The United States has suffered at the hands of the COVID pandemic worse than any other nation. A new report by Airlines For American (A4A) has thrown some light on just how significant the impact has been in terms of airline services and passenger numbers. The report looks at the figures on a state by state basis.

The state of the US

The United States has been one of the hardest-hit nations in terms of the coronavirus pandemic. At the latest count, the United States had registered more than 5.2 million cases, with almost 170,000 fatalities. Of course, some states have been hit worse than others, and at different times.

This variation has led to a tricky time for US airlines, with different states imposing different restrictions on incoming visitors. Some require extensive quarantine while others don’t ask anything at all, with situations often changing at short notice. This has led to a very uncertain period for air travelers, something which we’ve seen reflected in the peaks and troughs of the TSA checkpoint numbers.

Now, a new study has provided some insight into just how much different states are being affected by changes in both air travel services and demand for air travel. The report, published by Airlines for America (A4A) – the industry trade group representing major U.S. carriers, lets us see which states have seen the most impact.

New York hardest hit

To produce the report, A4A consulted the published schedules of its member airlines, and also considered the TSA checkpoint numbers. Airlines for America (A4A) members are Alaska Airlines, American Airlines, Atlas Air, Delta Air Lines, FedEx, Hawaiian Airlines, JetBlue Airways, Southwest Airlines, United Airlines and UPS. Air Canada is an associate member.

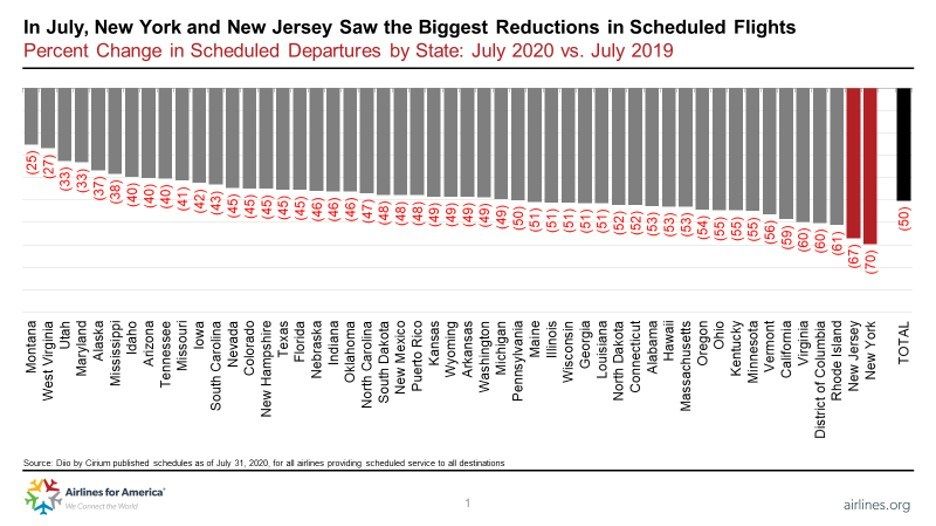

According to the report, the state worst hit in terms of losing passenger flights was New York. In July 2020, compared to July the previous year, New York state had 70% fewer flights operating.

Other significantly affected states included New Jersey with 67%, Rhode Island with 61%, the District of Columbia with 60% and Virginia also with 60%. Overall, 22 states experienced a drop in passenger flights of 50% or more.

At the other end of the spectrum, Montana managed to maintain the vast majority of its connections. Just 25% was lost in June compared to the previous year. West Virginia also survived well, with a 27% drop. These two were the outliers, however. Just four more states experienced a decline of less than 40% - Utah, Maryland, Alaska and Mississippi.

Although the CARES Act states that airlines need to maintain their route networks as they were before COVID, they are allowed to reduce their frequencies. Some airlines have even been granted exemptions from this rule, allowing them to drop routes with little or no demand. This is reflected in the loss of airline services, which averages 50% across all US states.

Reflected in the TSA numbers

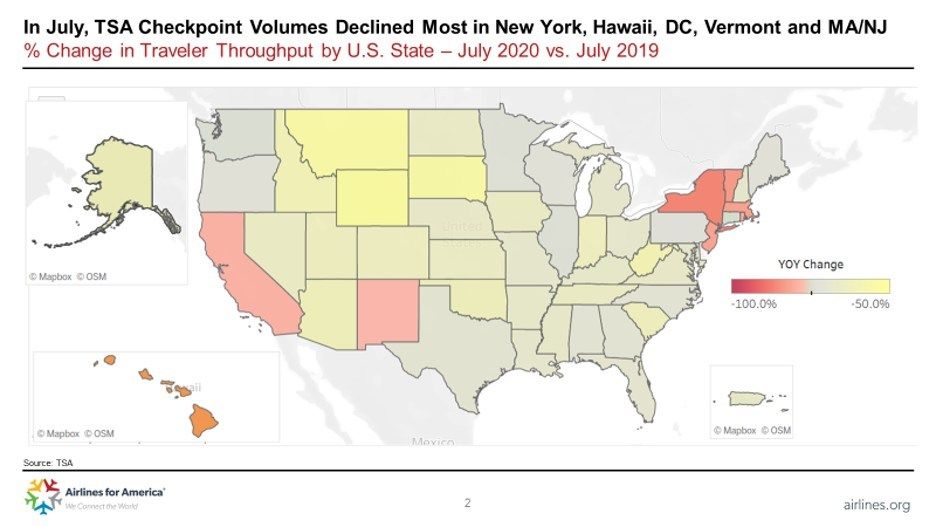

Although we have noted TSA numbers have begun to creep up, new outbreaks have subsequently caused them to stall. As part of their analysis, A4A has noted the states with the biggest drops in TSA checkpoint footfall as being:

- New York (-86%)

- Hawaii (-85%)

- Washington, D.C. (-83%)

- Vermont (-83%)

- Massachusetts (-82%)

- New Jersey (-81%)

- Rhode Island (-79%)

- California (-79%)

- New Mexico (-78%)

- Connecticut (-75%)

A4A notes that the industry is facing a long and slow recovery. In comparison, the industry took three years to recover from 9/11 fully, and over seven years to come back from the Global Financial Crisis of 2008. The current crisis has been far more impactful and is set to be much longer-lasting, so it follows that the recovery could be much longer than first anticipated.