553 million; that's how many seats are offered when American, Delta, and United's top-six airports are combined. We examine each hub and see how they vary this year. Which are fortress hubs? Which has the most and fewest seats per flight? And which are now the country's top-five hubs?

With these three carriers' top-six airports having 553 million seats this year, we can say that they have over half (55%) of the USA's total capacity across all airports and all airlines. That’s a finding based on examining schedules using OAG data.

We can also say that these 18 airports are accountable for nearly two in every ten seats available for sale across the world. They are, as you'd expect, all-important.

|

American |

Delta |

United |

|---|

The USA's top-five hubs this year

If the USA's largest five hubs are considered, American and United each have two against one for Delta. Of course, Atlanta overshadows the others, as it likely always will. However, the gap between it and Dallas has shrunk significantly from one-third in 2019 to just 13% now. Obviously, this is from the pandemic, with Delta's Atlanta hub at 82% of 2019 capacity against 96% for American's Texas counterpart.

- Atlanta, Delta

- Dallas, American

- Charlotte, American

- Houston, United

- Denver, United

United's Chicago hub is out of the top-five

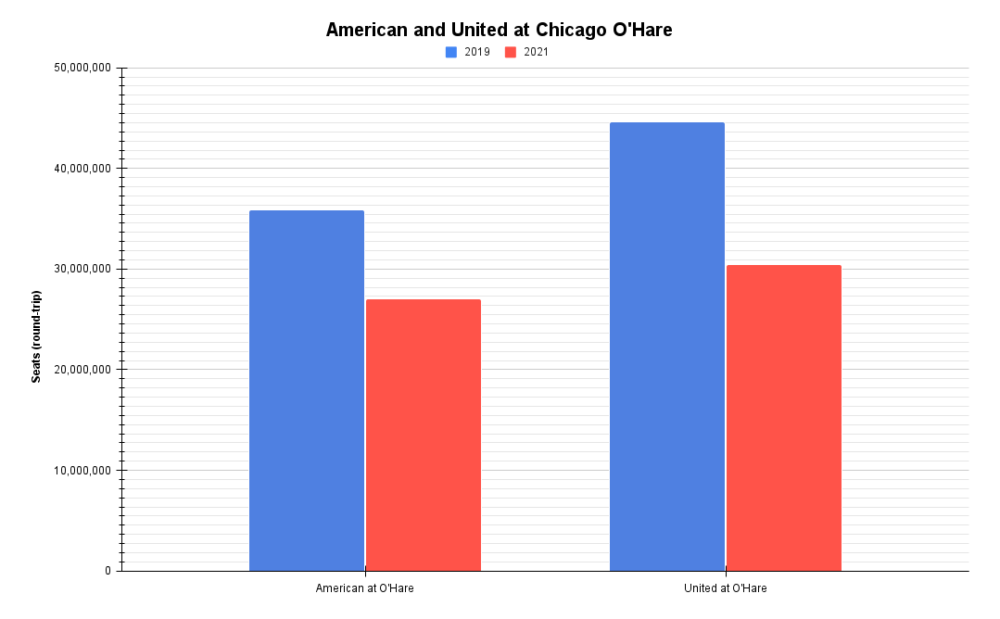

In 2019, Chicago O'Hare was United's number-one hub in terms of seats and flights. Now it is third behind Houston and Denver. This is just temporary, of course, but it is enlightening. And it means that United's Illinois hub has fallen out of the USA's top-five, with Denver joining the list.

Two years ago, Denver was eighth, with its rise up the table another consequence of the pandemic. Indeed, the Colorado hub has performed well so far in 2021, with United's seats across the whole year at 92% of the 2019 level, benefitting from the recovery in leisure demand. United's Denver hub has 164 routes on an example day this August.

Denver replaces O'Hare

Unlike Denver, United at O'Hare remains stubbornly one-third below where it was. Chicago has a greater focus on business demand, which will be the last source of demand to return after leisure travel and visiting friends and relatives (VFR). This business focus is reflected in O'Hare's very low seats per flight; see later in the article.

Stay aware: Sign up for my weekly new routes newsletter.

United's recovery at O'Hare remains below that of American, partly explained by United's bigger presence and therefore its greater exposure to business travelers. It is also from the airline's larger international network from the airport, with big impacts owing to border closures.

Which are 'fortress hubs'?

The US has long been considered a country where airlines develop fortress hubs to control their markets. While definitions vary, it is often believed that if 70%+ of an airport is controlled by one airline and its regional partners, it is a fortress hub, just like Delta's Memphis hub was.

This high domination makes competition difficult, for example from a lack of spare gates or slots. At the same time, it ordinarily keeps fares to/from the hub higher than they might otherwise be, somewhat offset by a much greater network.

Looking at the top-six airports of United, Delta, and American, the average domination is 59%. However, eight are over 70% and are therefore fortress hubs by this measure. Charlotte leads, with American having 92% of seats at the airport, its second-largest hub.

- 92%: Charlotte, American

- 86%: Dallas, American

- 79%: Atlanta, Delta

- 75%: Detroit, Delta

- 73%: Minneapolis, Delta

- 73%: Salt Lake City, Delta

- 72%: Houston, United

- 70%: Washington Dulles, United

Some hubs have seen shares fall

Ten of these 18 airports have seen main airline domination rise versus 2019, mainly reflecting cuts by other airlines. For example, Delta's capacity share at Minneapolis has grown from 70% to 73%, while United at Dulles has risen from 65% to 70%, meaning it joins the list.

But carriers at other hubs have seen their shares fall. Chief among these is United at Houston, which has fallen from 76% to 72%. The airport has seen a big (temporary) drop in United's presence (down by 18%) while, at the same time, multiple airlines have grown or at least remain only slightly down. Southwest entered in April 2021 and has 1.5 million seats across nine routes.

Seats per flight

One long-standing feature of hubs is the use of smaller aircraft to feed longer routes. Of course, this isn't applied worldwide, as exemplified by Emirates and its widebody-only fleet strategy, although it is increasingly using the narrowbodies of partner flydubai.

Regional jets (RJs) have been fundamental in the US, with 50-seaters an important historic gap-filler. And RJs remain essential, just nowadays those with larger capacities and therefore better economics. RJs enable more spokes to be served and to be served more frequently, driving connectivity. There's a strong relationship between frequency and market share.

Delta has the highest seats per flight

This raises the question: how does the number of seats per flight vary at each of these 18 airports? Delta's top-six airports have the highest number (133), followed by American (122) United (115).

United's much lower figure is strongly influenced by Dulles and O'Hare, each with just 100 seats per flight from very high RJ use. Nearly two-thirds of its flights at its Virginia hub are by RJs, OAG shows. United has increasingly used Dulles as a connecting hub versus Newark’s growing point-to-point focus.

American at Miami: 160 seats per flight

American's Miami hub tops the table with 160 seats per flight, far higher than its next hub, Phoenix. Miami features highly because fewer than one in ten flights is by RJs; extremely little in a US context. In fact, widebodies have more flights this year than RJs (11%), despite ongoing problems with long-haul service.

- 160 seats per flight: American at Miami

- 150: Delta, JFK

- 149: Delta, Atlanta

- 147: Delta, Los Angeles

- 141: United, San Francisco

- 138: United, Newark

- 128: American, Phoenix

- 125: American, Dallas

- 121: Delta, Salt Lake City

- 118: Delta, Minneapolis

- 113: Delta, Detroit

- 112: American, Charlotte

- 108: United, Houston

- 106: American, O'Hare

- 106: United, Denver

- 102: American, Philadelphia

- 100: United, O'Hare

- 100: United, Dulles

What surprises you the most about the findings in this article? Let us know in the comments.