State aid for airlines is a vexed issue. Aid, in any form, runs counter to most mainstream economic theories. But state aid is a fact of life and even more so in 2020. As this year unravels, many airlines are relying on state aid to keep flying. Recent work by aviation analytical group OAG threw up some fascinating numbers regarding state aid for airlines.

Singapore Airlines standout beneficiary from state aid

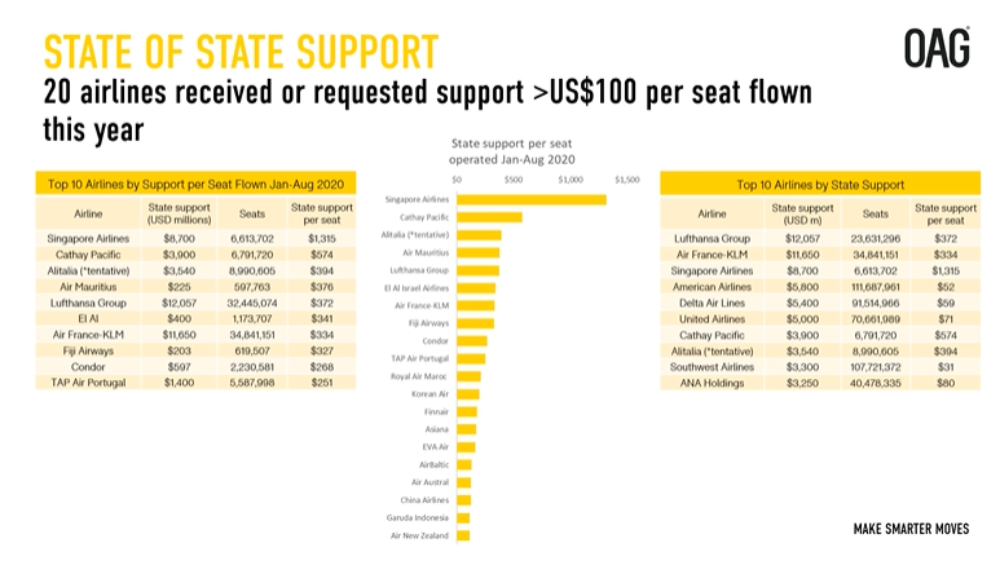

In an OAG webinar last week, Strapped For Cash: How Airlines Can Survive Winter, airline analyst John Grant discussed the amount of state aid some airlines got this year.

Leading the pack was Singapore Airlines. That state-owned airline received a massive US$13 billion bailout earlier this year. Singapore Airlines was more disadvantaged by the travel downturn than most airlines. It solely flies international routes and has no domestic network to fall back on. But it also has the advantage of being backed by a rich country.

"In some parts of the world, governments do not have the cash to support their airlines. If you look in Latin America, in times of a pandemic, there are much bigger issues than purely refinancing or protecting your airlines," said Mr Grant.

From January to August, Singapore Airlines had 6,613,702 seats available. It received US$1,315 in state aid per seat flown. Notwithstanding this largesse, John Grant says the Singapore Airlines example should not be seen purely as a bailout.

"It’s a more complex refinancing structure in Singapore than a loan. It’s an investment, and other considerations need to get taken into account."

Revenue per passenger-kilometer was down 99.5% for Singapore Airlines across the three months to June 30. The total cash revenue for that period was down 79.3% in the same period. Despite this, Singapore Airlines has the liquidity and the support to get through this travel downturn. Not all airlines do. And even airlines from affluent countries don't always have governments willing to help out.

"There is very little state aid or support for Virgin Atlantic who’ve just managed to refinance and the IAG Group," Mr Grant noted.

State aid provided to airlines that may not survive

In the list of top ten airlines by support per seat flown, there are several airlines whose medium to long term future is up in the air. Examples include Air Mauritius, and TAP Air Portugal.

Air Mauritius had 597,763 seats available between January and August and received state aid of US$375 per seat flown. TAP Air Portugal had 5,587,908 seats available between January and August and received state aid of US$254 per seat.

Some aviation experts have questioned whether providing aid or guarantees to airlines is a case of throwing good money after bad. But John Grant says;

"You can see the size and the scale and the strategic value that governments are placing on their airlines, whether they are public sector or private sector."

US airlines trailing the pack when it comes to state aid

In the ongoing discussion of state aid for airlines, US airlines have hogged the limelight, benefiting from funding via the CARES Act. But overall, the amount of state aid the big US airlines have received per seat is a fraction of what airlines like Singapore Airlines, Cathay Pacific, KLM-Air France, and the Lufthansa Group have received.

Whereas Cathay Pacific received US$574 in state support per seat flown between January and August, Delta Air Lines received US$59, United Airlines received US$71, and American Airlines received US$52.

In part, this can be explained by the large number of seats the US airlines have continued to operate. US airlines have been able to maintain domestic networks. Fallback domestic networks are not available for airlines like Cathay Pacific and Singapore Airlines.

In any case, Mr Grant sees the need for state aid to continue flowing if airlines are to keep flying. He notes that the existing levels of state aid were designed to carry the airlines through to the end of the 2020 northern summer period. That's ending soon. The OAG analyst says a lot more cash is going to be required in the coming months to see airlines flying through to summer 2021.