The pandemic has altered the course of the world's aviation industry for the past two years, but now it is ready to return to clearer skies. Unfortunately, more turbulence has been encountered as a consequence of the Ukraine-Russia conflict, and commercial flying is being impacted once again. Data released today by EUROCONTROL has highlighted the effects this is having.

Disrupted traffic flows

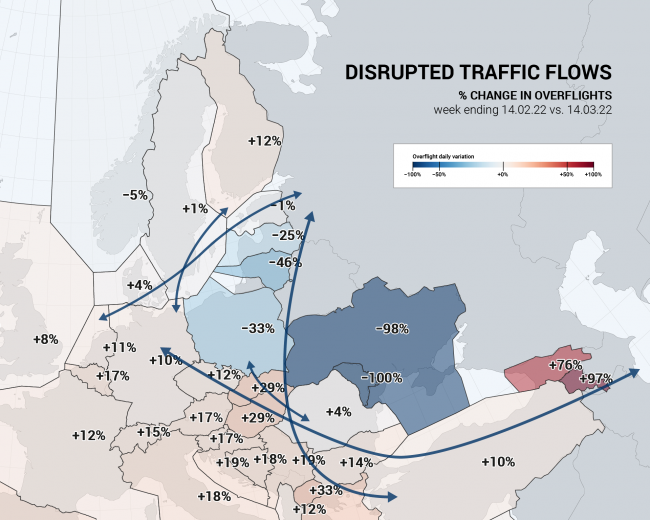

Several neighboring countries lost overflight rights from mid-February to mid-March due to closed airspaces. One such example would be Lithuania, which has lost close to 200 overflights per day, accounting for nearly 50% of the country's pre-conflict overflight quota.

More than half of these flights were because flows to and from Russia - mainly from France, Germany, and the United Kingdom - have stopped. Furthermore, shorter-haul flights such as Finland and Estonia to Germany are keeping further West which causes approximately 18 daily overflights to be moved from Lithuania to Sweden.

Other countries have been thrown into the same losing barrel as Lithuania for the same reason, including Latvia and Poland. But when there are losses, there are gains as well. Flights to and from Romania have grown significantly, adding about 70 daily overflights for Hungary.

These gains are primarily flights between Turkey and Russia, continuing but have been reduced by about 30%. Other Scandinavian and Baltic flows that are currently avoiding Ukraine are contributing to the overflight gains for Hungary as well.

Costly flight patterns

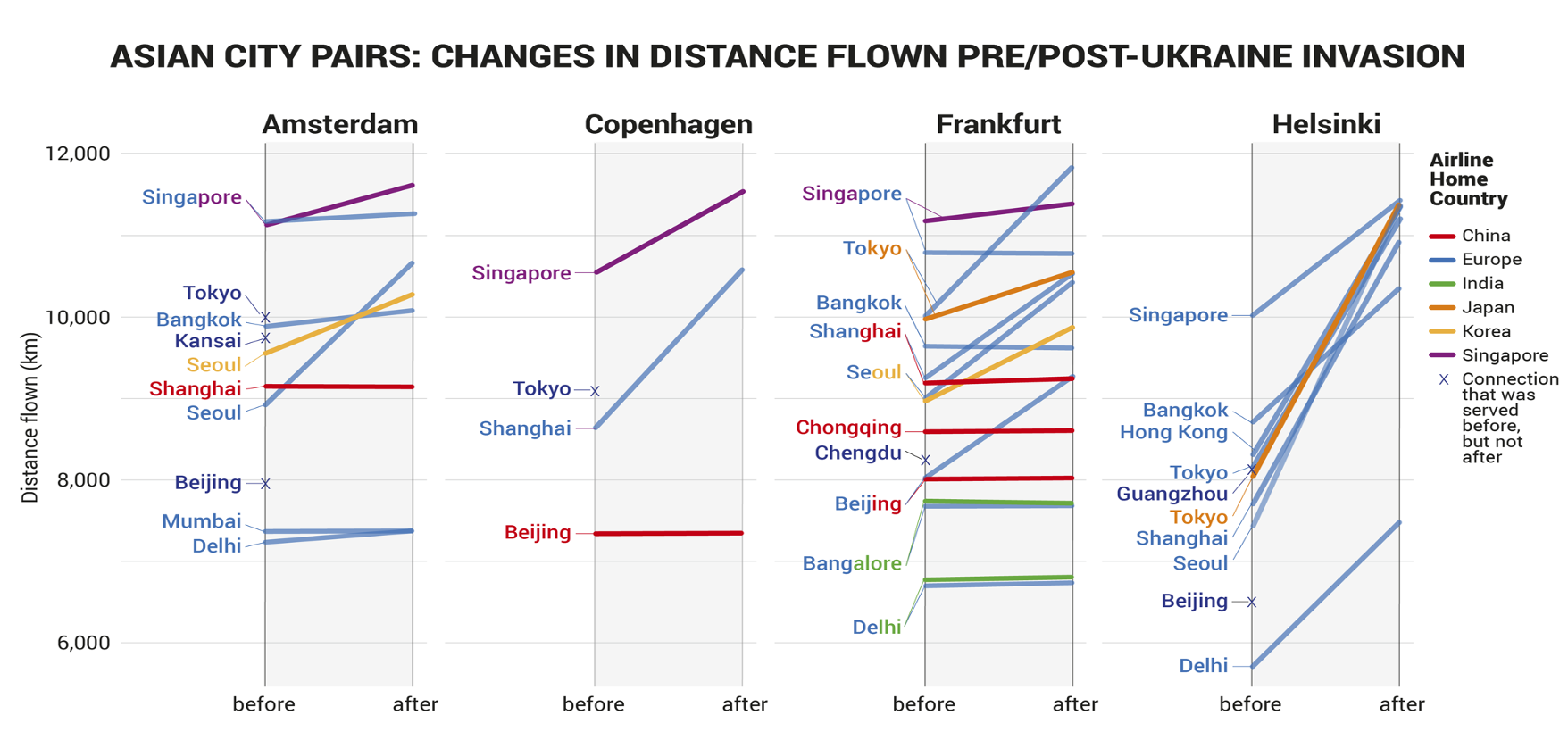

Having seen how the Ukraine-Russia conflict has severely disrupted traffic flows, it's only natural that it would also have a profound impact on short and long-haul flights. Flights from Eastern and Western Europe to Asia have been impacted with the unfortunate closure of Belarus, Russian, and Ukrainian airspace.

Copenhagen sees an additional distance of around 1,500 km to Singapore and Shanghai, and Helsinki sees a greater estimated distance of 4,000 km to Seoul. This means that flights from Copenhagen to Singapore would take a further 1.25 to 1.5 hours, and 4,000 km to Seoul as a round-trip would require an additional seven hours from Helsinki.

The tremendous increase in flight time has forced some airlines to cancel routes temporarily or to reduce frequency. An example would be Finnair stopping flight services from Helsinki to Beijing and SAS being forced to stop flights from Copenhagen to Tokyo.

Such decisions have been driven by scheduling and staffing constraints as well as airport limitations in terms of curfews and slots. In some cases, the capabilities of currently available aircraft, given the prevailing winds in the longer route, have meant services just aren't possible.

Surging fuel prices

Other contributing factors included passenger and cargo demand, which were not enough to offset the additional contribution from the Ukraine-Russia conflict - rising fuel costs.

As if airlines didn't have enough on their plates to worry about, the Ukraine-Russian conflict has caused global aviation fuel prices to surge to near 14-year highs as importers scrambled to secure alternatives to Russian crudes. Airlines were slammed with steep cost increases, which will inevitably be passed on to passengers in higher fares.

Before the Ukraine-Russian conflict, IATA had made an industry financial forecast that foresaw the airline industry losing only about $11.6 billion in 2022, with Brent crude at $67/barrel and fuel accounting for 20% of costs. However, since the conflict, IATA Director General Willie Walsh has said:

“The oil price has spiked to near $130/barrel. And it has been volatile within the $95–$110 range for a month. As fuel is an airline’s largest variable cost, absorbing such a massive price hike just as the industry is struggling to emerge from the two-year COVID-19 crisis is a huge challenge. If the oil price stays that high, then over time, it is reasonable to expect that it will be reflected in airline yields.”

Bottom line

The messy routes, longer fights, higher fuel costs, and fewer operational flights are a cocktail of headwinds that airlines currently face.

Although the demand for commercial air travel is sizzling hotter than at any point in recent years, the impacts of the Ukraine-Russian conflict has undoubtedly dampened the supply-demand equation, causing a probable deeper dent in the industry that has yet to recover fully.

Source: EUROCONTROL