I once read a quote that said, "the African aviation sector will be the next leading market, and always will be". While this statement certainly shines the market potential in good light, it also underlines the significant challenges facing the region. Here we focus on one particular challenge: air connectivity and traffic rights, epitomized by the development of the Single African Air Transport Market project.

History of SAATM

SAATM can be traced back to the signing of the 1999 Yamoussoukro Decision by 44 African states. In an attempt to further the 1988 Yamoussoukro Declaration on aviation integration and cooperation, the states pledged to gradually liberalize intra-African air transport services.

According to a comprehensive 2010 World Bank publication, the 1999 Decision is set to allow the free exercise of the five freedoms of the air. It also strives to increase cooperation on issues such as taxation, capacity, frequency, and safety issues.

The decision became binding in 2002, coinciding with the establishment of the African Union (AU). The formal processes of implementation of the 1999 Decision thus resides with the AU. However, unlike other transnational/supranational organizations, AU Assembly decisions are not automatically binding for member states. Individual countries, therefore, hold significant de facto implementation power and responsibilities.

The status quo

Since 2002, Yamoussoukro has undergone a very lengthy and largely incomplete implementation process. The reasons for this are multi-fold, ranging from technical capacity limitations to coordination issues to political will.

While some African airlines are striving, and many nations are supported by external assistance such as from China, the industry faces significant challenges. Though many of the region's challenges are related to infrastructure, the proper implementation of Yamoussoukro could help alleviate other issues. These include challenges such as costs, which could be solved through the implementation of tax coordination, or high fares with fair-competition frameworks, for example.

For now, Africa remains one of the toughest regional aviation markets in the world. It is typified by numerous airline failures, low load factors, high costs, and a poor safety record.

Future developments- SAATM and Agenda 2036

In an effort to overcome the numerous challenges and (finally) fully implement the 1988 and 1999 Yamoussoukro agreements, the AU has pushed to implement SAATM as part of its Agenda 2036.

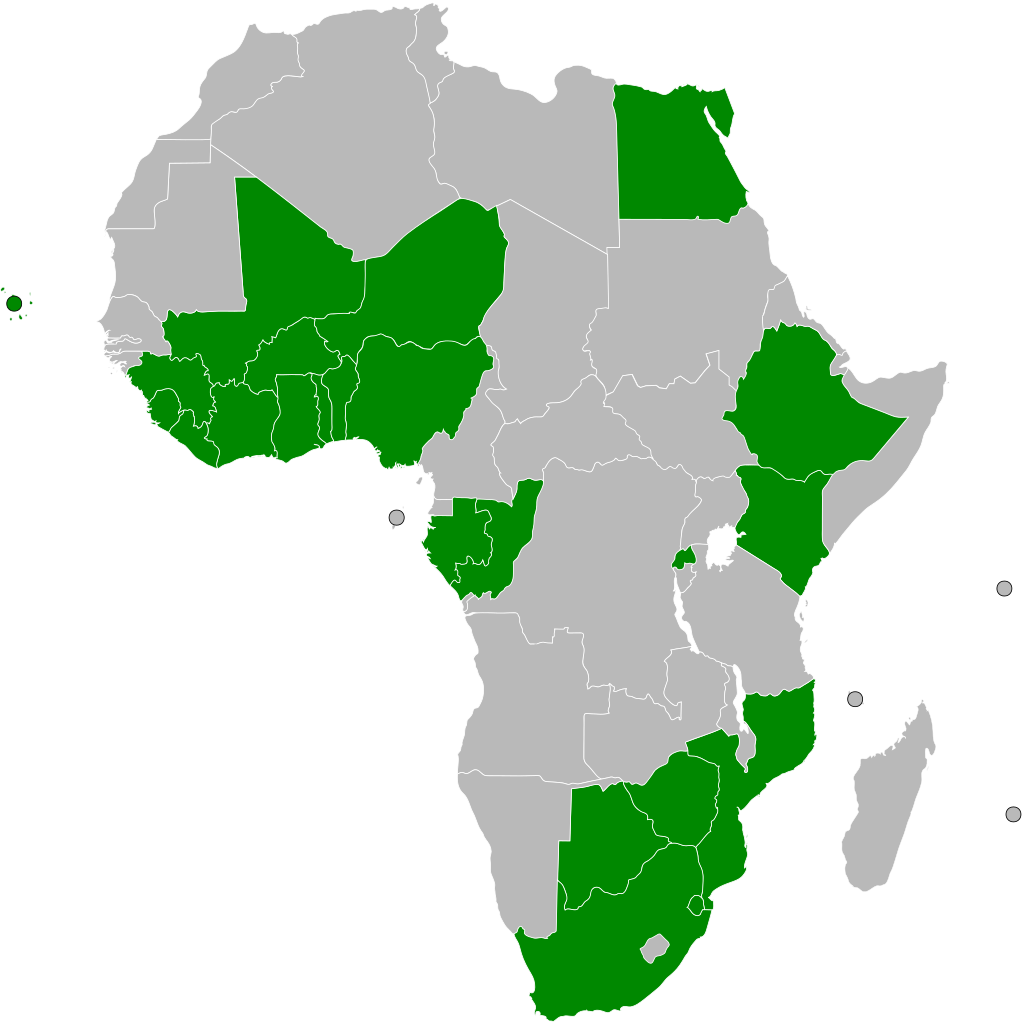

The SAATM project, launched in 2018 with 23 participant nations, is set to create a single unified air transport market among participants. SAATM thus reaffirms the desire to allow free exercise of the five freedoms of the air among member states. This would ultimately create a common aviation area, not unlike the one found in the EU.

Key to the SAATM project and the implementation Yamoussoukro are institutions at the AU and regional levels. Such institutions include the proposed Executing Agency, responsible for the supervision of the liberalized market and a Monitoring Body which will oversee the implementation process. Also in the pipeline are a dispute settlement mechanism and multi-jurisdictional consumer protection regulations.

It should be noted, however, that the number of participants is significantly less than the 55 AU member states or the 44 Yamoussoukro signatories, possibly indicating a widespread grievance with the scheme.

Prospects and implications

According to IATA's Vice President for Africa, Raphael Kuuchi,

"SAATM has the potential for remarkable transformation that will build prosperity while connecting the African continent".

According to an IATA chartered study of 12 African countries, an estimated 5m people cannot travel by air due to "unnecessary restrictions".

In addition to increasing passenger numbers, SAATM may have significant macroeconomic benefits. The same study estimates that liberalization could create an extra 155,100 jobs and contribute an additional US$1.3bn to annual GDP within the researched countries. This increased GDP contribution represents a 1.6% increase in aviation's current GDP impact on the continent.

Although the impacts of SAATM may be significant, some have expressed concerns over the project's implementation and the presence of factors which may distort SAATM's theoretical benefits. Core to these concerns are anti-competitive behaviors, such as preferential lending, protection of national champions, and unfair financial gains. The concerns, among others, have led to domestic trade groups such as the Airline Operators of Nigeria to lobby against national participation in the scheme.

SAATM thus has the theoretical possibility of liberalizing the African Air Transport Market. This, in turn, could spur economic growth by decreasing travel costs and increasing interconnection. Only time, proper implementation, and political will, however, will ensure that these potential benefits will come to fruition.

Do you think that one day we will see a single African sky? How do you think this will impact the regional market? Let us know in the comments.