According to the latest OAG update dated 13th of April, around five million scheduled seats for the coming week have been removed by airlines globally. This is the lowest weekly capacity-cut since the 16th of March. One of the prime reasons behind this trend might be related to the current capacity reaching a minimum operational threshold. In total, around 58 million scheduled seats have been removed by airlines in the last four weeks. Western Europe has shown the largest capacity drop, while China shows signs of improvement.

Changes in numbers

Comparing current airline capacity to the scheduled capacity in the week starting 20th January gives us a representation of the effects of coronavirus. Region-wise, Europe, Southwest-Pacific, and Lower South America have shown the most considerable decline.

An area-wise reduction in scheduled capacity is as follows:

- Western Europe: -90.7%

- Southwest-Pacific: -89.7%

- Latin America/Upper South America: -71.3%

- North America: -62.2%

- Middle-East, South, and South-East Asia: -67%

- North-East Asia: -52.9%

- Eastern/Central Europe: -65.9%

The current airline seat offering in Western Europe is said to be less than 15% of what it was a year ago. The main factor behind these numbers has to do with the massive number of flight cancellations since the 31st of March.

easyJet had grounded its entire fleet at the start of the month. Air France-KLM has reported a drop of 57% in scheduled capacity in March. In addition, the world's second-largest low-cost carrier Ryanair had suspended all operations by the end of March.

The only positive sign in the past week has come from North-East Asia, where scheduled capacity has, for the first time in months, seen positive growth. China noticed a weekly increase in capacity by 1% as many airports, including Wuhan, began to resume normal operations.

Looking at the current trends, it's not easy to predict how and when normal capacity will resume. However, it is pretty evident that domestic seats will be much more easily restored compared to international seats.

Initially, domestic seats constituted a 61% share in total airline capacity. After the coronavirus crisis, the number has risen to 85%. This is clearly due to increasing travel restrictions and plummeting international travel demand, which has led to a fall of 88% in international capacity since mid-January.

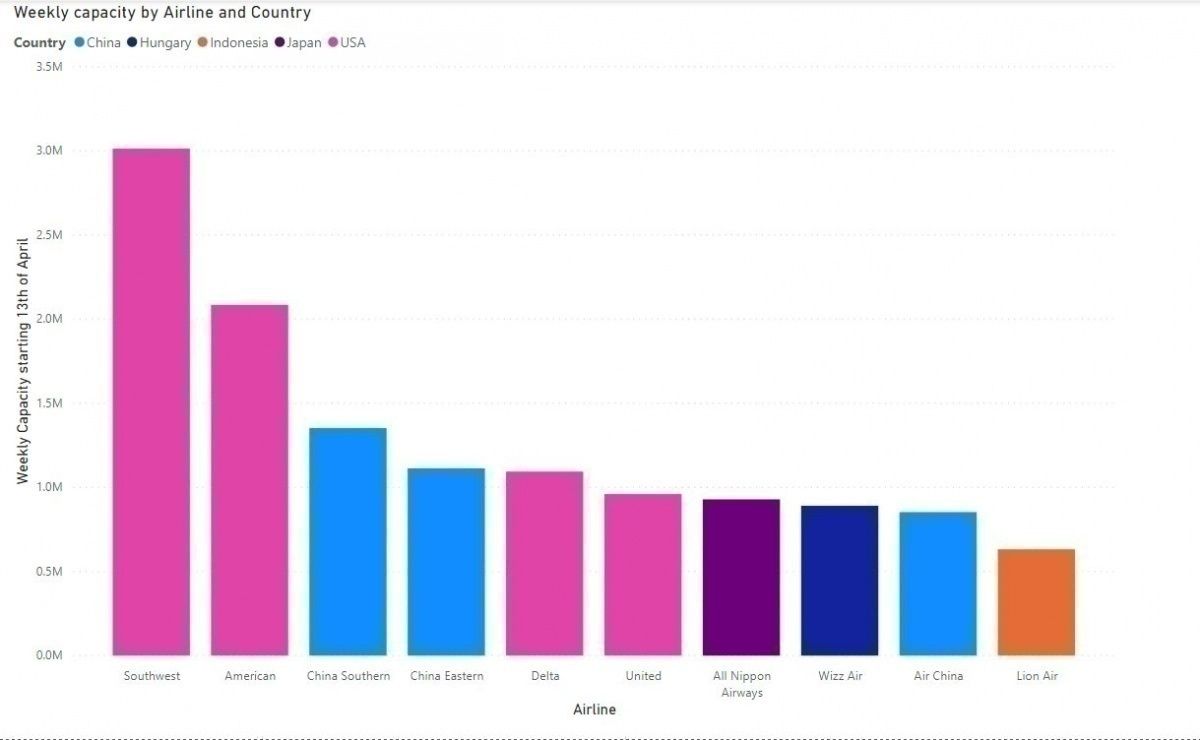

A graph representing the list of top-ten airlines by scheduled capacity is given below.

The graph clearly pictures a large number of operating domestic seats in the United States and China. The United States is by far the most affected country by the coronavirus, however, still the biggest country market in the industry. OAG has, in its report, combined the TSA data with the airline scheduled capacity numbers to give a realistic view of airline operations.

Although airlines in the United States are still offering a lot of seats, passenger numbers have declined so much that the average predicted load factor is less than 10%.

In the coming week, 590 airlines will operate worldwide as compared to 790 airlines during normal operations. The spread of coronavirus has certainly brought the aviation industry to its knees. It is predicted that the original airline capacity might not be restored for at least the next two or three years. It is going to take a lot of patience and sacrifice before we see the airline industry back to its normal ways.

When do you think that the airline industry will return to normal? Let us know in the comments.