The aviation industry has always typically been cyclical, with gradual periods of growth until it gets punctured by downfalls triggered by unforeseen external factors. As the industry commenced on its recovery path this year in the post-pandemic era, one notable observation was how used aircraft were being leased out in higher volumes. Let's discuss why.

Surpassing pre-pandemic volumes

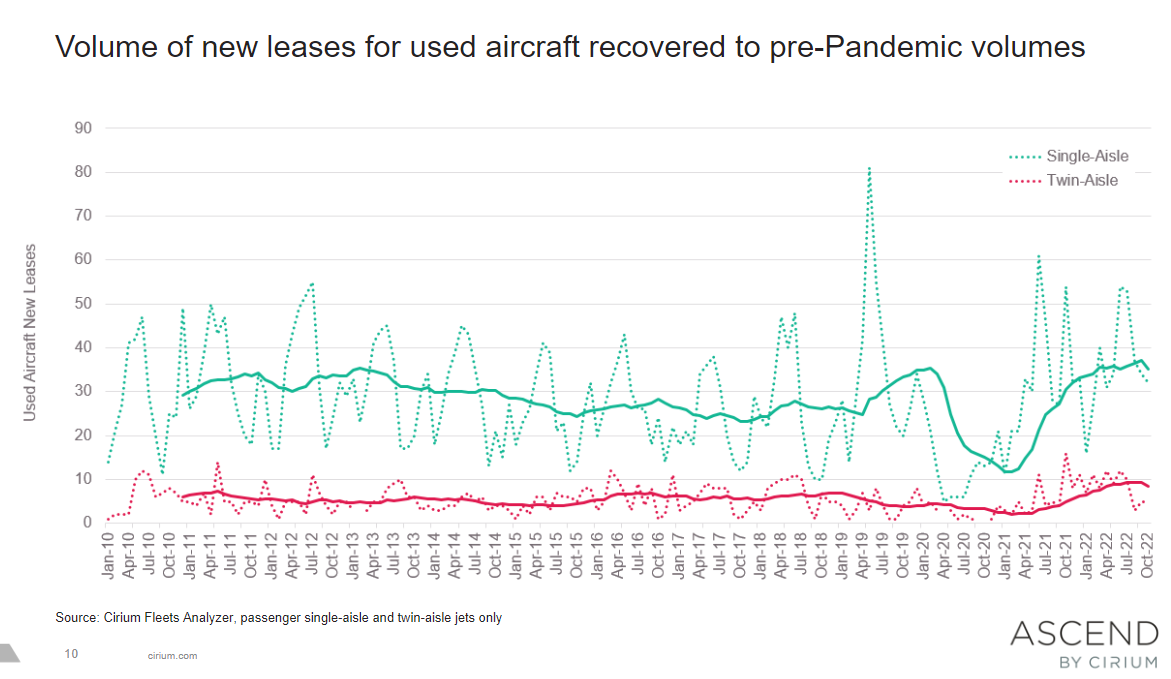

Prior to the pandemic, used aircraft were being leased out at relatively consistent volumes that were on a slight negative trend up till 2019, when there were surges between April and June. Once the pandemic hit, the volume of new leases for used aircraft evidently dropped and remained much lower up till this year.

During this year's recovery, volumes of new leases for used aircraft have quickly recovered to pre-pandemic levels and have consistently remained there as airlines are continuing to sign. Especially for used widebodies, it came as a pleasant discovery that the volume of new leases for used widebodies between January and October of this year was already significantly higher than the complete pre-pandemic cycle.

Get all the latest aviation news right here on Simple Flying!

Factors driving the surge

So what has been causing such a rush for leasing used aircraft? Besides an underlying market recovery whereby airlines are anxious to expand their capacities quickly to meet rapidly growing passenger demand, other factors made leasing used aircraft the main attraction this year. Market lease rates are reasonably attractive compared to pre-pandemic eras, especially for used widebody aircraft.

Airlines can acquire used aircraft for much lower prices than two years ago. Even though airlines might be financially struggling in the initial recovery phase, signing leases for used aircraft is not as big of a financial burden as signing leases for new aircraft or making immediate big orders. And besides a financial conflict, external factors limit the airlines' capabilities to buy new aircraft.

Global conflicts and economic instabilities have severely disrupted supply chains, resulting in lower production and delivery rates from aircraft manufacturers. Additionally, new aircraft in production also face delaying issues such as certification, which further limits the supply of new aircraft for airlines that require immediate capacity expansions. Given these factors, it's no surprise the demand for used aircraft was at such a record high.

Newer models are preferred

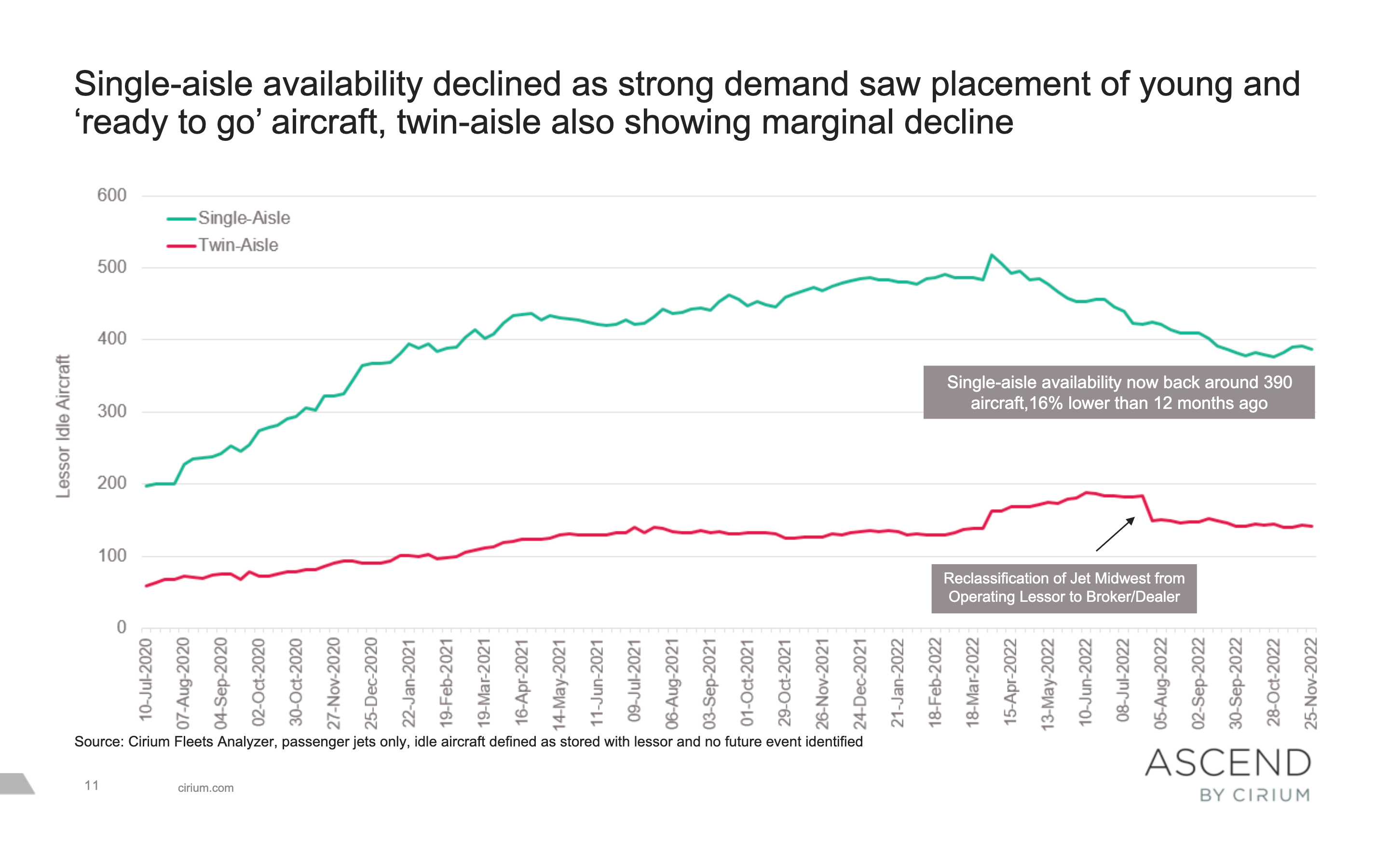

Contrary to how the lease volumes for used aircraft were on the incline, used aircraft availability declined. While the demand for used aircraft is certainly there, not every model sees a strong demand from the airlines, as they want the placement of younger and more 'ready-to-go' used aircraft. This means choosing the Airbus A320neos over the A320ceos or the Boeing 737 MAXs over the 737NGs.

Other than the fuel efficiency of the new-generation models, airlines have been eyeing the lifespan of the used aircraft. The older, not-so-popular models are mid-life in age, compared to the more sought-after aircraft models that are generally less than a decade old. For airlines, it's all about the cost savings they get from the younger aircraft placements.

Forecasted outlook for 2023

As this year gradually ends, it begs the question of if the leasing of used aircraft will remain as consistently high for the following year. As the demand surges, the availability of what airlines want from global aircraft lessors will continue to decline. As the younger placements go out, the aircraft lessors will be left with older placements that aren't that high in demand.

Unless the part-out markets open up more quickly next year, the aircraft lessors will be left with quite an idle fleet of used, older aircraft. And as production and delivery rates gradually start improving, the demand for newer aircraft will simultaneously increase from both the airlines and the aircraft lessors. Considering these factors, it's unlikely the leasing volumes for used aircraft will remain as high next year.