Just as the industry was coming to terms with two of the biggest ultra-low-cost carriers in the US becoming one, the tables have turned again. The Frontier-Spirit tie-up would have created the largest ULCC in the country, with a fleet of almost 500 aircraft targeted by 2026. But a surprise unsolicited offer from JetBlue has shaken things up, and with Spirit opening the door to negotiations with the New York carrier, the future looks increasingly uncertain.The Spirit-Frontier merger appeared to be a joint effort. The carriers jointly announced the move, in a coordinated fashion, issuing charts and data about how the two would grow together. The merger, they said, would create 10,000 jobs over the next four years and would allow them to add service to new markets at lower cost. Although it still needed to pass muster with competition watchdogs and the DOJ, it seemed very much to be something both airlines were keen to do.The entrance of JetBlue is a whole different kettle of fish. By its own admission, the offer was unsolicited, and something of a surprise even to the airline’s own CEO. According to Reuters correspondent David Shepardson, Robin Hayes said that the announcement had leaked out ahead of schedule, and at a rather inconvenient time for him.

Ignoring the fact that the CEO of JetBlue was riding the rails rather than flying his own metal on that particular journey, the impromptu entrance of JetBlue into this particular bidding war leaves a lot to unpack. The offer of $3.6 billion, or $33 per share, represented a premium of around 30% over the price Frontier had agreed. Clearly, JetBlue sees a value in the carrier, but why?

On the surface, they aren’t exactly a match made in heaven. Spirit is a true ULCC, lightweight, efficient and no-frills; JetBlue is very much a hybrid airline, offering better services at affordable price points, but not truly low-cost. At first glance, Frontier looks to be the better option, but how does that pan out when we consider routes, fleet, and what’s best for the passengers?

Fleet dynamics

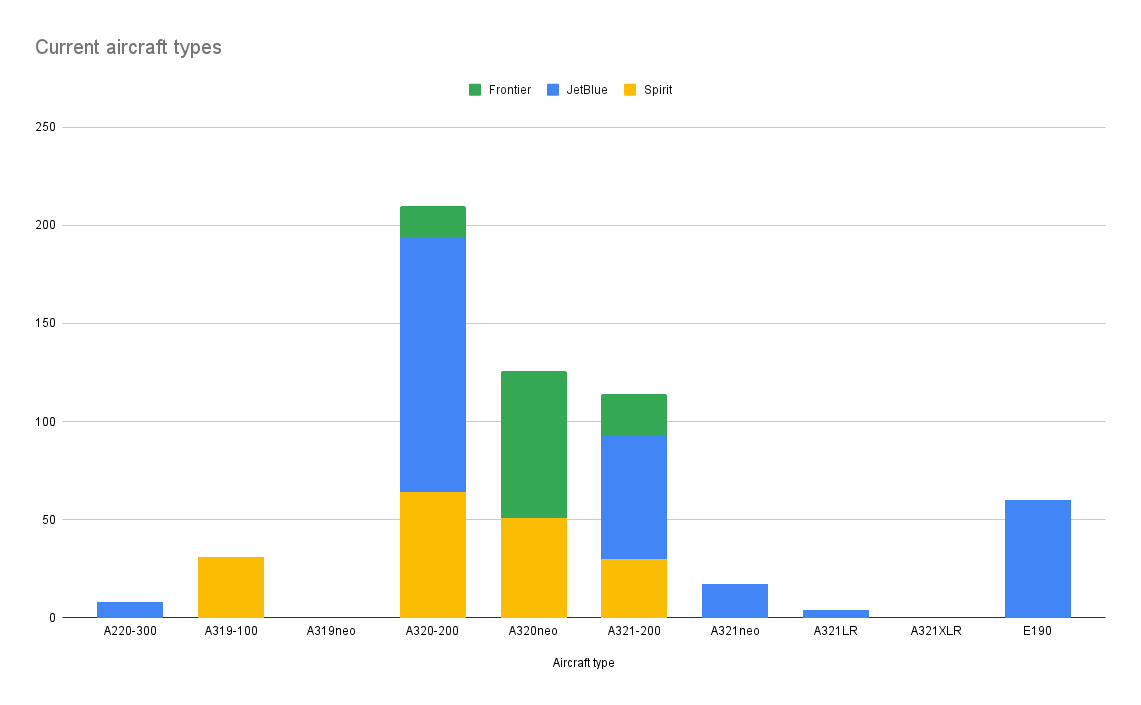

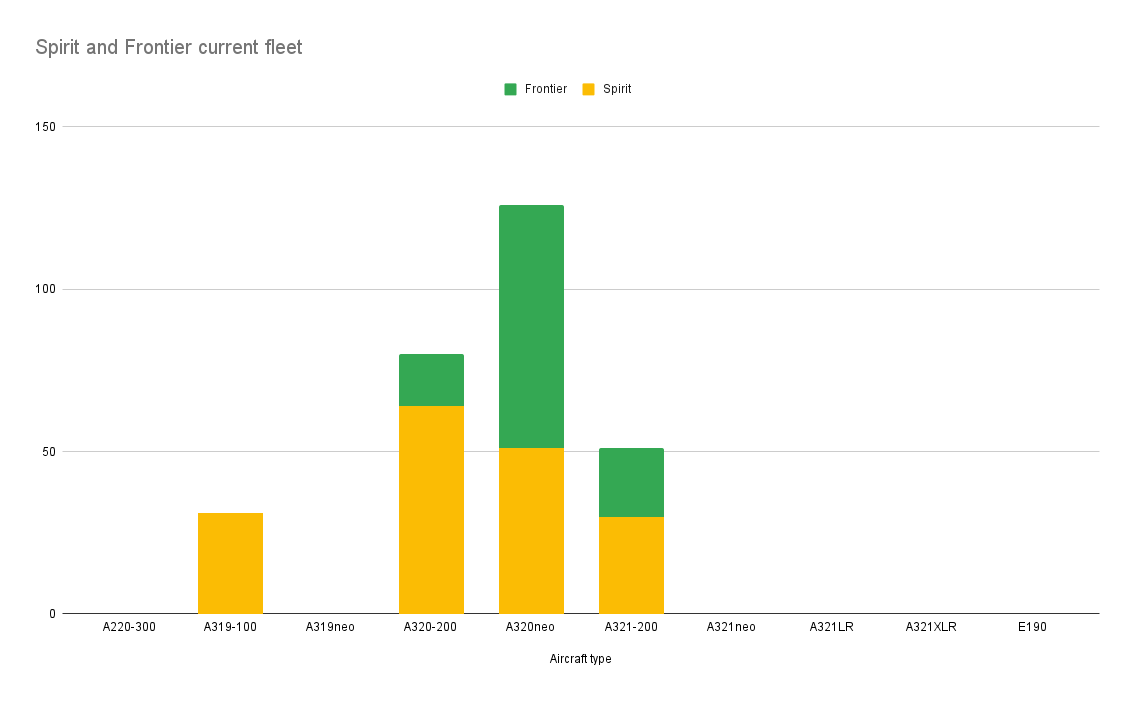

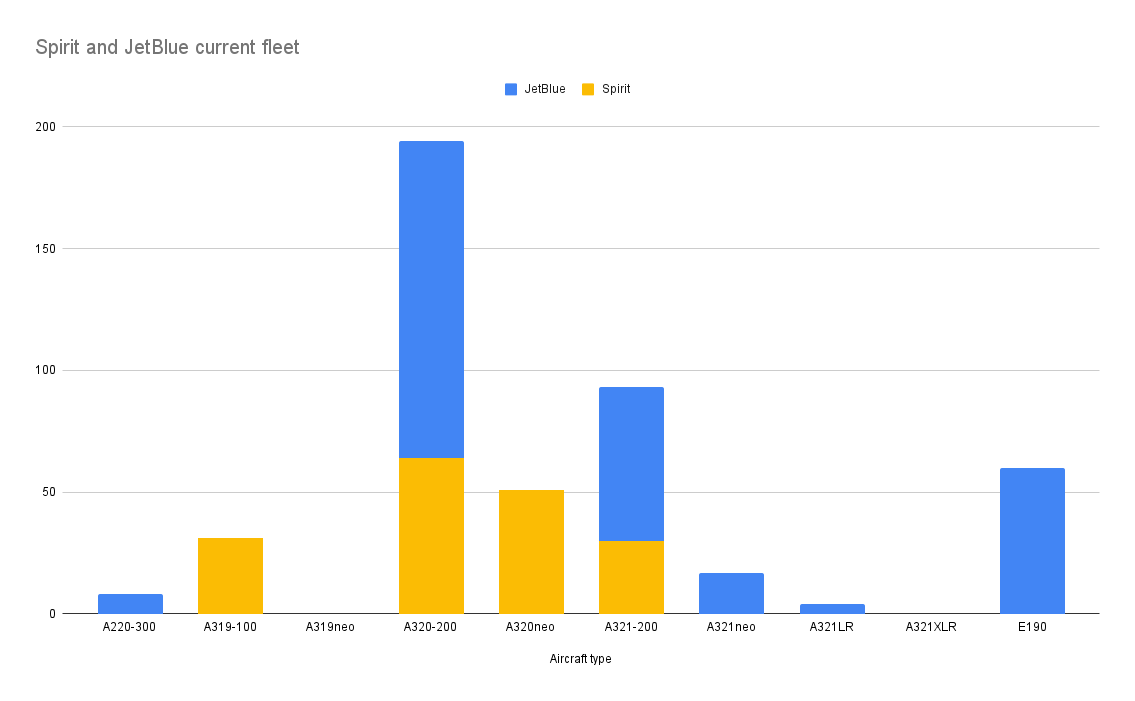

Whichever way Spirit jumps, its suitors have a fairly compatible fleet makeup. All three airlines are heavily Airbus at present, with large fleets of A320 family jets forming the backbone of their operations.

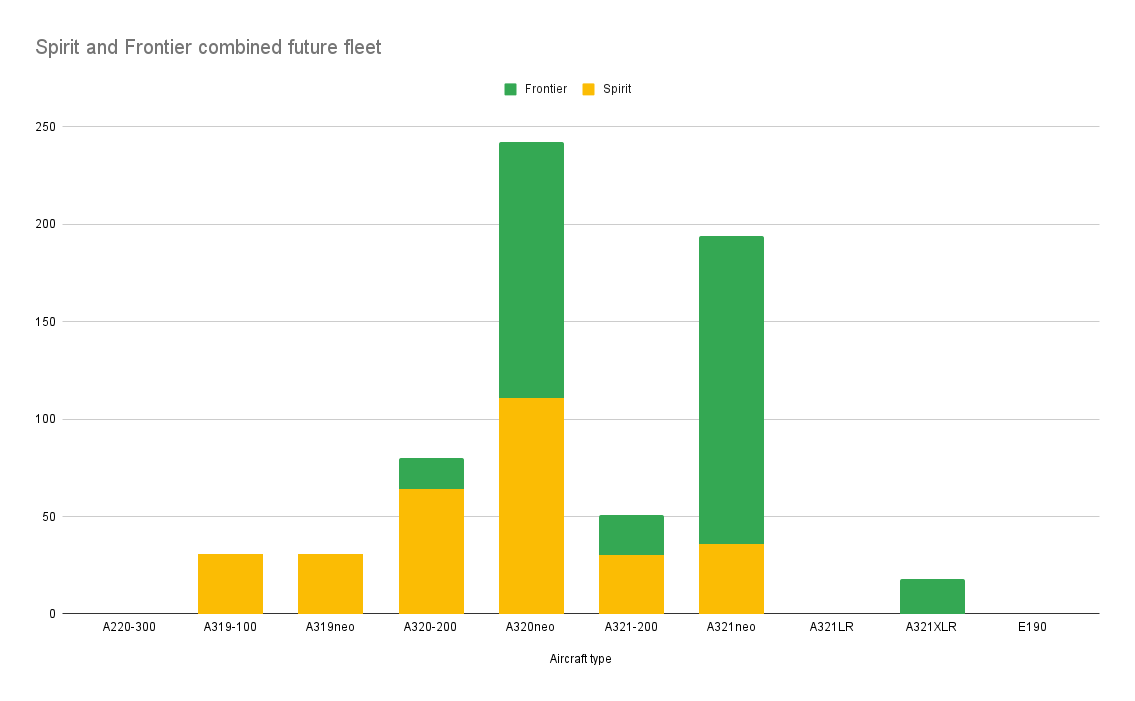

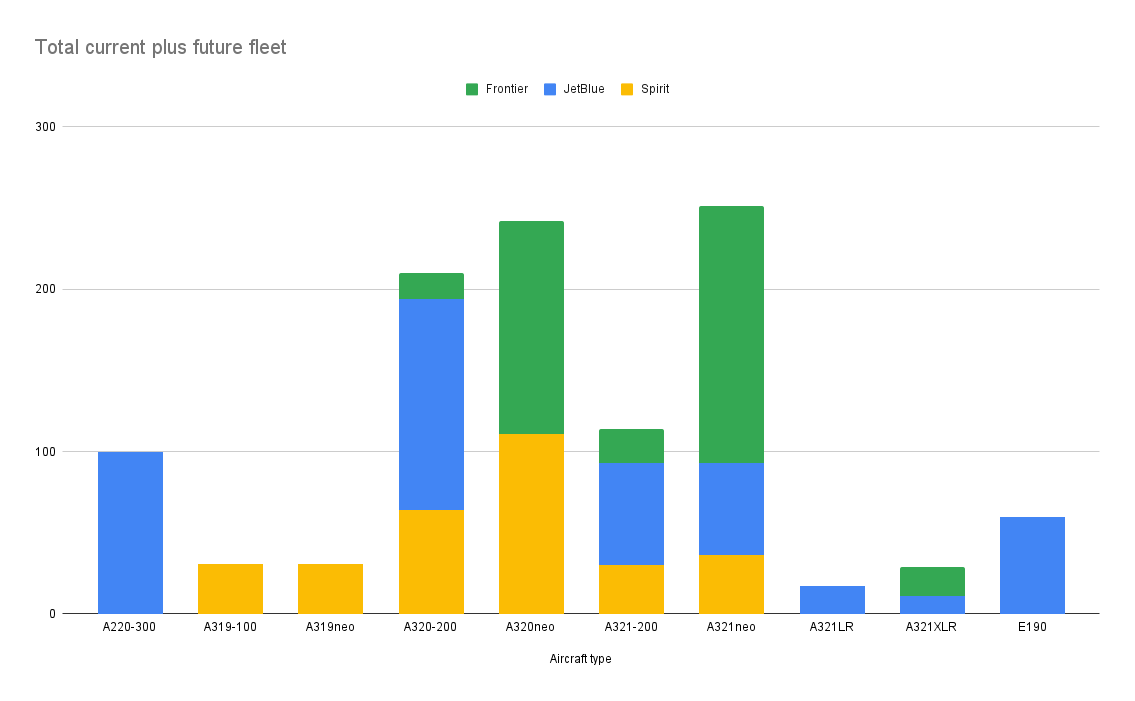

With Frontier, the dominant aircraft type would become the A320neo, the new technology Airbus with better fuel efficiency and fewer miles on the clock. Both Spirit and Frontier have very similar and very large fleets of this aircraft type. Close behind would be the A320ceo, mainly from Spirit, as Frontier has been phasing out these older aircraft as more neos arrive.

Frontier actually has the youngest fleet of the three airlines. Its average fleet age is 5.7 years, helped by that large fleet of very young A320neos. This compares to 6.6 years for JetBlue and 7.7 for Spirit.

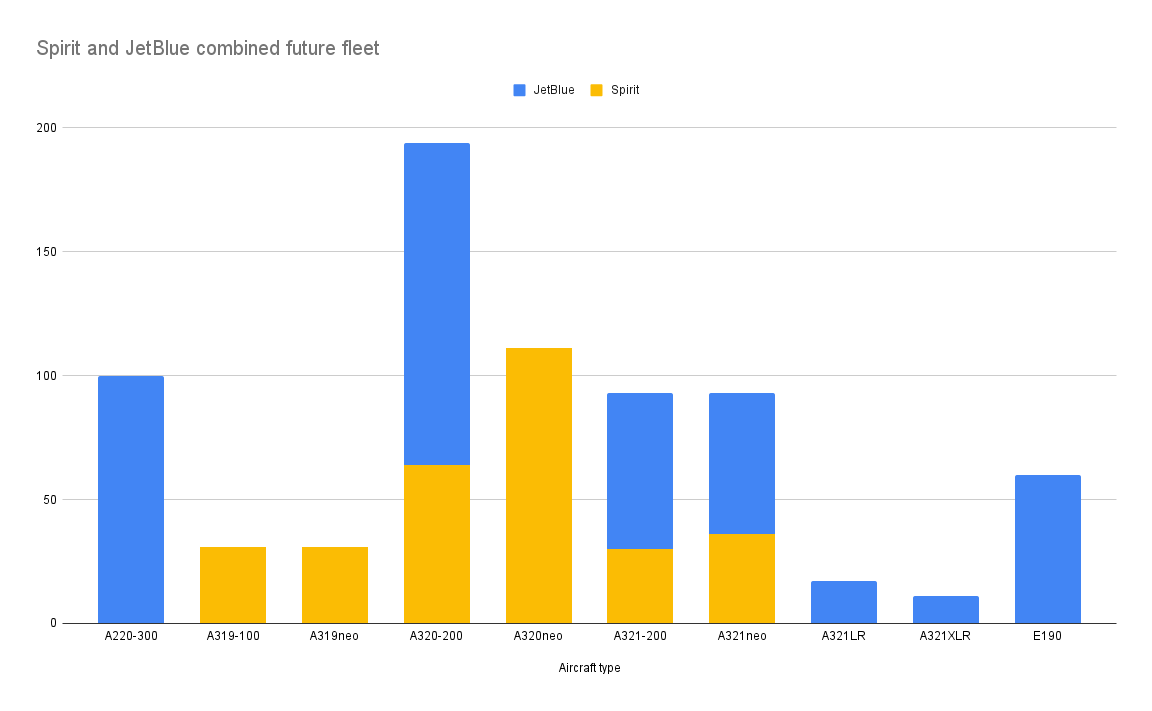

A combined Spirit-JetBlue airline would be heavily dominated by the A320ceo. JetBlue’s large fleet of these aircraft would combine with those of Spirit to give a total of almost 200 of the type. There are also complementary numbers of A321-200s, but fewer new technology aircraft than the Spirit-Frontier combined fleet.

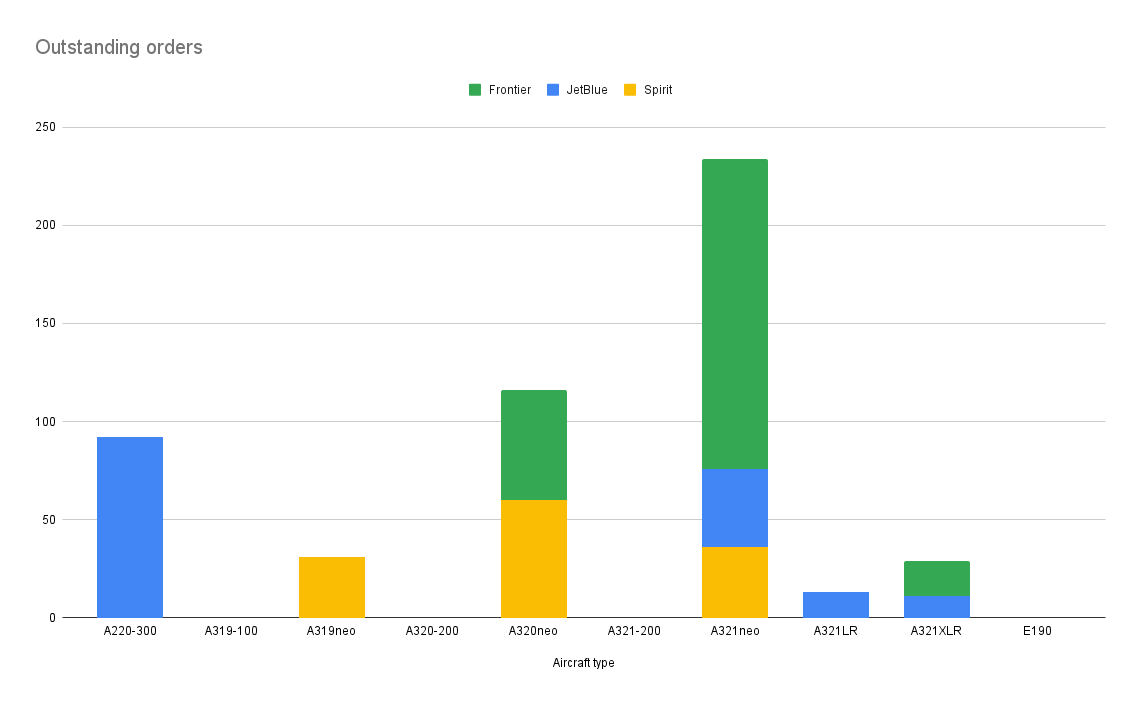

Where it gets really interesting is when we look at the outstanding orders for the three carriers. All three have some significant orders in for Airbus’ largest neo – the A321neo, but that really is where the similarity ends.

Spirit is committed to operating smaller aircraft in the future with a sizeable order for 60 A320neos confirmed. Frontier has a similar sized order on the books. However, only JetBlue is committed to the A321LR, while both JetBlue and Frontier will receive fairly small fleets of Airbus’ extra long range A321XLR in the future. Only Spirit has orders in for the A319neo.

When we combine the potential future fleets of these potential partners (ignoring, for now, any interim aircraft retirements) Frontier does appear to be a much better fit. The strength of the two carriers with their large neo orders is perfectly aligned with the ULCC strategy of both airlines.

JetBlue, on the other hand, is no longer a fan of the A320. It has orders in place for the A321LR and XLR, as well as for the A321neo, but is drawing away from the A320ceo as a type. Instead, it is favoring the A220-300 as its future regional to short-haul aircraft type.

That’s not to say that the fleet matrix of JetBlue-Spirit wouldn’t work. After all, these aircraft are all the same family, and come with all the same benefits of fleet commonality as befits any low-cost airline. And JetBlue was always going to operate the A220 alongside the A320 family jets, so absorbing Spirit's current and future fleet would not be an issue.

In terms of immediate fleet size, a JetBlue-Spirit merger would create a fleet of 458 planes. Spirit-Frontier would be somewhat smaller, at 288 planes. The ultimate fleet size (combined between current fleet and future orders) however would be very similar, with 741 for a JetBlue win against 647 against Frontier.

Passenger experience

There are swings and roundabouts in the onboard passenger experience too. Following the low-cost playbook, Spirit and Frontier have no complementary food and beverage, opting instead for buy-on-board to lower the cost of operating the flight. JetBlue, on the other hand, does provide snacks, drinks and meals.

Of course, inflight service can be adjusted with relatively little fettling, but aircraft cabins are more difficult to change. Both Spirit and Frontier are all-economy airlines, although they have some upgraded seats available for a fee. Frontier’s aircraft have between 24 and 36 ‘stretch’ (extra legroom) seats, while Spirit offers its iconic ‘Big Front’ seats on many of its aircraft.

JetBlue has a much more complex cabin and fare structure, with ‘even more space’ extra legroom on all planes, Mint on some of its A321s and Mint Studios on its transatlantic A321LRs. It also has IFE screens at every seat, something neither of the other two airlines offer.

Would a JetBlue win see IFE installed across Spirit’s fleet? What would happen to the Big Front seats? These are all questions both parties will inevitably be asking themselves and each other over the coming weeks.

Partnerships

Spirit Airlines has been proudly independent or most of its life. It has no codeshare partnerships and is not a member of any alliance. It runs its own loyalty scheme – Free Spirit – for which miles can only be earned and burned on Spirit’s own metal.

Frontier is owned by Indigo Partners, a private equity firm with its fingers in many low-cost pies. Led by Bill Franke, the firm has a controlling interest in Frontier, Chile’s JetSmart, stakes in Volaris and Wizz Air and is in a partnership with Energjet heading up the newly launched Canadian Lynx Air. But Frontier’s codesharing relationship is limited to only Volaris at present, and it is not a member of any alliance.

JetBlue is similarly not in an alliance, but it does codeshare with a bunch of other carriers. These run from SAA to Qatar, Royal Air Maroc to Emirates, Icelandair to Hawaiian and, of course, it is in a close partnership with American Airlines known as the Northeast Alliance.

Contemplating how Spirit would mesh with these other partnerships and models, it clearly fits neatly with the Indigo Partners/Frontier strategy. With JetBlue, not so much. Can you imagine a business class passenger coming off a transatlantic 777 service into JFK and being shoved onto a Spirit flight down to Florida? It doesn’t make much sense.

JetBlue has been in hot water recently with its Northeast Alliance (NEA). The US Department of Justice (DOJ) has sued the airlines in a bid to force the unwinding of the partnership, citing concerns with excessive network domination in the NEA area. Adding Spirit to the mix would surely give the DOJ even more cause for concern… wouldn’t it?

CEO Robin Hayes doesn’t think so. As reported in FlightGlobal this week, he believes that the addition of Spirit would actually improve the situation, stating that the percent of JetBlue’s network within the NEA would diminish thanks to the Spirit-fueled expansion. Given Spirit’s dominance in the Florida region, that could be one way to look at it.

Nevertheless, the timing of this takeover bid seems ill-advised, given that JetBlue is already under scrutiny for potentially non-competitive behavior.

Routes

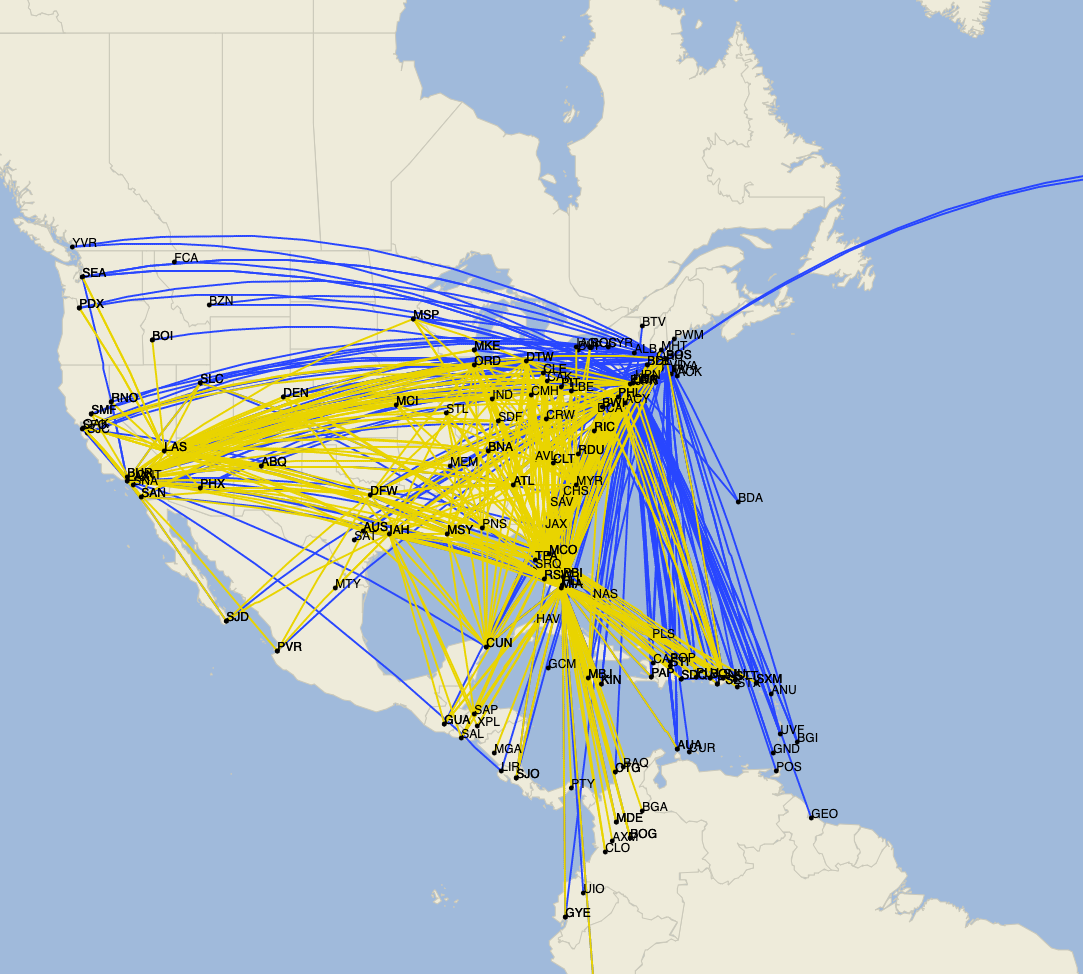

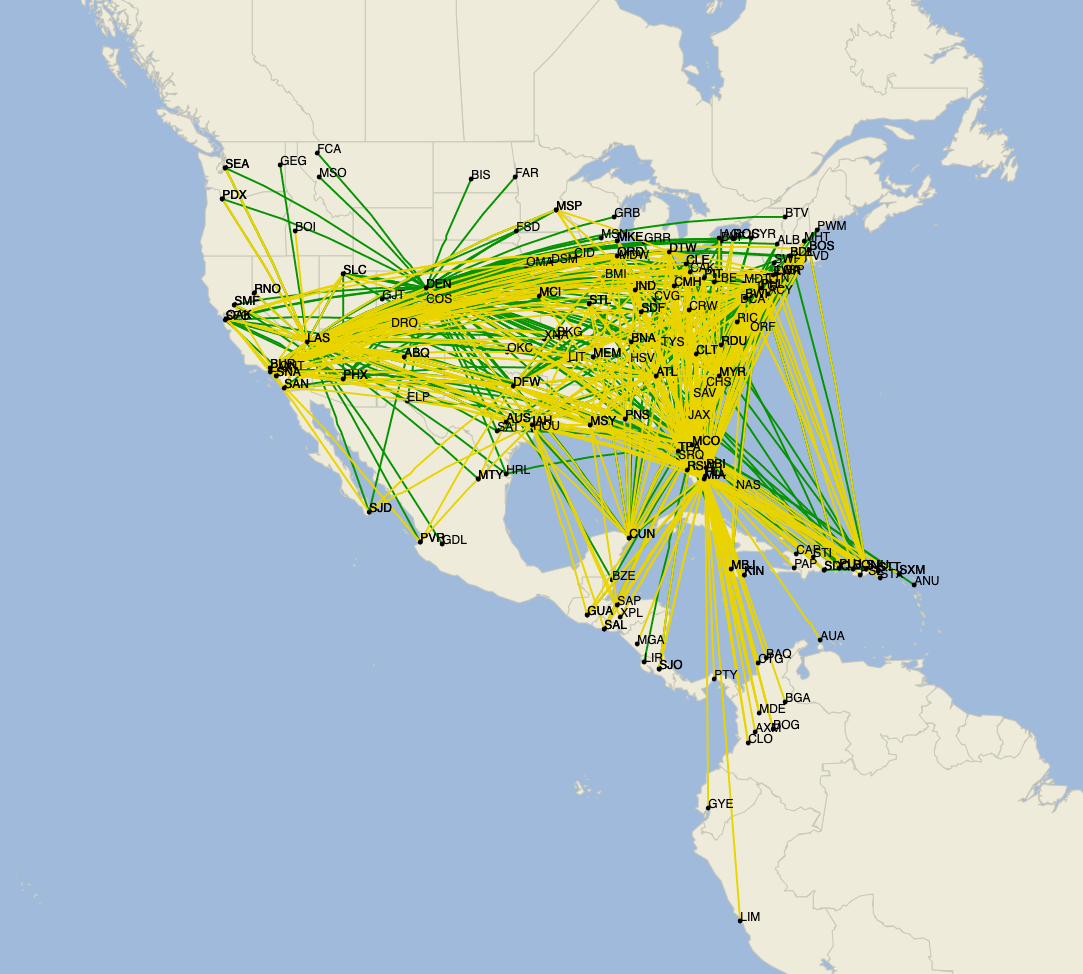

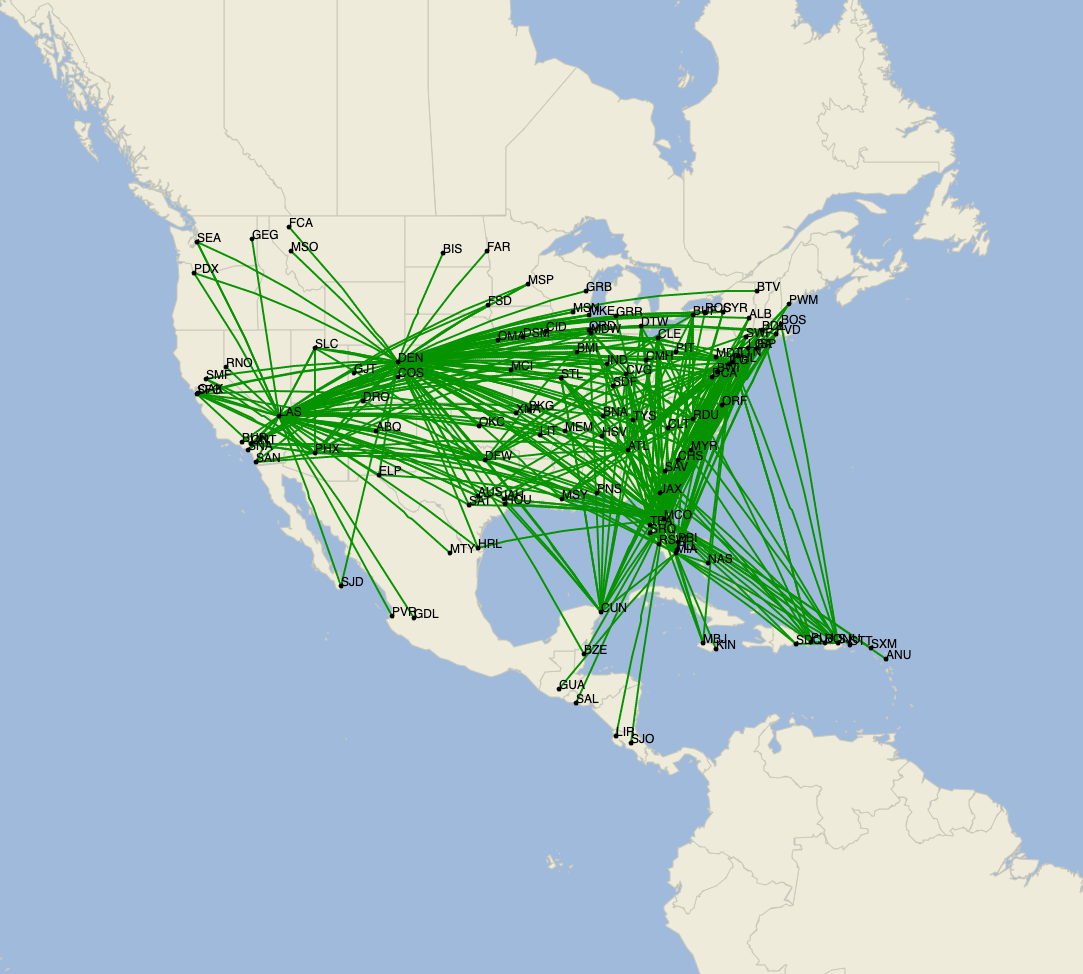

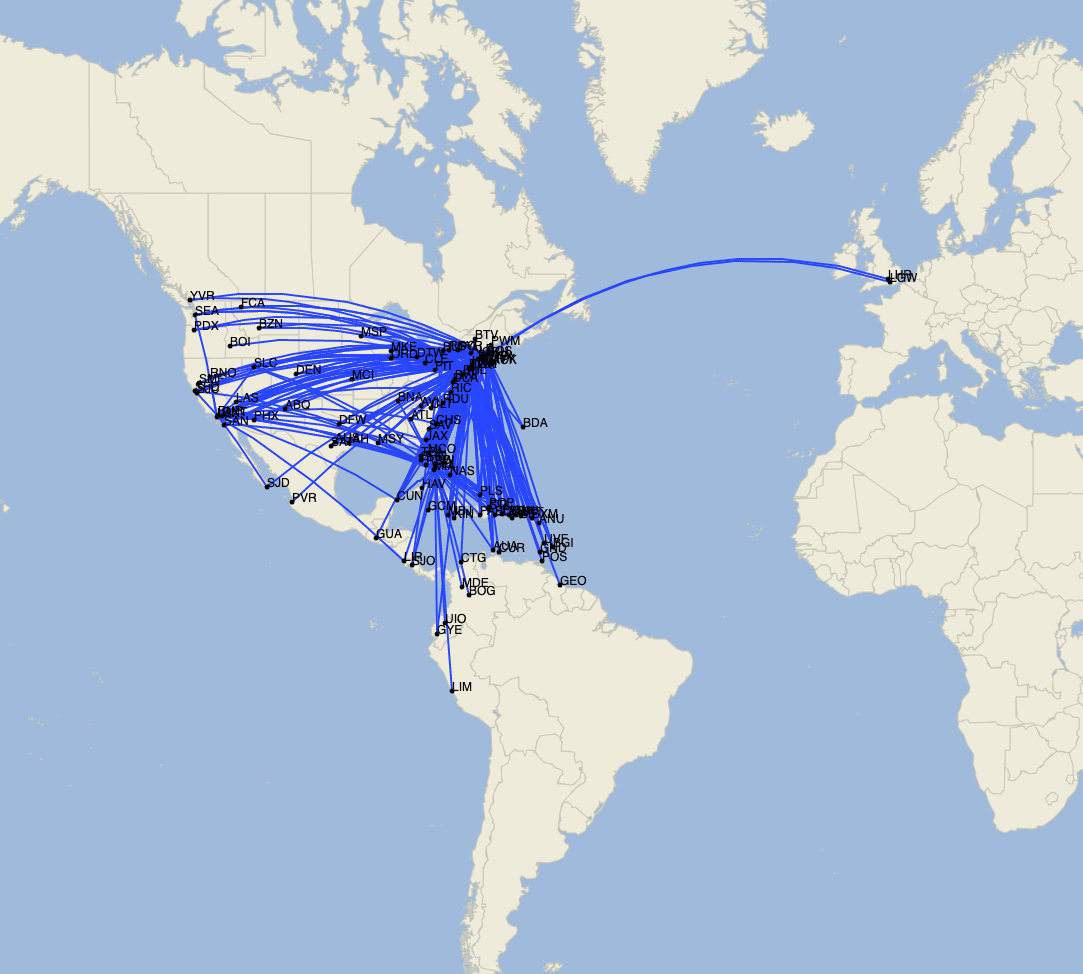

Frontier’s network centers heavily around Denver, although it also has an increasingly strong presence up and down the east coast. It largely flies to secondary airports, and only ventures as far south as Costa Rica.

Spirit’s network is very similar, there is a lot of overlap between the two carriers. It too focuses on smaller, secondary airports, but has a reach that extends much further to the south, touching points in Peru and Colombia. It also has a dominant footprint in the Florida region, and strong connectivity to the Caribbean.

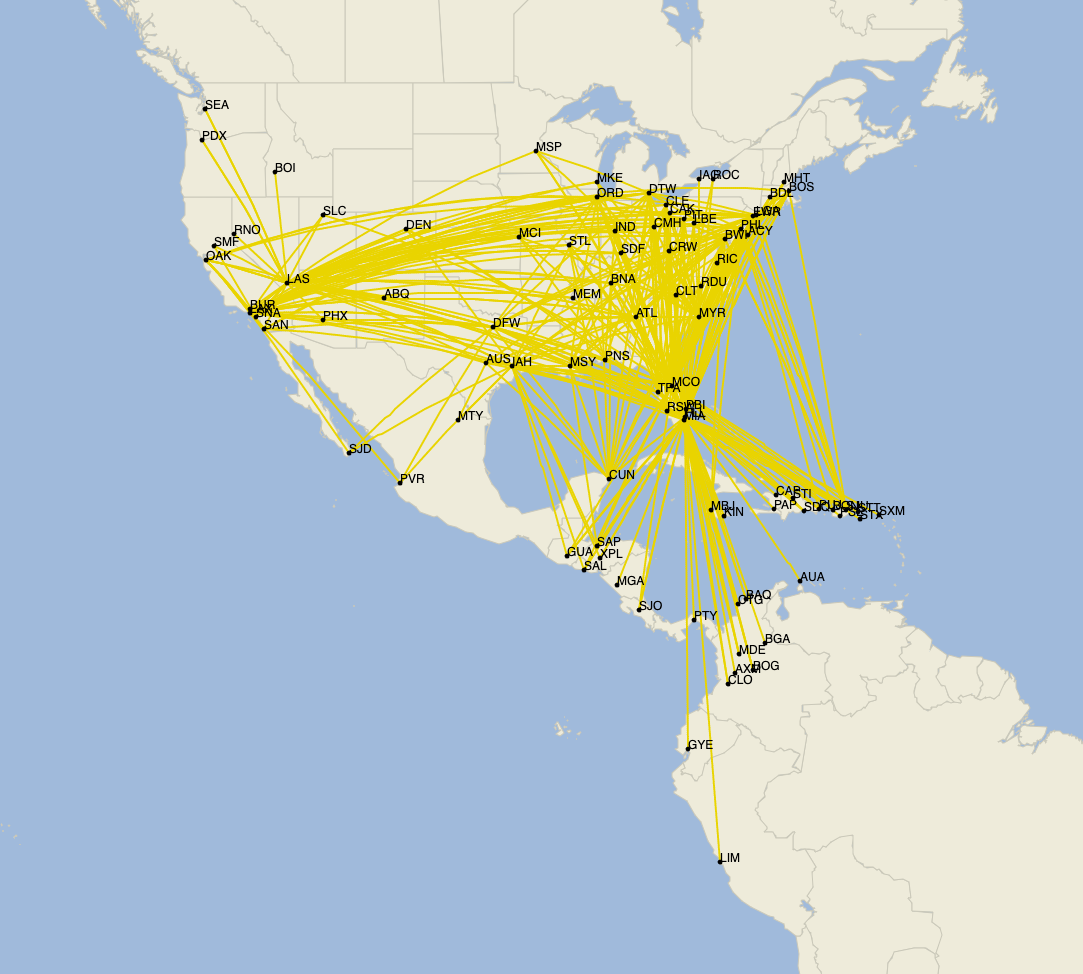

JetBlue, again, is a somewhat different kettle of fish, It does take in some secondary airports, but holds a lot of slot-controlled, primary positions too. Its network out of New York and Boston is a much more hub and spoke affair than its point-to-point competitors.

While Spirit offers new connectivity in Florida and the south of Mexico, it’s hard to see how these two networks would mesh together comfortably.

What does JetBlue want with Spirit?

This isn’t the first time JetBlue has attempted to soak up a competitor airline. The carrier previously bid for Virgin America, but was beaten in the end by Alaska Airlines. It hasn’t stopped it from contemplating the best route to growth, however.

Hayes called the Spirit bid a ‘window of opportunity’, but opportunity for what? Well, pretty much everything. Aside of the potential for new destinations to be added to the route map, a successful acquisition of Spirit would solve a lot of the problems currently facing the US airline industry.

The shortage of pilots and other professionals is a perennial problem that has been bubbling away for several years. A JetBlue-Spirit merger wouldn’t solve this issue entirely, but it would give the airline some breathing room and a large amount of bargaining power to attract more talent.

Most notably, Spirit has those all-important slots In production queues to grow its fleet significantly in the coming years. JetBlue has some of its own, but with so much of its fleet growth hinging on the (very slowly produced) Airbus A220, Spirit comes with an attractive level of incoming jets to fuel rapid expansion.

Speaking to media this week, Hayes said that the JetBlue name would be retained, suggesting it is keen to fully dismantle Spirit and cherry-pick just the parts that are seen as desirable. The combined entity would immediately leapfrog Alaska Airlines to become the fifth largest in the US, putting it in a powerful position to compete against the ‘big four’.

It’s easy to see why JetBlue took the opportunity to have a crack at Spirit. Nevertheless, the way in which it was done smacks of a knee-jerk reaction, ill-prepared and poorly timed, with reports of difficulties in even getting JetBlue shareholders onboard with the idea – let alone Spirit’s.

What’s going to be best for passengers?

Consolidation rarely results in anything good for the flying public. Nevertheless, the Frontier tie-up looked promising. Two ULCCs extending their networks and remaining true to their low-cost roots wouldn’t have been a bad thing for passengers. At the end of the day, there are still other ULCCs and LCCs in the US offering price competition, so the combined entity would have needed to keep a lid on its costs.

The JetBlue offer is more of a concern. JetBlue has never competed purely on cost, preferring instead to attract passengers to a middle-of-the-road option that straddles low-cost and full service. Passengers can be convinced to trade up from the likes of Spirit with the promise of free meals, IFE, free WiFi and other perks. Others can be attracted down from the full service carriers with a lower price point.

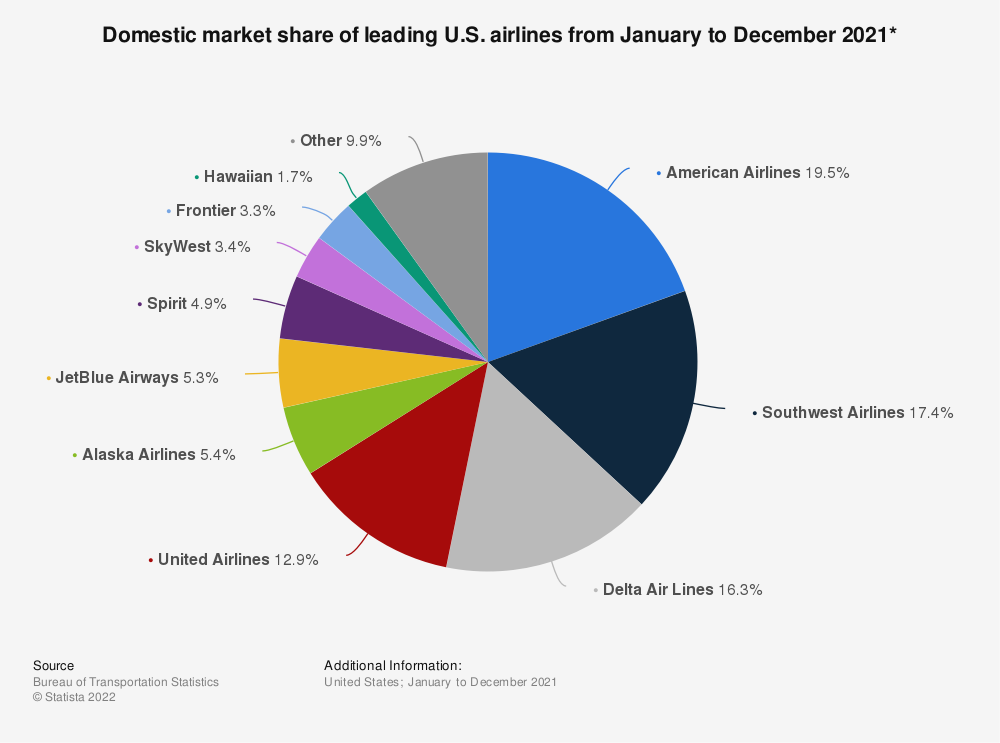

Taking Spirit off the ULCC table is worrying. According to Statista, Spirit held a 4.9% share of total US traffic in 2021, making it the largest ULCC in the country. Bringing it into the hybrid stable of JetBlue would leave Frontier as the largest ULCC, with just 3.3% of the market. That’s a huge loss of capacity for price-sensitive passengers, and severely reduces the options for those who want to fly on a shoestring.

Compare this to European short-haul flying, which is dominated by Ryanair at 23.6% of the market share, and you can see Americans are not getting a great deal already. Taking Spirit off the table will only hurt the ULCC market and, ultimately, mean US passengers will continue to pay more to get from A to B.

But JetBlue’s offer is strong, and might be too attractive for Spirit’s shareholders to turn down. It remains to be seen if Frontier will up its bid, or if JetBlue will be forced to pull out by the competition watchdogs. One thing’s for sure, the next six months will be interesting to watch!

Sources mentioned: FlightGlobal

.png)

.jpg)

.jpg)

.jpg)