This time last year, the airline industry was in turmoil. Demand, capacity, and revenues had all crashed. What many hoped would be a six-week hiccup was morphing into a longer running disaster. In the midst of the mess, one of the world's highest-profile investors bailed out of the airline industry, taking a multi-billion dollar bath in the process.

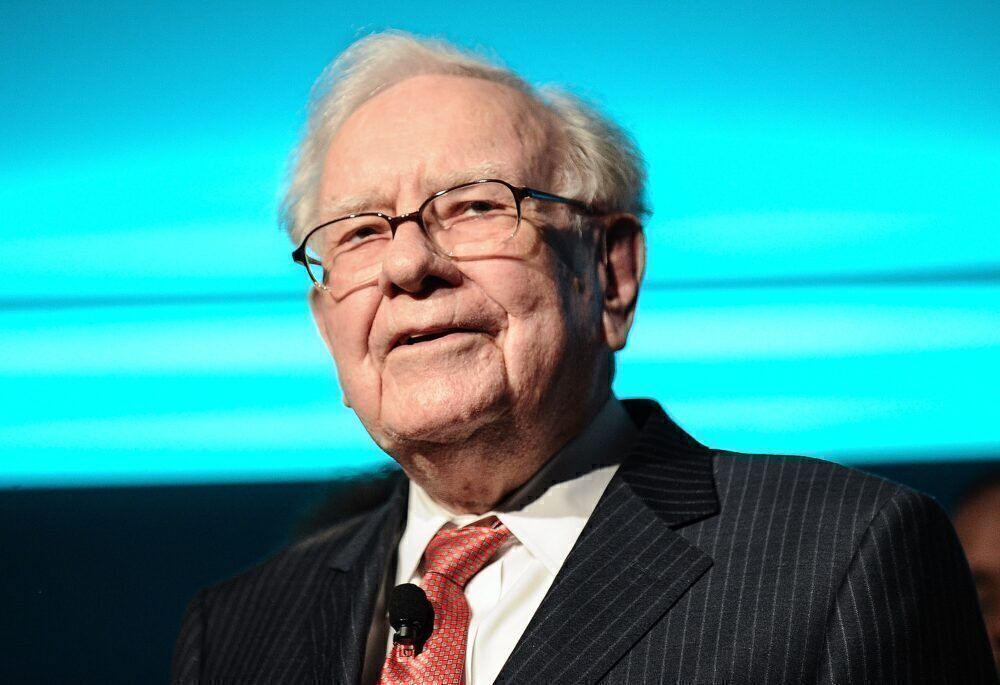

Warren Buffett loses billions selling airline stocks in 2020

In early May 2020, Warren Buffet's investment company, Berkshire Hathaway, liquidated its holdings in American Airlines, Delta Air Lines, Southwest Airlines, and United Airlines. Mr Buffett pocketed around US$4.3 billion from the sale. The problem was, when Mr Buffett bought those stocks, between mid-2016 through to early 2017, based on stock prices at the time, Mr Buffet paid approximately $9.3 billion.

Berkshire Hathaway has a successful investment record. Except for an ill-fated USAir investment in 1989, he has famously eschewed airline investments. In a 2002 interview with The Daily Telegraph, he said;

"It has eaten up capital over the past century like almost no other business because people seem to keep coming back to it and putting fresh money in. You’ve got huge fixed costs, you’ve got strong labor unions, and you’ve got commodity pricing. That is not a great recipe for success.”

But like so many others, Mr Buffett found the siren call of the airline industry hard to resist. In 2016, Berkshire Hathaway dived in and, taking many by surprise, bought big holdings in four major United States-based airlines. At the time, the airline industry was profitable and growing. No one foresaw what would happen in 2020.

Stay informed: Sign up for our daily and weekly aviation news digests.

Warren Buffet says he made a mistake investing in airlines

In December 2019, before any whispers of the travel downturn, Berkshire Hathaway owned 42.5 million shares in American Airlines, 58.9 million shares in Delta Air Lines, 51.3 million shares in Southwest Airlines, and 21.9 million shares in United Airlines. All were performing well.

Between December 2019 and Mr Buffett's decision to bail out in late April 2020, the value of American Airlines shares fell 62.9%. The value of Delta Air Lines shares fell 58.7%. At Southwest Airlines, their stocks were down 45.8%, and United Airlines was down 69.7%.

"The world has changed for airlines," Mr Buffett said last year when announcing the liquidation. He said he'd made a mistake getting into the industry in the first place. At the time, Mr Buffett also said when Berkshire Hathaway liquidates an investment, they liquidate the full 100%.

If Warren Buffett hadn't sold out, where would his airline stocks be now?

With that decision to walk away, Berkshire Hathaway lost billions. One year later, had Warren Buffett not sold out, where would his airline investments be now?

Like the travel downturn, no one anticipated the swift rebound of domestic flying in the United States this year. That rebound, along with government support and ample liquidity, has seen the stock prices of all four airlines increase since Mr Buffett sold out.

Since last May, Delta Air Lines and United Airlines stock prices are up about 70%. American Airlines and Southwest Airlines stock prices performing even better, up about 80%. According to Yahoo Finance, if you measured gains from the worst troughs in May 2020, the rebound across all four airlines was even better. United Airlines was up over 200% over the period, while American Airlines was up 190%.

Mr Buffett did not sell when airline stock prices were at their worst. But he broke a cardinal investment rule and sold in a slump. Despite the rebound in stock prices since their nadir in 2020, Yahoo Finance notes an investment that loses 70% requires a 333% gain to get back to breakeven.

What do you think? Was Warren Buffett right to sell his airline stocks? Should he have tried to ride it out? Post a comment and let us know.