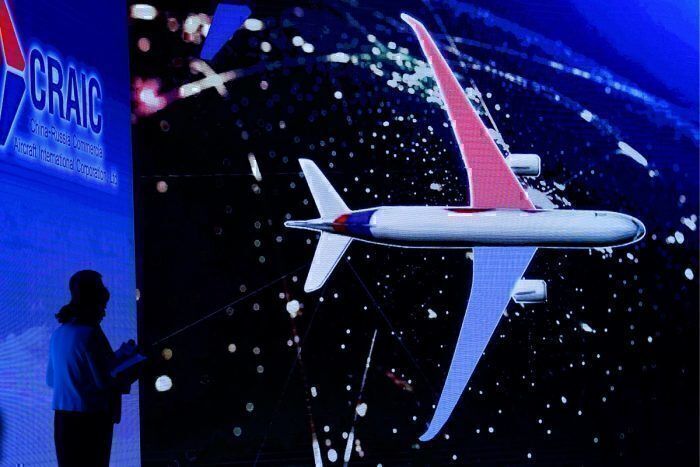

China and Russia are working in an unlikely partnership on a brand new widebody aircraft for the world. Although first deliveries aren’t expected until at least 2025, the manufacturers, calling themselves jointly CRAIC, are targeting a 10% share of the widebody market globally. Is this even possible?

CRAIC’s 10% target

State-owned companies in both China and Russia have been collaborating on a new widebody aircraft since 2014. The Commercial Aircraft Corporation of China (COMAC) and Russia’s United Aircraft Corporation (UAC) are building a plane called the CR929. This will be a long-range, widebody jet with a capacity of 250 – 320 seats. In a single class layout, it could seat as many as 440 passengers.

CRAIC, as the consortium calls itself, is under no illusions that it’s building a plane for an incredibly competitive marketplace that is absolutely dominated by Boeing and Airbus. As such, it has set itself a realistic goal of securing 10% of the market for widebody aircraft, estimated to be some 9,100 widebodies, over the next 20 years.

That’s 910 aircraft, which over 20 years would be an average of 45 to 46 planes a year. Sounds reasonable, right? But will there be a market?

Do Boeing and Airbus need more competition?

In short, yes they do. There’s been no serious competitor to the Boeing / Airbus duopoly since the former acquired McDonnel Douglas in 1997. There have been a handful of try-hards; China’s COMAC and Russia’s Irkut, for example, but neither have yet built a widebody contender.

Aircraft like the MC-21 and C919 make a strong proposition for the narrowbody market. The C919 is strikingly similar to the A320neo, while the MC-21 applies similar economics to the MAX 8, but with a wider cabin and better flight controls. Despite being the cheaper option, neither is likely to unseat Boeing or Airbus as the narrowbody champions, so why would the C929 be any different?

While the C929 will be unlikely to come anywhere close to outselling aircraft like the A330/A350 or the 787/777, even a small minority share of this market would be detrimental to the big two. Boeing recently announced a slow down on 787 manufacture, due in part to a reduction in orders from its valued Chinese customers.

If the CRAIC aircraft is a decent proposition, the manufacturer is likely to see some solid orders from China and Russia at least, eating further into the profits of the mainstream manufacturers. This could see Boeing and Airbus scrambling to offer better discounts on their widebodies in a bid to soften the losses the CR929 could potentially bring.

Who will order the C929?

The geography of the aircraft’s manufacturer has got to be worrying, with China predicted to have a voracious appetite for widebody aircraft in the coming years. As most Chinese headquartered airlines are under government control, it’s highly likely they’ll be forced to show a preference to the CR929 by way of supporting the local development of the plane.

A similar situation exists in Russia. Although the Russian aviation sector is not likely to experience quite the growth predicted for China, it’s still a source of sales for Boeing and Airbus. A number of independent carriers do exist, but the lion’s share falls to the ownership of Aeroflot, and therefore the Russian government. This includes Pobeda and Rossiya and, of course, the Aeroflot fleet.

The preference to buy locally made products is evident in Aeroflot’s fleet. Alongside many popular Boeing and Airbus models, it operates the world’s largest fleet of SSJ100s, with 49 in the fleet and 100 more on order. It also has orders in for 50 of the forthcoming MC-21 narrowbodies.

Therefore, whether it’s a great aircraft or not, we can expect to see a flurry of orders from Chinese and Russian airlines, but are they the only ones? Probably not.

Up and coming airlines in South America and Africa, in particular, are often on the lookout for cheaper alternatives to ordering from the big two. This is evidenced in the number of secondhand Boeing and Airbus aircraft in operation in these geographies. If CRAIC could offer a widebody capacity with similar economics to a Dreamliner or A330neo at a lower price point, they could snag some orders from these developing countries too.

What do you think? Will the CR929 achieve its 10% goal? Let us know in the comments.