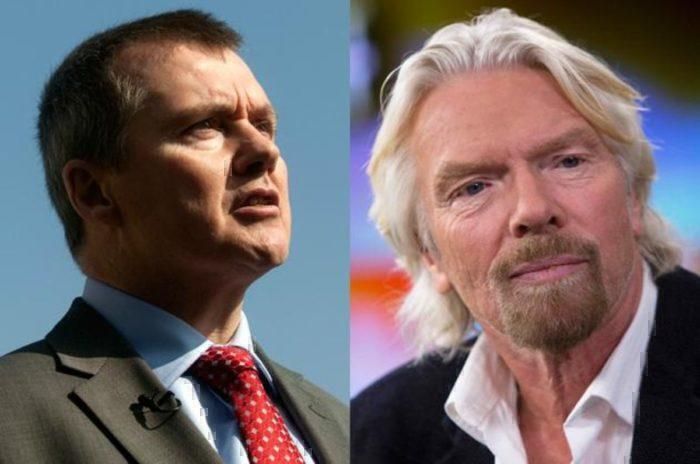

Airline bigwigs and long standing rivals, Willie Walsh and Richard Branson, are set to go head to head in a bidding war over struggling airline Flybe. Put up for sale two weeks ago, Flybe had already attracted the interest from Virgin Atlantic, while IAG’s interest comes more recently.

The sale comes following a full year profit warning from Exeter based Flybe. Last month, the carrier revealed a massive drop in profits of 54% over the six months to the end of September. Valued at just £26m / $34m, the purchase of Flybe will be a bargain for whoever comes out on top.

Virgin Atlantic have confirmed their interest, releasing a statement which said:

Virgin Atlantic has a trading and codeshare relationship and confirms that it is reviewing its options in respect of Flybe, which range from enhanced commercial arrangements to a possible offer for Flybe. Virgin Atlantic emphasises that there can be no certainty that an offer will be made nor as to the terms of any offer.”

IAG, owners of BA, on the other hand, refused to comment on ‘rumours and speculation’.

[ege_cards_related id="7"]

Why would IAG and Virgin want Flybe?

There are a number of good reasons to purchase the failing airline. For a start, Virgin would gain access to the lucrative British short-haul market. This is something they have done in the past with Little Red and failed. So purchasing an existing domestic airline would be far cheaper than trying to do another Little Red.

From IAG’s point of view, they lack a true domestic offering in the UK with Flybe having the biggest domestic share in terms of routes offered.

Grabbing a piece of the domestic British market would be great for either IAG or Virgin, as both operate mainly from major UK hubs. Having a shuttle service in place would enable them to grab more passengers from regional departure points, conveying them by the Flybe shuttle to their hubs.

As well as this, Flybe currently owns some slots at Heathrow, which could either be used to add capacity to their current routes or sold for hundreds of thousands (even millions) of dollars.

A bit of an ego trip?

Added to all the good business reasons for Virgin and IAG to want to buy Flybe, there’s undoubtedly an element of testosterone fuelled one-upmanship going on here too. Walsh and Branson are long standing rivals, with a feud going back almost a decade ongoing.

Back in 2012, the two CEOs had something of a public spat. It culminated in the two men offering each other out, but not in the traditional sense. As much as we’d love to take bets on a Walsh vs Branson bar room brawl, it was marginally more professional than that.

In short, Branson suggested a bet, with the loser paying £1m to the winner (to be shared among staff). The cause? Virgin was about to form a partnership with Delta, with the US carrier talking to Singapore Airlines about purchasing their 49% stake in Virgin.

[ege_cards_related id="17"]

Walsh thought this would result in the demise of the Virgin brand. He predicted Virgin would fail, but refused to take Branson’s £1m bet, saying that Branson, being a billionaire banker, would barely feel the loss of seven figures. Instead he suggested something much more painful; that the winner be allowed to ‘knee the other in the groin’. Ouch.

"Branson is a billionaire banker, allegedly. I’m not a billionaire. So maybe a bet that would have as much pain to me as it would to him – a knee in the groin.”

Sadly, it never happened.

Perhaps what we’re seeing today is yet another swipe from the IAG Chief Exec at Branson; let’s see how far it will go this time. Either way it's a very interesting time for change in the UK aviation market, and we will keep you updated with regular articles on Flybe in the coming weeks.