Virgin Atlantic has revealed Tampa as its next destination. Taking off in November, it'll link London Heathrow to the Florida airport, Heathrow's largest unserved USA market. It'll supplement British Airways' long-served London Gatwick-Tampa route.

Virgin Atlantic to Tampa

The UK carrier has today (July 6th) announced Tampa. Taking off on November 3rd to benefit from winter demand, it'll run 4x weekly at first before climbing to 1x daily from November 28th – a surprisingly high frequency. It'll be a year-round route.

It'll go on sale on July 13th. The schedule is as follows, with all times local. The times seem, in part, to result from slots acquired from Aeroflot: 13:25 was previously used by the Russian carrier to Moscow. However, it was also the time of Virgin's (not currently operating) departure to Shanghai.

- London Heathrow to Tampa: VS129, 13:25-18:35 (10h 10m block time)

- Tampa to London Heathrow: VS130, 2050-10:15+1 (8h 25m)

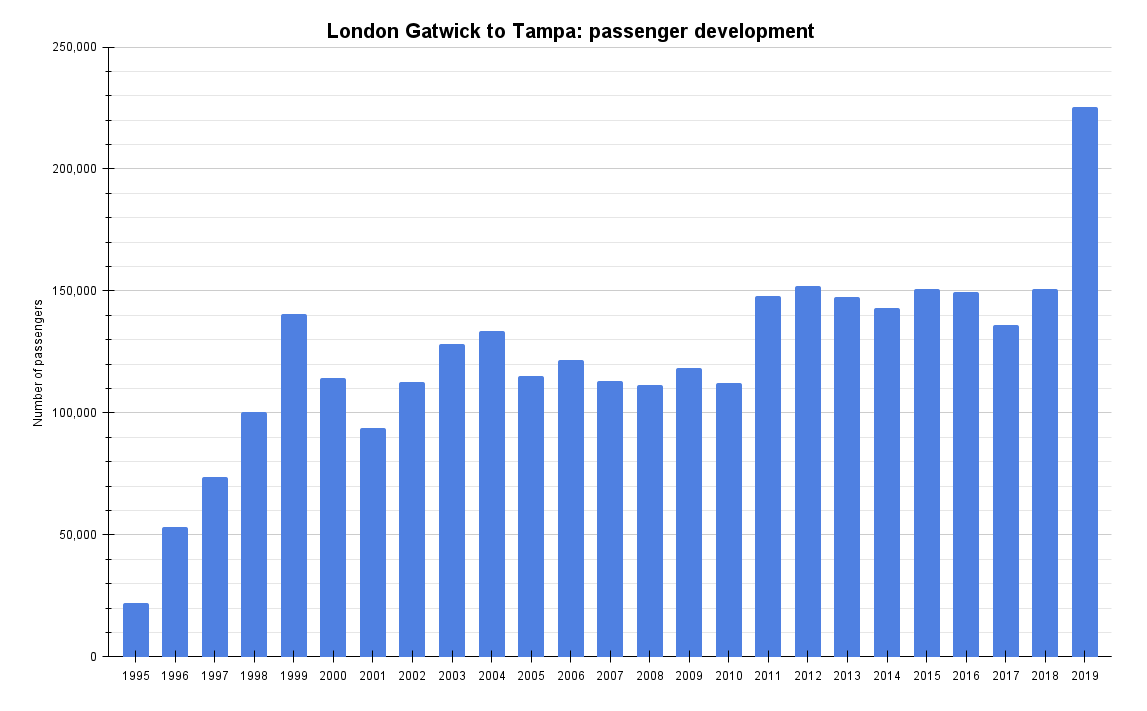

It'll join British Airways' 4x weekly winter service from London Gatwick, which BA has operated for decades. Department of Transportation data shows that it carried 165,224 passengers in 2019, its highest passenger volume thus far.

It was helped by the entry of Norwegian on the route in 2018, lowering fares (and yields) and growing overall traffic. However, it didn't mean BA had a higher seat load factor (SLF) – it fell to 79%, its lowest since 2016. Performance would have been reduced.

Stay aware: Sign up for my weekly new routes newsletter.

Why Tampa?

Virgin must, in part, be attracted to the void left by Norwegian, although they're different operators and it involves different airports. And it must have received financial incentives. More importantly, Tampa is Heathrow's second-largest unserved US market – it took the crown from Orlando after it received Heathrow flights.

Despite BA's non-stop Gatwick option, booking data shows that over 42,000 roundtrip passengers traveled indirectly between Heathrow and Tampa. Not far from Tampa's Heathrow traffic volume are St Louis, Cleveland, Kansas City, and Indianapolis, none of which are Virgin markets. (BA eyed Indianapolis last year.) Moreover, Heathrow-Tampa's average fare was lower than these other cities because of lower premium demand. After all, Tampa is mainly leisure-driven.

Discover more aviation news.

It must grow demand

To consistently fill a 1x daily service at decent SLFs while achieving required yields for performance, Virgin will have to stimulate Tampa's demand.

Given Virgin's timings and limited non-Americas network, it'll revolve around point-to-point demand, for instance, those traveling only between London and the Florida airport. However, it'll also have two-way connections to/from Delhi and Mumbai, although with a long, five-hour-plus wait in London en route to the US.

- Delhi: 1h 15m wait to India, 5h 55m on the way back

- Mumbai: 1h 15m wait to India, 5h 20m on the way back

The return appears less than competitive and generally doesn't stand up well against other one-stops, whether via US hubs, Toronto, or Frankfurt. But it is offset by the quick outbound transit time, possibly too short at Heathrow.

As Indians are the largest Asian demographic in Tampa Bay, Delhi and Mumbai had around 12,000 passengers in 2019. That excludes those leaked to Orlando, 90 minutes away, for Emirates' one-stop option via Dubai.

What do you make of the development? Let us know in the comments.

With thanks to Sean Moulton for the heads-up.

.jpg)